The raw sugar market opened lower today and immediately looked to challenge the floor of the 18-19c/lb we have been in for much of the last month, quickly reaching as low as 18.03clb. However once again the floor held firm as the Jul’24 raw sugar futures quickly recovered back toward 18.10c/lb and didn’t look back for the rest of the session. From there followed a flurry of buying, lifting prices 20 points to finish out the morning.- Through the afternoon prices bounced fairly rapidly between 18.3c-18.4c/lb on some of the largest volumes seen in recent sessions, with a final 4k lot flurry into the close, settling for the week at 18.32c/lb.

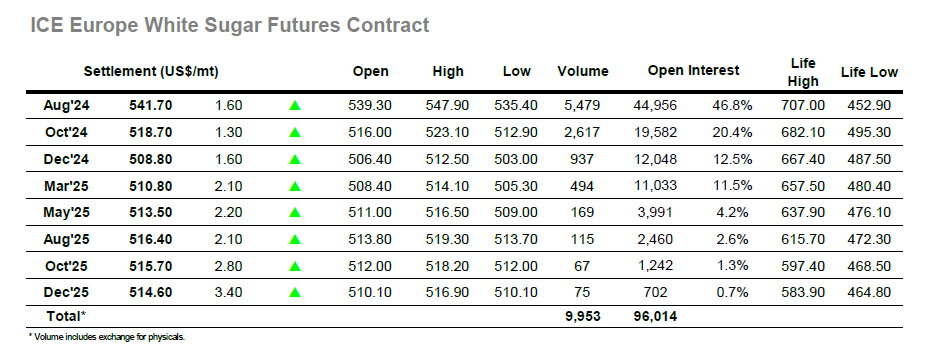

The white sugar market again fairly closely matched moves on the No.11 through the morning, opening lower before strongly rallying up over 12USD/tonne to almost 548USD/tonne by the halfway point of the day. From here prices hovered around 545USD/tonne for much of the afternoon, short of a sharp drop down to 541USD which was quickly reversed. The last hour or so saw more persistent selling into the close, finishing the week at 541.5USD/tonne and again seeing the Aug/Jul’24 white premium shrink, now at 137.6USD/tonne.