Insight Focus

Urea prices cooled this week as Egyptian gas supply resumed. Processed phosphate prices are moving up on limited supply and potash producers are pushing for higher prices in Brazil. But ammonia looks like it could be weakening as supply improves.

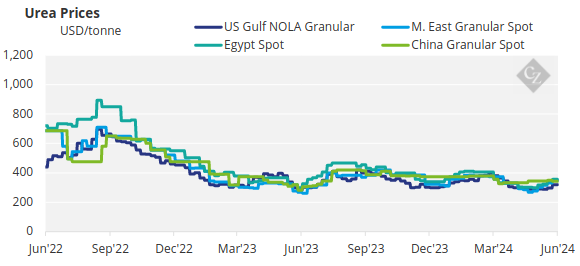

Urea Depends on India, China

International urea prices have cooled this week – and even seen some reductions – on the back of gas supplies returning to Egyptian producers and they are now reported to be producing at an average rate of 80%.

Middle East FOB levels retracted by around USD 5/tonne although the range has narrowed with the lower level having increased by USD 5/tonne. Spot urea is now trading between USD 340/tonne and USD345/tonne FOB.

Buyers in Argentina have taken a step back, having paid as high as around the USD 390/tonne CFR level. Brazilian CFR prices have dropped by as much as USD 10/tonne this week with offers in the range of USD 360-365 yet buyers are indicating around USD 350/tonne CFR. Mexican buyers are absent from the market due to drought.

Southeast Asian FOB levels have increased to slightly above USD 350/tonne and producers are said to be comfortable long into July.

There is currently no sign India will come into the market, but there is an expectation that shipments will begin in September. Chinese exporters are still waiting to enter the market in the hope that the NDRC will ease restrictions once the domestic market slows down.

The immediate outlook for urea is softer and again. The direction of the urea price will be decided either by India and/or China coming into play.

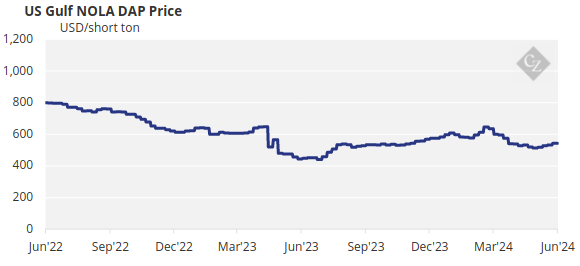

China Poses Risk to Processed Phosphate

Processed phosphate prices are going up on the back of limited supplies. Some producers are holding back for higher prices.

One of the reasons that prompt availability has been limited is that Chinese producers have seemingly shown greater discipline over export volumes. China’s January-May DAP/MAP exports were down 30% year on year at 1.64 million tonnes, according to updated Global Trade Tracker data.

MAP prices in Brazil have reached USD 620/tonne CFR, the highest since March 2023. India has bought DAP at USD 528/tonne CFR but is holding back on FOB prices in China, which are said to be around USD 550/tonne, up around USD 40/tonne in the last three weeks.

Another interesting market development may also be emerging, with the European Union reportedly being urged to consider imposing tariffs on imports of Russian fertilisers. Concerns of overdependence on Russian supply will have to be weighed against concerns over fertiliser price increases and wider food security by European politicians.

The outlook for processed phosphate prices is still bullish, but as always, rapid price increases could curtail demand and with China increasing exports, prices may have a limited upside.

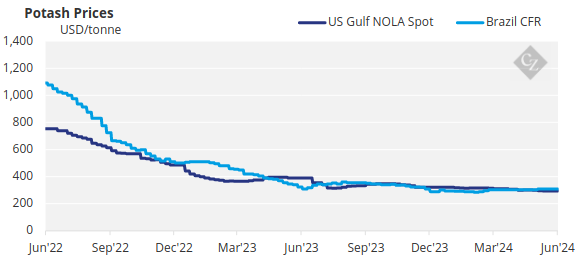

Potash Upside Limited

Potash spot price benchmarks were mostly assessed stable this week, while the US market saw significant declines in anticipation for summer fill prices.

Producers claim to have sold Brazil CFR at USD 320/tonne although market fundamentals indicate that price increases may be limited. The Southeast Asia standard MOP market dropped to a range around USD 280-290/tonne CFR this week, down around USD 10/tonne. The market is awaiting price directions with India still not having concluded a contract.

China’s MOP imports keep climbing, with January-to-April imports reaching 5.67 million tonnes, a 35% increase year on year. Chinese importers are in an advantageous position in negotiations for the next potash import contract as the MOP inventory continues to grow month on month.

Potash prices are expected to stay stable to slightly soft as the market awaits the Indian potash contract. In Brazil, producers continue to push for higher levels, although upside remains limited.

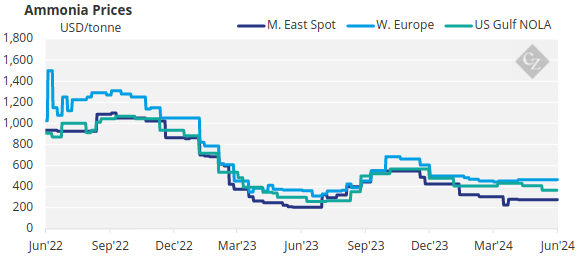

Ammonia at Risk of Surplus

National holidays in many manufacturing hubs have resulted in a quiet week but ammonia enquiries from northwest Europe might give rise to some clarity on prices going forward.

In addition to lack of demand from agricultural and industrial buyers, suppliers in some regions appear in no rush to load vessels, with the delays hinting at a surplus that could emerge shortly.

There is still no sign of softening in the Far East, although demand remains underwhelming and supply improving. India could see higher prices as there is still demand to be covered.

The resolve of suppliers West of Suez should be tested next week in Europe and when the Tampa price is settled for July.