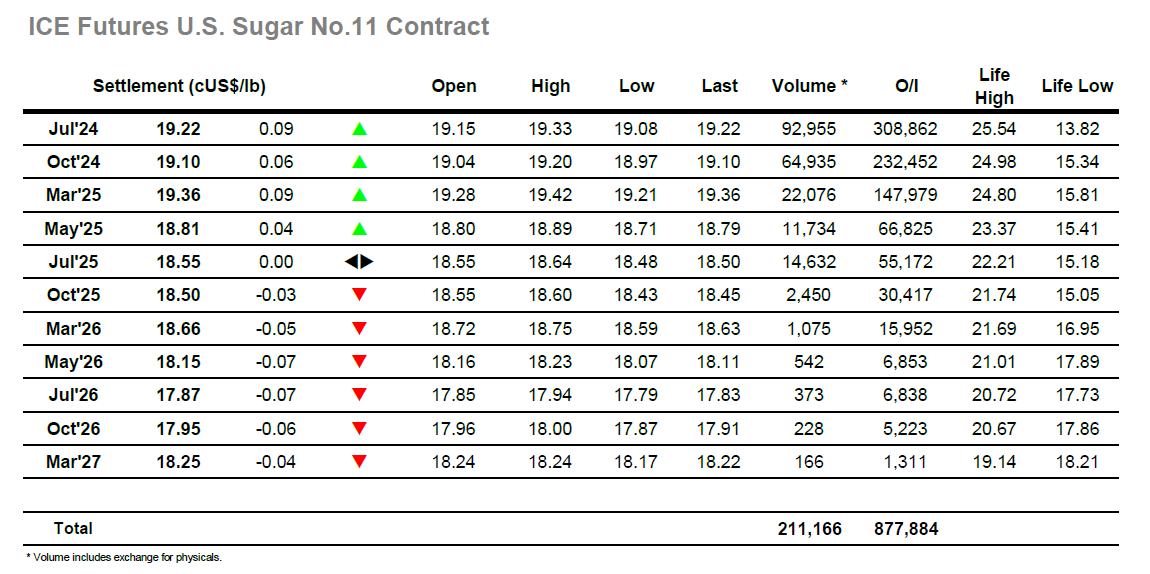

The technical stability garnered by yesterday’s push back through 19.00 and subsequent higher close provided the impetus for additional buying on the opening, and this continued through the first hour to take Jul’24 up to 19.30. The rest of the morning was far less interesting as consolidation gave way to some long liquidation, with little else happening of interest as the market remained comfortably above 19.00. There was some fresh impetus from small traders which brought prices back towards the highs early in the afternoon but having failed to draw additional buying into the mix another slide followed, on this occasion to anew daily low of 19.08. The flat price continued to yo-yo and new highs were recorded at 19.33, however with scale selling containing the gains the market soon moved back towards the centre of the range, allowing the spreads to dominate the volume. Jul/Oct’24 was again moving positively ahead of the main index roll commencing tomorrow (though some rolling does commence today), and recorded highs at 0.15 points premium through the afternoon as volume moved through 40,000 lots. Outright values maintained in the 19.20’s through the last couple of hours, bringing a calmer session to a close with modest gains showing at 19.22 to maintain the positive outlook.

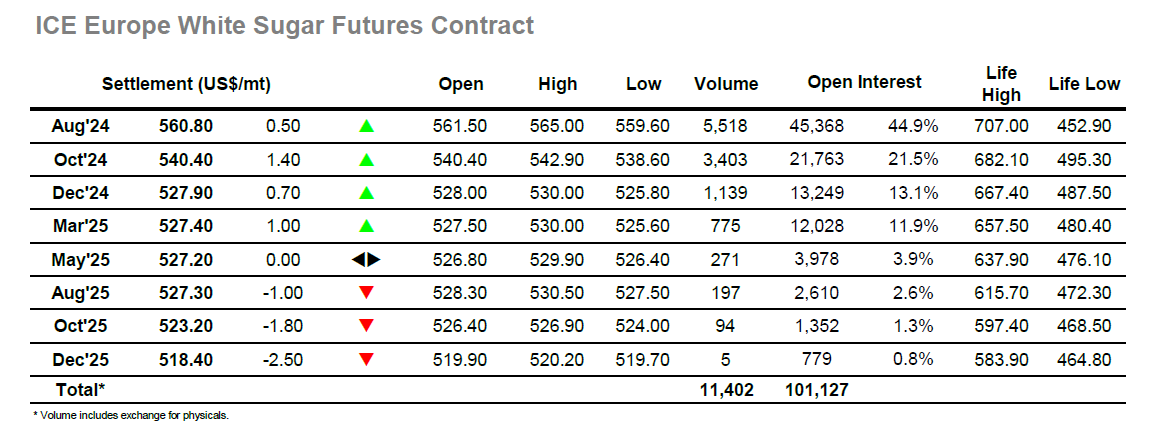

Aug’24 opened right on yesterday’s $561.50 high and continued its resurgence with an early push up to $565.00. The progress then stalled, and some mid-morning position squaring followed, though the general outlook remained positive with Aug’24 maintaining above $561.00 as we headed past noon. The arrival of additional volumes sparked a little more movement with underlying support being tested on a push back to $559.60, the results of which were favourable as prices rebounded quite quickly to be challenging the morning highs. Prices continued to chop around within the range as the afternoon wore on, which somewhat disappointingly provided another ‘slow’ session for the outright positions, and spreads / premiums were not much more active either. In the front month spread there was mildly contrarian movement with Aug/Oct’24 slipping back to $19.90 during the afternoon, while Aug/Jul’24 was also weaker on the day and slipped to $137.00. There were no fireworks through the closing stages, prices simply edging back down within the range to end with small net changes, Aug’24 settling just 0.60c higher at $560.80.