Opinion Focus

Rains hit crops in Rio Grande do Sul, one of Brazil’s great agronomic hubs. The biggest losses in agriculture will be for soybeans, but the damage to infrastructure will impact the entire sector.

Rains Take Over the State

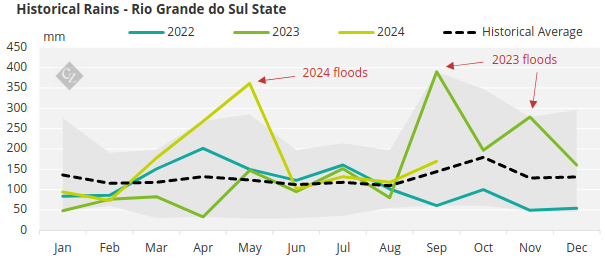

The beginning of May was turbulent for Rio Grande do Sul. During the first days of the month storms quickly turned into floods. To date, around 446 cities have been affected – more than 90% of the state’s cities – with some completely immersed in water. Some areas received more than 600 mm in 1 week.

Source: BBC

This is the third flood recorded in the state in less than a year – and the biggest in history. In 2023, Rio Grande do Sul suffered from two other floods, with September’s being the biggest, caused by an extratropical cyclone, with massive, concentrated and fast storms.

But Not Only Urban Regions Were Affected

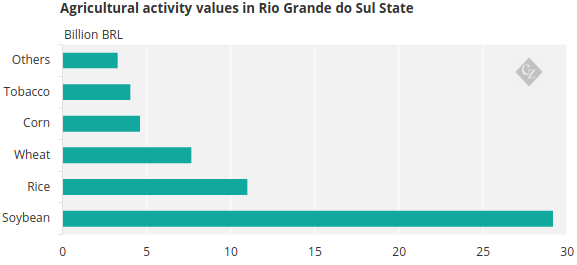

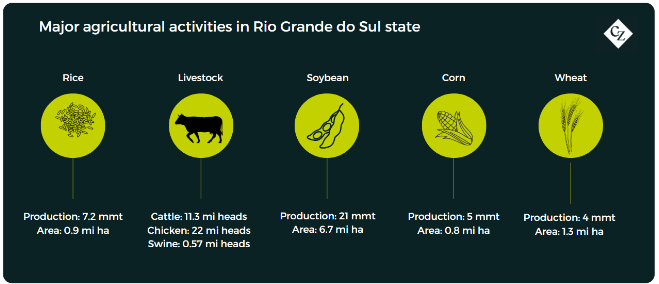

Rio Grande do Sul is a strong hub in national agriculture, with almost 13% of its GDP and 67% of the state’s exports represented by agricultural activities. The State has a significant participation in the production of soybeans, rice, wheat, corn, livestock, etc.

Source: IBGE

In livestock farming, the state stands out mainly with chickens and pigs, being the 3rd largest slaughterer in the country, in addition to being among the 5 largest producers of eggs and milk.

The rains fell during the soybean planting season and many producers had to postpone their work. Some needed to replant their soybeans. The rain also delayed harvesting. According to CONAB, 60% of the soybeans were harvested when the rains began and halted operations. Products that were already harvested and stored may also have been impacted.

Furthermore, the flooded fields made it impossible for machines to enter for harvesting. Many producers lost all the remaining soybeans in the fields due to grain rot, and the soybeans that managed to be “saved” will have quality discounts.

As we mentioned in the corn harvest report, the greatest damage should be seen in soybean areas. When the rains began, around 6m tonnes of soybeans were still to be harvested from the fields due to the delay in harvesting this season.

For more grain climate information, visit: CZ app Weather Report

What is Real Impact?

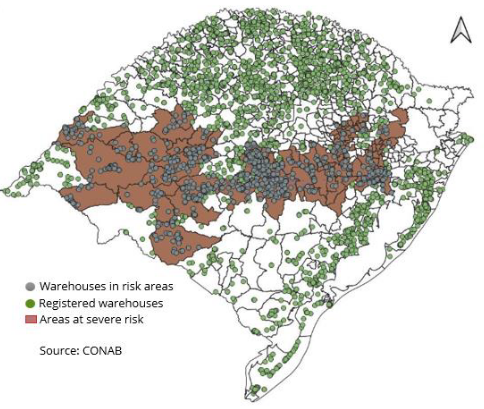

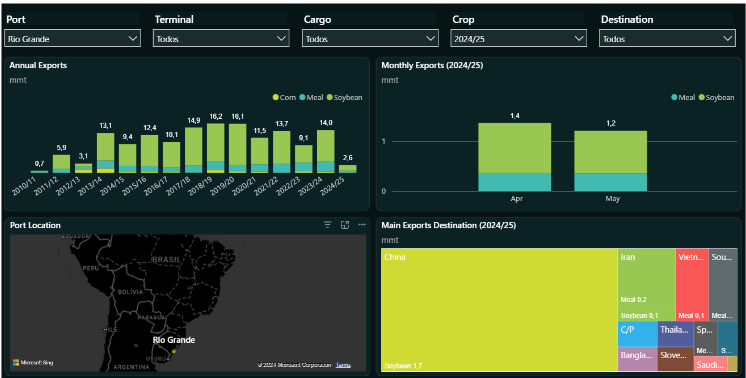

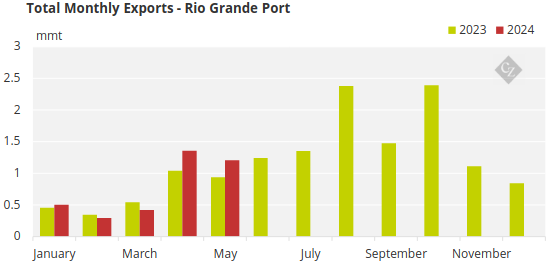

For agribusiness, the biggest impact will be on infrastructure. The floods not only washed away crops, but also destroyed warehouses, machinery, livestock, and damaged roads. At the moment, many transport routes are blocked due to the damage, making it impossible to move inputs, food, animals and making it difficult for products to arrive at the port of Rio Grande – the 4th largest soy export port in Brazil.

To see more information about grains line up, visit: Brazilian grain exports

Currently, there are no estimates of when the situation will return to normal, much less the exact size of the losses that have been caused.

According to data from the National Confederation of Municipalities (CNM), damage to agriculture has already reached BRL 2 billion, while in livestock farming the damage reaches BRL 220 million. Despite this, many municipalities have not yet reported their losses to the CNM, which indicates that the number should still increase as more municipalities fill in the information in the system.

Despite the situation, the port of Rio Grande continues to operate normally, having not been affected by high water levels, just with a lower volume of products.

For the grain harvest, estimates indicate that 1.5 million tonnes of soybeans were lost completely – almost 4x more than the 400 thousand tonnes of corn. Thus, production in Rio Grande do Sul, which could have been 20.9m tonnes of soybeans (7m tonnes more than in the last harvest and the highest production in the state in all harvests), should be reduced to 19.4mm tonnes.

This number may still change due to losses due to grain rot, but we believe that we will see the real impact of the flood more clearly in the next harvest. With soil degradation, losses of machinery and structures such as silos and warehouses, rural producers in Rio Grande do Sul must suffer from higher costs for the next harvest, in addition to productivity that will be affected by soil quality, reducing their profit margin.