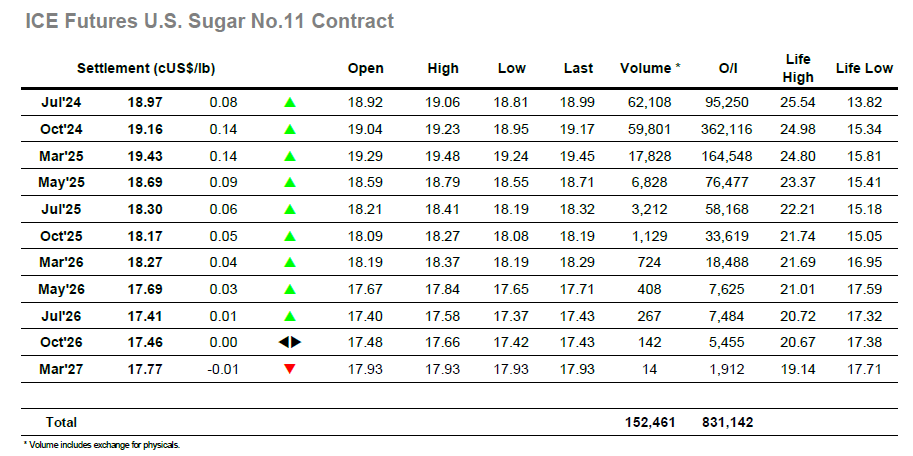

The No.11 raw sugar market opened broadly positive, climbing almost 15 points within the first 30 minutes of the session, before trading sideways around 19c/lb for the next several hours. Heading into the afternoon, Jul’24 futures continued to lack direction, instead trading in a narrow range of 18.85c/lb and 19c/lb. This continued into the close, ending the week at 18.99c/lb, down 50 points from the start of the week. The NV spread weakened slightly further, down 5 points from the previous settlement to -18 points. Next week marks the final week of trading on the July contract before expiry.

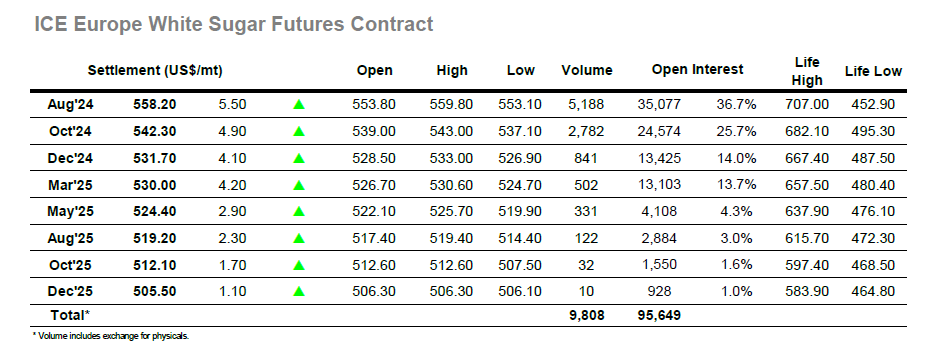

Over on the whites the story is broadly the same. Trading on the Aug’24 No.5 began positively, gaining 5USD within the first hour, before beginning to consolidate around 558USD/tonne for the next few hours. From there prices followed the No.11 tick for tick, moving sideways in a 3USD range for the majority of the remaining hours, closing the week just shy of 559USD/tonne. However, unlike the No.11, refined sugar prices have seen gains over the course of the week, this means the August-July white premium extends back above 140USD/tonne, a level it has traded at for the majority of the previous month.