Insight Focus

Urea prices have increased on lack of supply as Egyptian gas issues persist and Indonesia faces bad weather at Bontang. There is a similar supply issues in processed phosphate, but more clarity is likely after the Indian elections. Potash and ammonia remain stable.

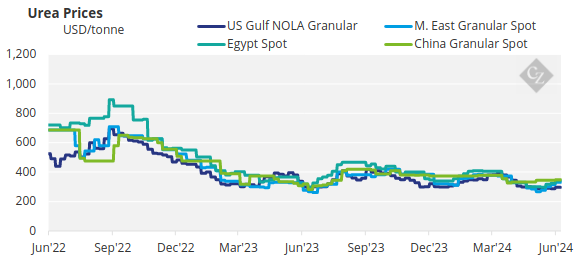

Urea Price Rises as China Remains Absent

The international urea market is currently driven by lack of supplies due to continued gas outages in Egypt, lack of exports from China and delayed shipments from Indonesia due to bad weather at load port Bontang.

Export losses from Egypt could amount to as much as 300,000 tonnes if the problem persists. However, FOB levels in Egypt have advanced on the back of one small 10,000-tonne parcel sold at USD 355/tonne FOB.

Middle East prices are also on the upward run with one SABIC cargo reportedly sold at USD 350/tonne FOB with no destination attached. Other sellers in the Middle East are at around the USD 335/tonne FOB level but with the expectations of higher prices. Middle Eastern urea prices have gained USD 80/tonne over the past five weeks but are still short of the February levels of USD 380-385/tonne FOB.

Latin American prices are also up by around USD 60/tonne over the past few weeks. The latest price is now around USD 375-385/tonne CFR. Buyers in Brazil are holding back from buying although they will have to get on the bandwagon soon to secure volumes.

Producers in Southeast Asia have little to offer with Malaysian producer Petronas catching up on contract sales and Indonesia facing massive delays loading cargoes already sold due to bad weather at Bontang in Borneo.

Chinese domestic values are now below those of the international market so we may see Chinese exports emerge in July. Still, nobody is holding their breaths for that to happen. The outlook for the urea price is bullish but with an eye on China coming into the market in July, which could put pressure on the current upward trend in urea pricing.

On another note of interest is the Thailand government’s consideration of introducing a massive subsidy on fertilizers to rice farmers at the tune of USD 1 billion to procure 2.4 million tonnes to be sold at half price directly to the rice farmers. The National Rice Policy Board passed the program on June 13th and the bill is put forward for approval by the Thailand government next Tuesday. Not only urea is included in the list of products to be sold at half price but also 11 different types of NPK. Certainly, if this program is enacted, the fertilizer situation in Thailand will be considerably changed. There is no news on where the Thailand government will secure the 2.4 million tonnes but most likely from the current domestic importers and providers of fertilizers in Thailand.

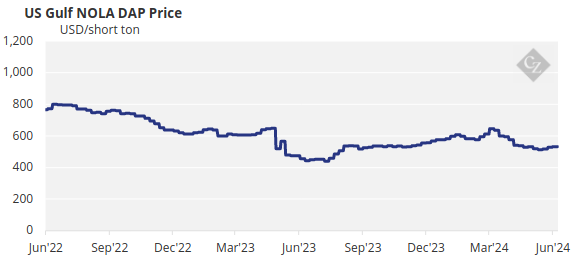

Processed Phosphate Awaits India

India is still holding back buying DAP and Chinese DAP is now being offered at prices around the USD 530-540/tonne FOB levels. This on the back of traders expecting to see USD 475/tonne FOB levels just a few weeks ago.

India is expected to come back into the market once the election dust has settled. Inventories are dwindling and importers are awaiting instructions from the government. Price guidance will emerge from the upcoming private processed phosphate tender in Bangladesh.

MAP is notoriously short worldwide and the current price of MAP in Brazil is approaching USD 600/tonne CFR. This is a USD 12/tonne week-on-week increase and a level not seen since April 2023.

The outlook for processed phosphate prices is bullish with limited availability driving price increases across the board.

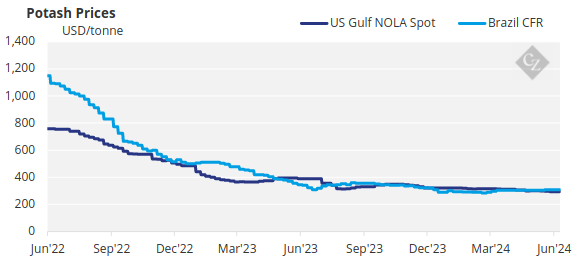

Indian Election Delays Potash Pricing

Potash prices were once again stubbornly flat as yet another week passes without a fresh benchmark from the Indian potash contract. All eyes remain on the settlement of the Indian potash contract, but delays are expected following the general election.

In Southeast Asia, the average price of standard grade potash has remained at USD 290/t CFR for the eighth consecutive week. Demand in the region has become limited, with some producers now seeking sales opportunities in areas of higher demand or simply not offering at all in the region until a fresh enquiry emerges.

Brazilian potash spot prices remained at USD 305-315/tonne CFR again this week since most producers are sold out for June and selling is well underway for July deliveries. However, one producer indicated higher prices at USD 310-325/tonne CFR, in line with the other fertilizer products, phosphates and nitrogen, which also increased this week.

The 2024 potash demand in Brazil is expected to fall around 1% year on year to 13.2 million tonnes. Producers in Brazil are keen to push for higher levels in line with other fertilizers. However, potash benchmarks may remain flat to soft in most key global markets amid the lack of a fresh input from India.

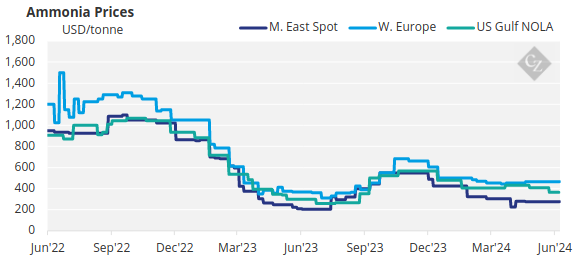

Ammonia Remains Fragmented

Ammonia markets were relatively quiet this week. Benchmarks both East and West of Suez were predominantly unchanged, with fresh price direction eagerly awaited across both regions.

Import appetite in the Far East remains sluggish, with industrial demand across the likes of China, South Korea and Taiwan unlikely to inspire any bullish momentum any time soon. Recent price upticks across the region have been largely supply-driven. However, previous buyer fears over cargo procurement appear to have subsided slightly amid talk of gradually improving export availability out of Southeast Asia, namely in Indonesia.

The outlook for the ammonia price in the Eastern Hemisphere, whilst still flat-to-firm, do not appear as supported as they have been over the past month. Meanwhile, indexes West of Suez look balanced for the time being, with regional supply issues seemingly counteracted by a lack of demand.