Insight Focus

Corn lost all the gains of the previous couple of weeks on strong planting progress in the US. European corn rallied while wheat had a negative week in all markets. Weather continues to influence the market.

US corn is looking good with improving conditions. There is a clearer picture of the aftermath of flood damage to the Brazilian crop, so this is now priced in. Another week of good progress in the US could put some pressure on Chicago corn.

But the remaining question marks over Russian and Ukrainian wheat production could continue providing support to European wheat. We would expect some consolidation and volatility.

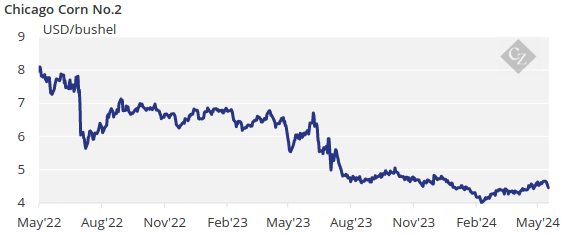

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop upwards to average USD 4.60/bushel. The average price since September 1 is running at USD 4.55/bushel.

Corn Diverges in Europe and Chicago

Corn in Chicago started and finished the week negative right after the publication of the US crop progress report showing another big catch up of corn planting. While the pace is still behind last year, it remains above the five-year average and took away any risk premium from the delay in planting.

European markets did not follow Chicago as there are still supply risks. Wet conditions in Europe are damaging wheat quality and slowing corn planting pace. The frost damage in Russia and Ukraine is still an unknown in terms of production.

The impact of the floods in South Brazil are starting to trigger downward revisions to crop forecasts. Datagro last week reduced soybean production to 147.6 million tonnes from 147.9 million tonnes and corn production to 114.4 million tonnes from 136.5 million tonnes last year.

US corn is 83% planted, up from 70% the previous week and versus 89% last year and the five-year average of 82%. Corn areas experiencing drought fell to 5% last week — or 5 points lower week on week. Safrinha corn harvesting in Brazil was 1.1% complete, while the first corn harvest is 78.4% complete versus 81.8% last year.

Russian corn planting is 88.7% complete, slightly ahead of last year. Ukrainian corn planting has now finished. French corn is 85% planted, behind the 97% recorded last year and versus the five-year average of 98%. French corn condition was 81% good or excellent versus 92% last year.

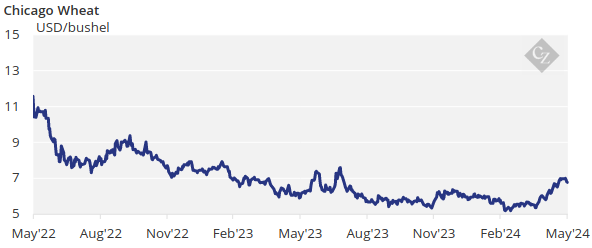

Russia-Ukraine Weighs on Wheat

On the wheat front, there is still a lot of uncertainty surrounding the extent of the damage in Russia and Ukraine with some voices saying we could see less than 80 million tonnes of wheat out of Russia compared with 104 million tonnes last year.

It is not only the frost damage to consider, but now there is hot and dry weather, which again threatens the latest stage of crop development.

The US wheat condition was 48% good or excellent, down 1 point week on week and versus 34% last year. Areas under drought conditions were unchanged at 25%. French wheat condition was 61% good or excellent, or two points lower week on week and down significantly on the 91% recorded last year.

Weather continues to influence the market. In the weather front, dry weather is finally coming to southern Brazil along with cold temperatures. Argentina is also expected to be dry. The US is expected to have warmer than average temperatures together with average rains. In Europe, France is expecting dry weather again, while Germany will continue to receive rains.