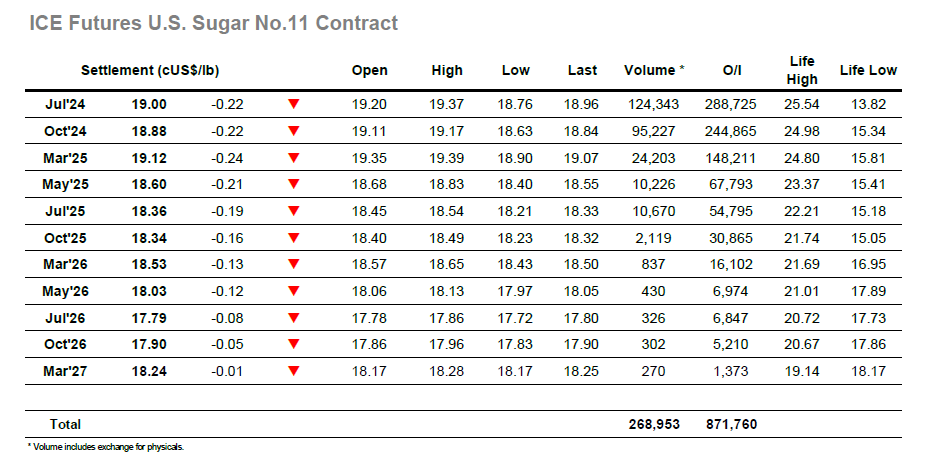

Lower opening prints were quickly shaken off and the initial period then saw another look higher with traders pushing Jul’24 through yesterday’s 19.33 mark and another recent high at 19.37. Having made new highs there was no apparent impetus to continue from specs, and so a washout into the range followed as day traders closed positions and regrouped. This left Jul’24 trading marginally lower as noon arrived and with the buying having dried up a test of the 19.00/18.96 pivot developed. Initially this area just hung on to continue providing support, but a second push lower had a more dramatic impact with sell stops triggered as a low at 18.76 was reached. Such movement was not a good lock for the technical side after all the efforts made over this week, and so buyers set about trying to re-stabilise the picture through the later pat of the afternoon. Initially Jul’24 only reached 18.94 but a more concerted effort during the final hour saw the price move back to a 19 handle as they looked to achieve a better close for the chart. Spreads meanwhile were again showing a strong volume with the index roll now fully underway, and Jul/Oct’24 saw 75,000 lots change hands (by far the largest part of todays volume) as it range 0.11 points to 0.22 points before ending the day unchanged at 0.12 points. A mixed close saw defensive buying offset by pre-weekend position squaring and Jul’24 making settlement bang on 19.00, placing it right on the pivot as eyes turn to the COT report to gauge how much short covering has been concluded to Tuesday / over the subsequent days.

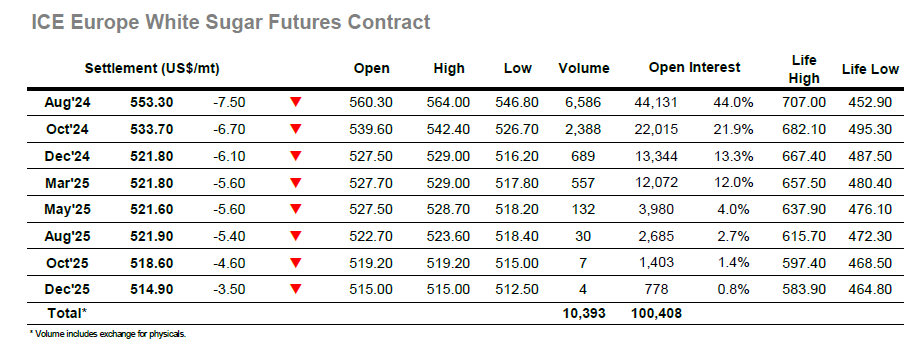

It was a slow but steady start to the day for Aug’24 as the price edged its way up to $564.00, but though this potentially placed the market in a position to push ahead through yesterday’s highs the necessary buying volume was lacking. Instead, there was a washout by day traders which left the market in the upper $550’s by late morning and attention turned to the Americas to see whether additional buying might emerge. The answer was a resounding no and instead the price fell back to $554.00, causing questions to be asked of the recent resurgence. Sell stops followed to send the price plunging to $546.80, though once concluded there was a quick bounce through $550.00 with smaller traders rushing to switch positions. This movement led to another weakening for the nearby white premiums with Aug/Jul’24 dropping beneath $134.00, though spreads were non-plussed as Aug/Oct’24 remained near to $20.00. The $550 area provided a consolidation target through the later afternoon from which a final push back up was mounted and raised Aug’24 to $555.40 ahead of the close. A mixed call saw settlement made at $553.30, weakening the recent sentiment and possibly confining the market to a range again heading into next week.