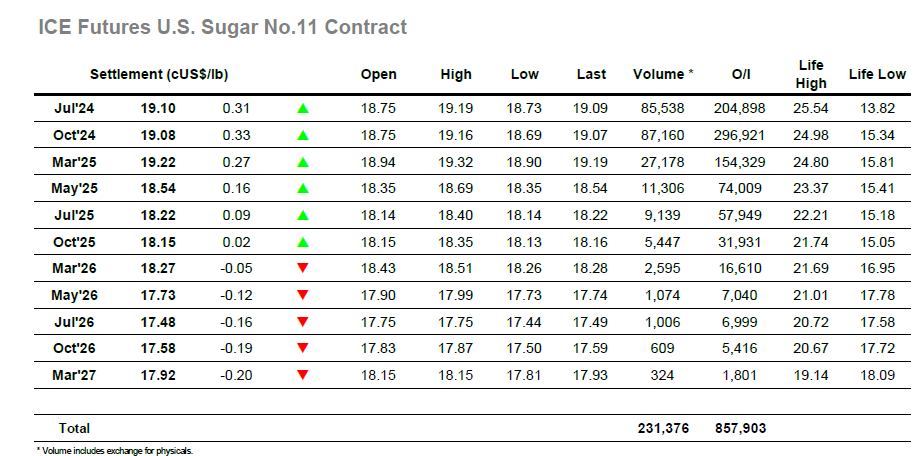

A marginally lower opening was soon erased, and the market then climbed into credit as trade buyers joined alongside the usual array of day trader activity. Within an hour Jul’24 had reached 18.97, but failing to nudge back through 19c things then calmed down and the rest of the morning was spent consolidating the 18.80’s / 18.90’s. Moving into the busier afternoon period some additional buying emerged and it was not long before the price moved to new highs, working through 19c on this occasion and drawing in additional buying from specs and algo’s. The climb continued to 19.19, though there was not to be a challenge of the recent highs as selling emerged for 2024 and 2025 positions with growers keen to take advantage of the recovery and lock in a little more of their hedge. Things then levelled out and the afternoon became monotonous with the flat price holding to a narrow band above, though maintaining above 19.00. This left the spread to generate much of the volume, with good amounts of volume still changing hands in Jul/Oct’24 at a small premium as the index roll nears its end. The close proved uneventful with Jul’24 moving to a settlement at 19.10, bringing recent highs back into view though with scale selling to be worked through in order to try and reach them.

The whites market was buoyant during early trading with a spike up to $553.80, widening nearby white premiums with No.11 failing to keep pace. Consolidation then followed and for several hours the market was confined to a narrow band in the lower $550’s, and it was well into the afternoon before the market looked to break from this range. Additional upside movement was seen, though progress was proving tougher than tis morning with producer selling in place, and so an extension to $556.00 was the best that Aug’24 could muster. By now the No.11 was performing better and this led the premiums to give back earlier gains, by late afternoon Aug/Jul’24 was sitting back around $134.00 while Aug/Oct’24 was holding the upper teens and ended at $18.70. An afternoon dip to $552.30 was reversed with defensive buying during the cosiing stages taking Aug’24 to a settlement at $554.80. This positions the market more positively again though there remains work to be done if we are to break ahead through recent highs.