Insight Focus

PTA and MEG futures see further gains due to lower spot liquidity, even in a weak crude environment.

Excessive container rates and lack of availability sees buyers take to the sidelines.

PET resin export prices following feedstock costs, margins set to come under increased pressure.

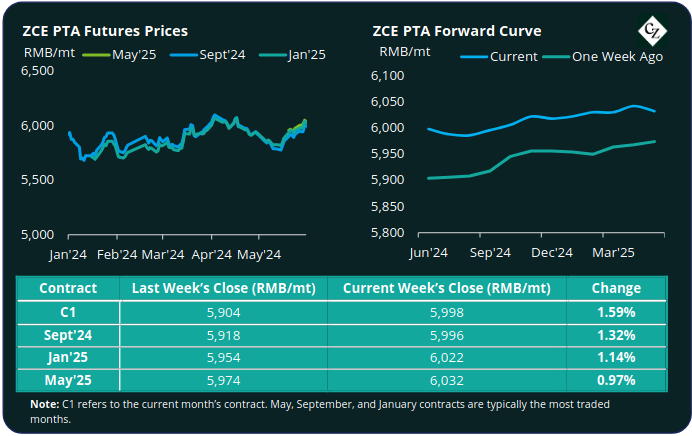

PTA Futures and Forward Curve

PTA futures pushed higher last week, with the main Sept contract adding a further 1.3%, by higher Naphtha and PX values.

Underlying crude market showed weakness late last week, recording a weekly loss of around 1% by Friday, despite an earlier price rally mid-week.

Earlier gains were erased, despite EIA reporting a decline in US crude oil inventories, as traders remain cautious on demand, fuelled by expectations that OPEC+ will extend voluntary cuts into H2’24 signalling weaker demand.

The PX-naphtha price spread kept relatively steady; PTA-PX CFR spread went flat-to-soft through the week, with the weekly average narrowing marginally.

Although recent destocking has tightened PTA spot liquidity, PTA units are gradually returning to operation following maintenance shutdowns, with supply expected to lengthen through June.

Hanbang’s new 2.2 million tons PTA unit is also expected to commence production at the end of June adding to the supply-side, amid softer demand due to lower polyester operating rates.

The forward curve is flat through to Sept’24, with the Jan’25 forward contract now holding just a minimal RMB 24/tonne premium over the current month.

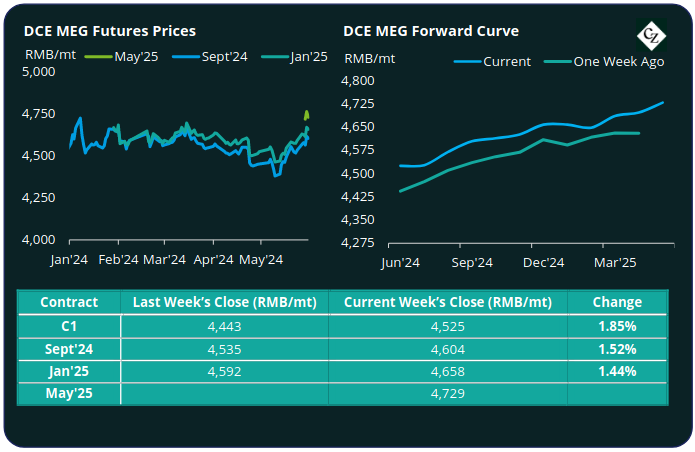

MEG Futures and Forward Curve

MEG Futures continued to build on their recent rally, with main forward contract months up by around 1.5%.

East China main port inventories fell sharply by around 10.5% to 739k tonnes last Friday, as daily offtake leapt to new multi-year highs.

Delayed plant restarts and slower domestic supply recovery are at least in-part fuelling the surge in port offtake.

Whilst polyester operating rates have declined through May, they have now steadied and are expected to remain stable through June, supporting demand.

Although MEG imports from the US and Middle East are expected to increase late June, these volumes are likely to be readily absorbed by the supply chain due to current low midstream inventories.

The forward curve kept in contango, with the Sept’24 contract holding a RMB 79/tonne premium over the current month; the Jan’25 premium over the current month narrowed to RMB 133/tonne.

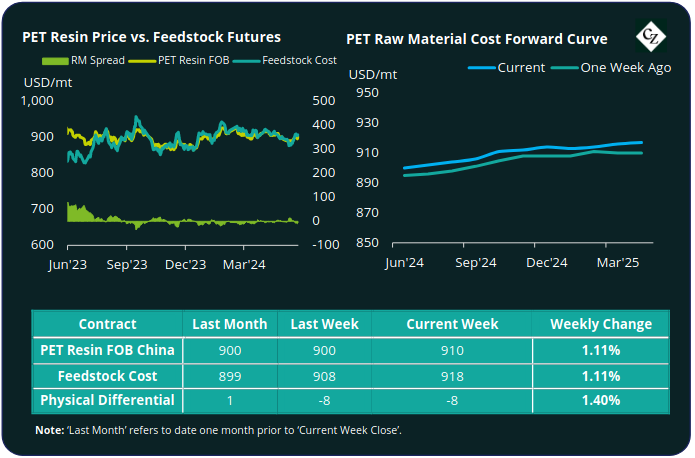

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices saw slight incremental gains last week, with the average price up USD 10/tonne to USD 910/tonne by Friday.

The PET resin physical differential against raw material future costs remains depressed, decreasing USD 1/tonne, to average minus USD 9/tonne last week. By Friday, the differential was USD 8/tonne.

The raw material cost forward curve kept flat/slight contango through to year end; Sept’24 contract premium over the current month was just USD 3/tonne, whilst the Jan’25 premium fell to just USD 9/tonne.

Concluding Thoughts

Chinese PET resin export sales are being hit by exorbitant freight rates, with most buyers only covering what they need to avoid stocking out, in the hope that freight rates come down later in the summer.

At the same time, carriers are increasingly sold-out for June shipment, with shipping lines hiving off vessels and containers from other Asian origins to support routes out of China.

Meanwhile another Houthi attack on a ship in the Red Sea has reinforced suspicions that normal traffic through the Suez Canal is not about to return anytime soon. And with peak season approaching, rates are likely to remain high for a sustained period (see latest freight insights here).

Given the slowdown in port throughput, inventory through the chain is expected to rise, increasing domestic Chinese availability, and keeping PET resin margins pinned down.

Maintenance restarts and further capacity expansion may also lengthen near-term PET resin supply in China.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.