Insight Focus

The wheat markets have rallied significantly over recent weeks due to weather concerns that have disrupted wheat supplies in major exporting countries. Meanwhile, demand is predicted to reach record levels in the coming marketing year.

The Markets

There is an old adage that “The Bulls Need Feeding” and news of frosts in Russia is certainly providing food for thought.

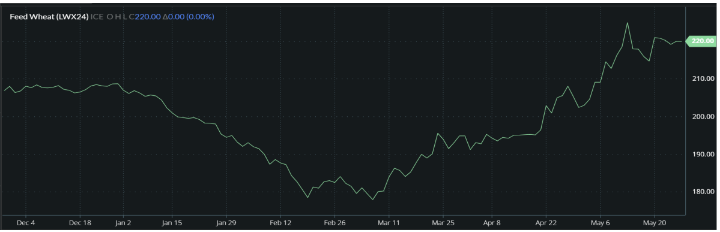

The recent incredible bull run in prices has been driven by the weather, spurring managed money funds to buy in their large short positions, as wheat harvest prospects for 2024 have fallen for important exporters.

Chart 1 London feed wheat, November ’24 contract

Chart 2 Paris milling wheat, December ’24 contract

Chart 3 Kansas hard red wheat December ’24 contract

Source: Barchart Commodityview

Global Wheat Production 2024

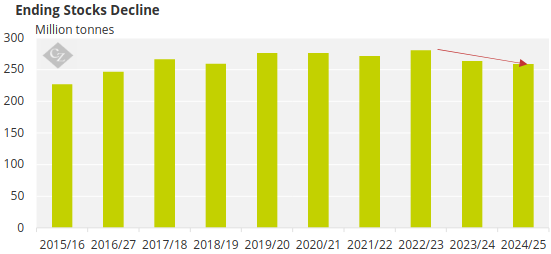

Last week saw the International Grains Council (IGC) revise down its global harvest production forecast for 2024 to 795 million tonnes from 798 million tonnes last month.

Meanwhile, consumption is anticipated to exceed 800 million tonnes, continuing the trend of declining world end stocks.

Source: IGC

Russia Battered by Frosts

Weather issues persist in western and northern Europe, adding to the ongoing concerns for the upcoming harvest. However, it is Russia stealing the headlines with forecasts slumping significantly in the last couple of weeks.

Russian wheat prospects have been dealt some big weather hurdles in recent weeks, from dryness to frosts. As we reported in our last article, frost damage has led to regions declaring a state of emergency. In the last few days, suggestions have emerged that up to 2 million hectares of wheat crop could have seen notable frost damage.

Forecasts for total Russian wheat production for harvest 2024 are seeing remarkable downgrades. For example, IKAR, the Russian consultancy, estimate a crop of 81.5 million tonnes, down from 93 million tonnes only a few weeks ago. This has reduced IKAR’s export estimates to 44 million tonnes in the coming year, down from 52 million tonnes in a matter of weeks.

Concluding Thoughts

- Russia is always high on the watch list when it comes to wheat news and, as the largest exporter in the world, the impact of the frosts is noteworthy.

- However, wheat is an extremely resilient plant. That is why it is grown more widely on more acres than any other grain.

- The Russian harvest will not be fully rolling for another few weeks. It will take time to fully assess the impact of weather issues that the plants have endured through their growth.

- If prices are to maintain their upward trend, this will require more physical buyers, who appear to have been less active in driving the current rally.

- Managed money funds have been the greatest bull players, as they exit shorts in the US and even go long in the European wheat market.

- These funds have helped drive prices higher at an alarming rate in a matter of weeks.

- If new headlines continue to feed the ‘bulls’, then the rally will likely stay strong.

- If weather and wheat crop resilience combine to alleviate some of the concerns, we may yet see some retracement.

As a buyer or a seller, consider taking your profit margins when you see them and wait for another day to trade again.