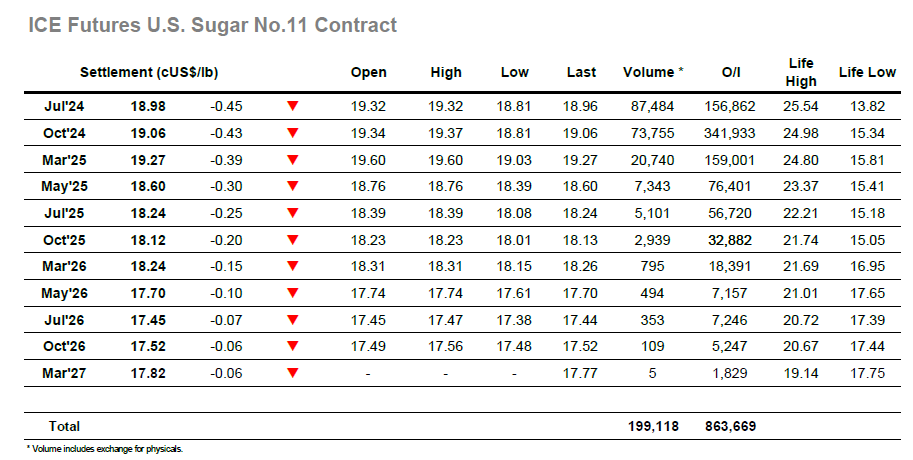

The intra-day charts gapped lower as the new week got underway and there were further losses to follow before Oct’24 levelled out in the low teens. This proved to be a mere pause in a wider reversal and as the morning progressed, so the decline continued at a slower pace to put the 19c area back under scrutiny for the front two positions. Sentiment appeared to have shifted back to a more positive Brazilian outlook since last weeks UNICA numbers, and this was being attributed as the market driver, pleasing news for the plentiful shorts who remain, with last Fridays COT report showing a net short still at -71,651 lots, a reduction of only 10,000 lots over the reporting week. Moving into the early afternoon some additional pressure was applied and so the market edged further down to an eventual low at 18.81 before returning to 19c on short covering. Nearby spreads had climbed to be slightly firmer, with Jul/Oct’24 moving back to flat, while the later afternoon saw both Jul’24 and Oct’24 holding near to 19.00, likely due to tonight’s Jul’24 options expiry. This pattern endured for the flat price for the rest of the session, though a late weakening for the spread saw Jul?oct’24 back down to -0.08 points as Oct’24 settled at 19.06 with Jul’24 just beneath the important 19c strike at 18.98.

The market was called lower against a weaker No.11 market and followed this with an immediate drop down to $554.00. There was no bounce to follow as consumer buying continued to be scarce and so the price regressed further throughout the morning to register a low at $548.00 just ahead of noon. This fall was more than that seen elsewhere and so the white premium values narrowed to show trades below $130.00 for Aug/Jul’24 and $114.00 for Oct/Oct’24. This weakness across the market did finally draw in some buying interest however its only impact was to stabilise against further decline with the next three hours spent holding a narrow $2 range in front of the lows. A small widening to $550.90 aside the rest of the afternoon saw no change and were it not for Aug/Oct’24 rolling the volumes would have been poor. Reaching the close we remained just above the lows, recording a weak settlement for Aug’24 at $548.50, while Aug/Oct’24 ended down at $14.00 and the Aug/Jul’24 premium at $130.00.