Jul’24 swung between 18.80 and 18.62 as a mixture of early activity took place though as things settled down it was the long side attracting the greatest interest with the price nudging through yesterday’s highs ad printing 18.88. This failed to yield any continuation of spec covering, something that will likely be limited this side of 19c, and so Jul’24 settled down to another slow session of laborious sideways trading. There were occasional pushes to try and broaden the parameters as we moved into the afternoon, the first of which did edge the price up to 18.90, however with the USDBRL moving towards 5.30 the higher levels were attracting an increasing volume of producer pricing. This kept things in check throughout the afternoon with the price holding either side of 18.80 throughout, and with news still limited there was no hint of a breakout. This lack of movement eventually drew some day trader liquidation with the market dropping back to 18.64 late in the afternoon as a result, though the picture reversed again late on to leave this rather less bleak. Buying returned to send Jul’24 back up, matching the earlier high as settlement was made at 18.86. This leaves the congestion basis the old 18.97 low still in view, and moving on this may encourage more buying as traders look to break through 19.00 and generate some fresh movement and test for buy stops.

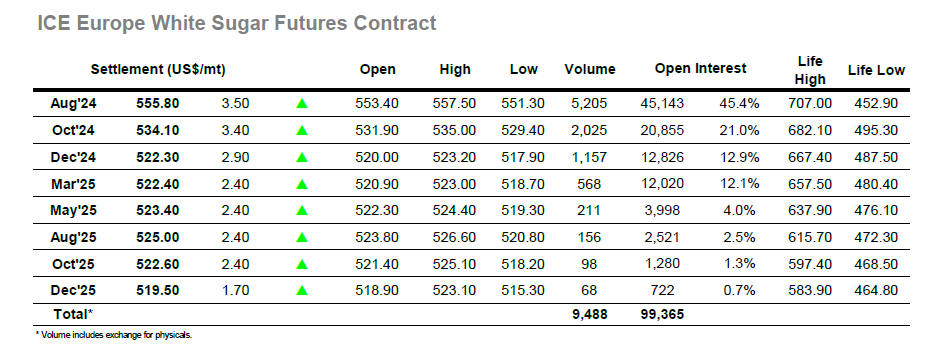

The recovery in values yesterday seemed to inspire some additional overnight buying and through the early part of this morning Aug’24 pushed ahead to reach $557.50, the highest level recorded since the fall of May 13th. Ordinarily such movement may have inspired a continuation higher but with No.11 still struggling to break its own range and the specs not holding a net short in London there was limited interest in continuing and so the market settled back down. A morning of slow “rangebound” duly ensued before some fresh buying appeared in conjunction with the US morning. This next move failed to attain the recent highs and so things calmed again, repeating the morning tedium with further trading either side of $555.00. Marginal new lows were seen late in the afternoon at $551.30 before a closing push to dress the settlement higher, emphasising the desire to generate a break from the range. This ensured a higher settlement for Aug’24 at $555.80 while the Aug/Jul’24 was firmer at $140.00, the question now is whether it can provide a sufficient springboard from which to climb further.