Insight Focus

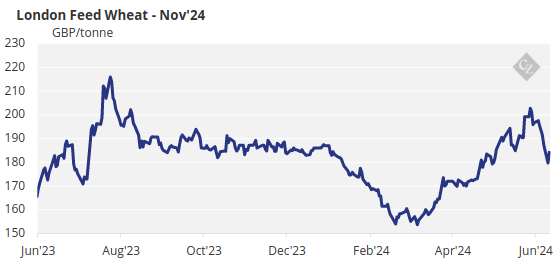

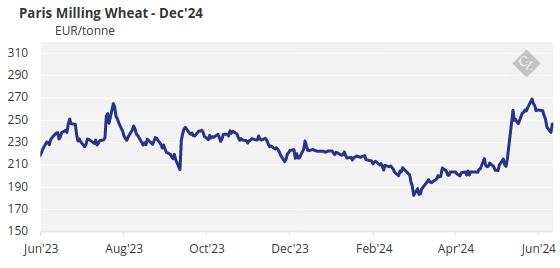

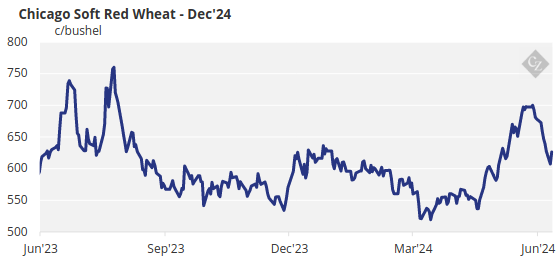

Turbulent markets can make decision making a tough process. This has been particularly true recently. The last eight weeks has seen an impressive rally in global wheat prices, followed by a sharp fall from the highs.

The Instability of Markets

Looking at the charts below demonstrates the uneasy ride many participants have faced, as values rocket or plummet on the whim of a new headline.

Despite speculation of normalisation for the markets in the aftermath of Russia’s invasion of Ukraine, the overall unstable nature of prices appears set to continue.

Advice for The Farmer Seller

Farmers are experts at producing good yields of wheat, navigating the uncertainties of weather extremes, politics and paperwork.

The ability to assess wheat potential yield and quality are critical to determining what your costs of production might be post-harvest. Thus, providing an estimate of price needed to ultimately generate a profit for your business.

The earlier this information can be forecast, the easier it becomes to look for profitability in the market.

- Assess cost of production, as best you are able.

- Look for this price as a benchmark — anything higher is likely a profit and a sensible sell.

- It is easier to sell into a price rally, than try to catch a falling market.

- When a market is falling, do not look for yesterday’s price…it may never come back!

- Sell little by little, unless the price is ‘too good to be true’…in which case it probably is.

- Selling the rallies and achieving better than average will stand you in good stead.

Advice for The Buyer

From the livestock farmer buying his feed, to a global food business buying their meat and bread products, wheat prices can be critical to your business’ margins.

The ability to determine your sale price may not always be that easy. Sometimes they will be a complete unknown weeks or months in advance.

- Know your market and buyers to assess your costs.

- Look for enhancing margin rather than hitting the lows.

- Buy into bear markets — it is easier than chasing a bull.

- If prices are too low for wheat growing farmers, they are probably good for you.

- When prices are profitable, look to buy forward to alleviate pressure buying spot.

- Sky high prices reduce demand. If it’s not profitable there may be better days ahead.

Conclusions

- Whether buyer or seller, know your business and where your margins lie.

- A profitable business is a good business — do not let hindsight beat you up.

- Buy when sellers are there or sell when buyers are there; do not try to chase a running market.

- If it is unaffordable, things will probably change for the better. Be patient and look at history.

- Never succumb to ‘Hope, Fear or Greed’… the three biggest downfalls of a wheat trader.