Opinion Focus

Sugarcane and sugar beet area has been growing in several countries thanks to higher prices. Now that prices have fallen some of the gain in acreage may be lost.

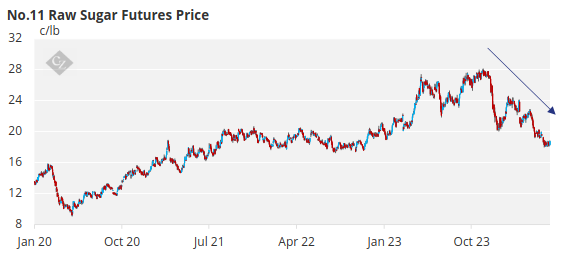

30% Drop In Sugar Futures Price

Sugar futures have collapsed by about 30% since their high towards the end of 2023.

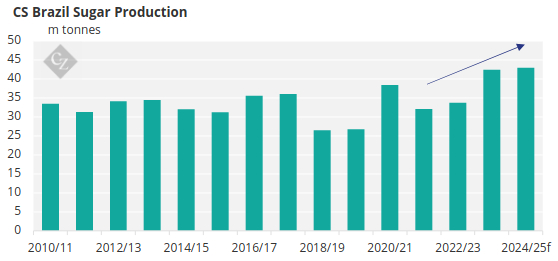

The higher price environment for the past few years has encouraged investment in sugar production capacity. Most notably mills in CS Brazil increased their crystallisation capacity to increase their sugar output.

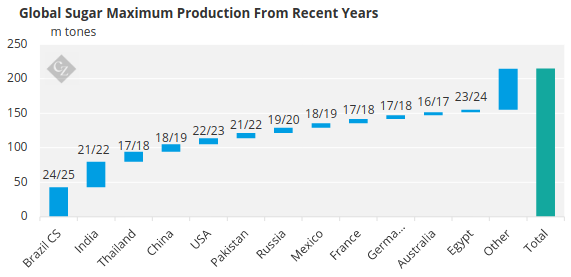

Based on this, we now think that sugar production capacity is more than 200m tonnes, which is plenty to meet consumption needs for several years to come. Even if prices fall, production capacity is unlikely to reduce for several years as machinery and crystallisation units are already installed.

What is up for change is how much sugar beet or sugarcane farmers plant. In general, higher sugar prices meant higher prices for these crops leading to increased area.

With the drop in sugar prices, it’s likely that some of the gains in cane and beet acreage in recent seasons could be lost.

But not so soon; this won’t happen today or even in the next year. Any impact on sugar production won’t be noticed until the 2025/26 northern hemisphere crops (with sugar becoming available very late in 2025). Southern hemisphere 2025/26 crops will already be in the ground providing limited flexibility.

We think the most significant changes could come in Europe and Thailand. Acreage in other countries is less related to world sugar prices – take India for example where a minimum cane price is set by the government.

Thailand

We estimate the cost of production for Thailand in 2023/24 was over 20c for raw sugar, which is higher than world market prices.

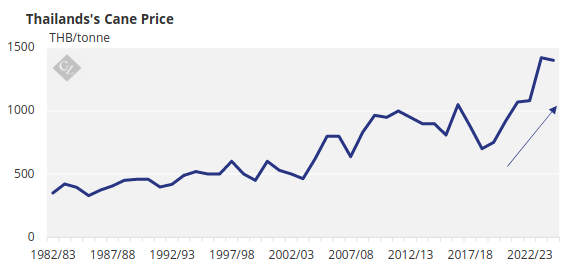

Cane prices here have almost doubled since 2018/19, as sugar prices rallied.

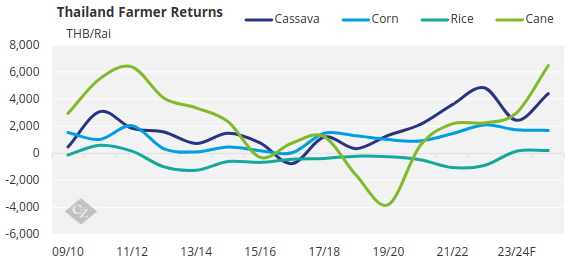

Cane has become the best returning crop for Thai farmers, even with the increasing costs of labour and fertiliser.

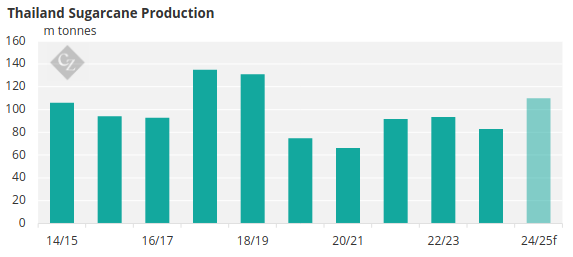

Planted area has rebounded significantly for the 24/25 season which we think will yield 110m tonnes of cane, the most since 2018/19.

However, this rebound in acreage and cane production was only possible with such high cane prices. As the cane price. As the cane price is linked to sugar futures prices (and several other variables) by a complex formula, cane prices are likely to be lower for 2025/26 which will reduce farmers margins from cane. If farmers switch away from cane will also depend on cassava prices which are currently weakening because of poor demand from China.

Europe

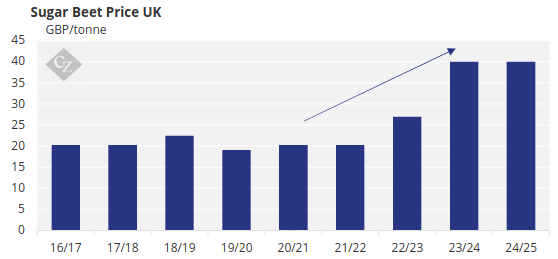

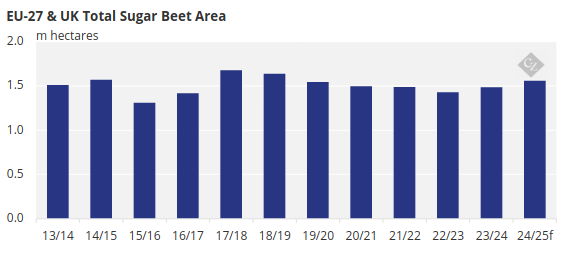

Beet prices in Europe are slow to react to price: they’re negotiated once a year for the next crop. It’s taken 2 consecutive seasons of much higher beet prices (almost double previous years) for the beet area within the EU to see any meaningful expansion.

For 2024/25 beet area is 5% larger but it’s unlikely this will be sustained into the following season (2025/26). We think beet area could fall as much as 10% if beet prices reflect the 30% drop in sugar futures prices. A 10% drop in production would be equivalent to a loss of about 1.7m tonnes of sugar.

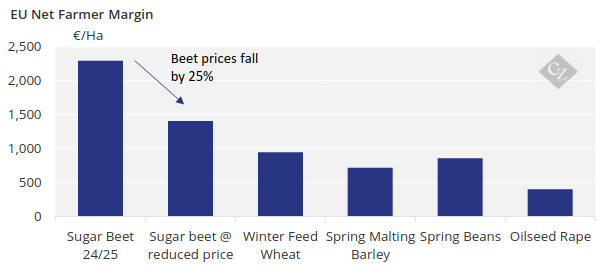

As an illustration, if beet prices fell by 25% in Europe, farmer margins would drop significantly. On paper we think beet would still be better than other crops. In reality some farmers have already started to suggest they would have been better planting wheat this year. This is in part because wheat prices have been rising but also because sugar beet remains a risky crop for farmers due to the risk of crop failure due to beet yellow virus.