Insight Focus

China’s direct imports of white sugar may decline in 2024. This is because of changes to import regulations. Imports of liquid sugar and premix powder continue, but the outlook is uncertain.

Policy Changes Put Pressure on Direct Whites Imports

China’s sugar imports generally are placed into the following categories: quota sugar imports; out-of-quota (AIL) sugar imports; import of white sugar into bonded zones (CBZ); Entrepot trade.

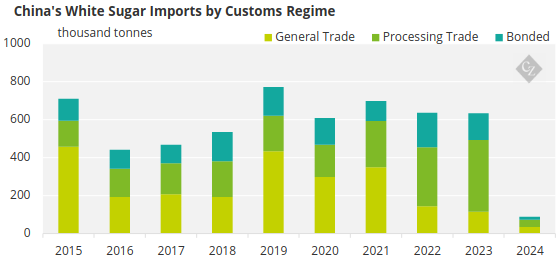

Last year’s white sugar imports totalled 634k tonnes, similar to 2022, but with major changes in the import category allocations. Since 2022, imports of general trade (quotas and AILs) have shrunk, while imports from processing trade and bonded areas (CBZ) have increased significantly.

Note: 2024 is updated until end of April

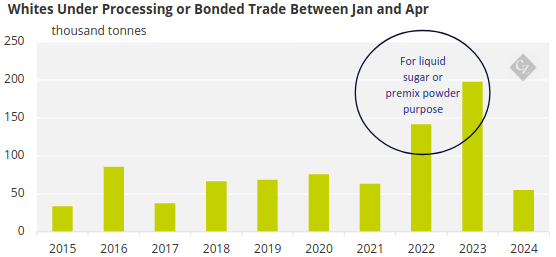

As discussed in our report last month, the new regulations mean that the white sugar imports in CBZ will no longer be able to bypass quota/AILs regulations or sugar import tariffs. Although the new regulations will be officially implemented on July 1, these importers may have been informed in advance. The import of white sugar under the bonded or processed category in the January-April period of this year has dropped sharply compared to the same period in the past few years.

Note: 2024 is updated until end of April

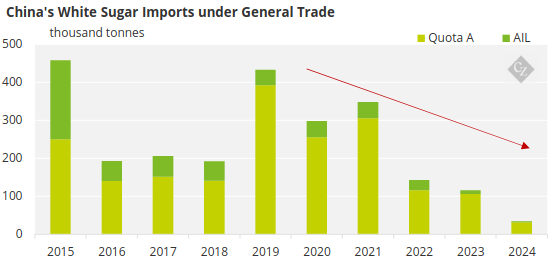

In addition to the fact that AIL imports subject to a 50% tariff are too costly to be feasible, the volume of sugar imports within the regular 15% tariff quota is also not optimistic. The decline is mainly due to the fact that the A quota held by state-owned trading enterprises is allocated more to raw sugar than to white sugar.

This means that the volume of white sugar imports in 2024 may be about 200,000 tonnes lower than last year, coming in at around 400,000 tonnes.

Note: 2024 is updated until end of April

Liquid Sugar and Premix Powder Import Continues

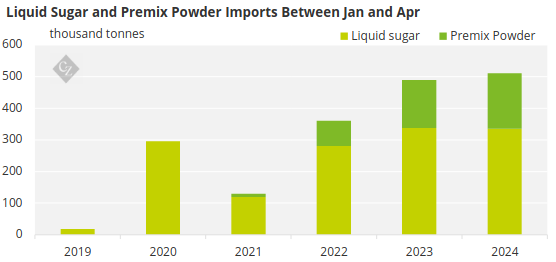

In stark contrast, the import of liquid sugar and premix powder continued, and even hit a new high in the same period from January to April, reaching 510k tonnes.

In 2023, China imported a total of 1.81m tonnes of these two products, which is equivalent to 1.34m tonnes of dry weight white sugar. It has become the most popular way to satisfy China’s white sugar demand.

Despite the recent rumours of a slowdown in customs clearance for liquid sugar, imports of this product so far have not been blocked. Sugar market players should closely monitor the changes in import regulations and the impact on China’s white sugar demand.

We estimate China’s white sugar import demand in 2024 at 1.74m tonnes, down about 200k tonnes year-on-year.

Still, China remains one of the world’s leading sugar importers.