Insight Focus

PTA and MEG futures close week relatively flat, with higher polyester operating rates supporting fundamentals.

Chinese PET resin export prices kept flat, high freight rate delaying shipments and damaging export demand.

PET profitability further threatened by increasing stock levels and additional new capacity.

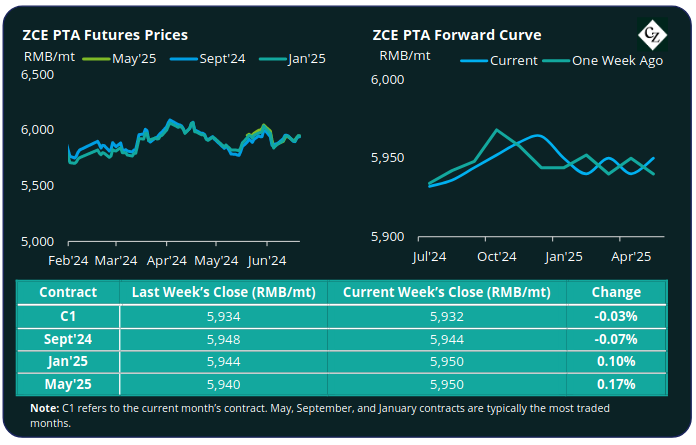

PTA Futures and Forward Curve

PTA futures finished relatively flat last week having experienced upward momentum over the last couple of weeks.

Brent crude oil prices moved 3% higher to over USD 85/bbl by Friday, up close to 10% since the start of the month.

Oil prices were boosted by a combination of the Energy Information Administration’s latest inventory report, lower jobless claims, and the beginning of peak driving season in the US.

The PX-N spread narrowed by around USD 15/tonne, as maintenance season came to an end, and several domestic and foreign plants restarted.

Although several PTA plants are also expected to restart, inventories remain low, with tight spot liquidity. As a result, the PTA-PX CFR spread widened to over USD 90/tonne last week, its highest levels since March.

Polyester operating rates also increased slightly, supporting a relatively balanced PTA market.

Overall, the forward curve is relatively flat through the main contract months. The Sept’24 contract only holds a RMB 12/tonne premium to the current month, while Jan’25 holds just a RMB 18/tonne premium.

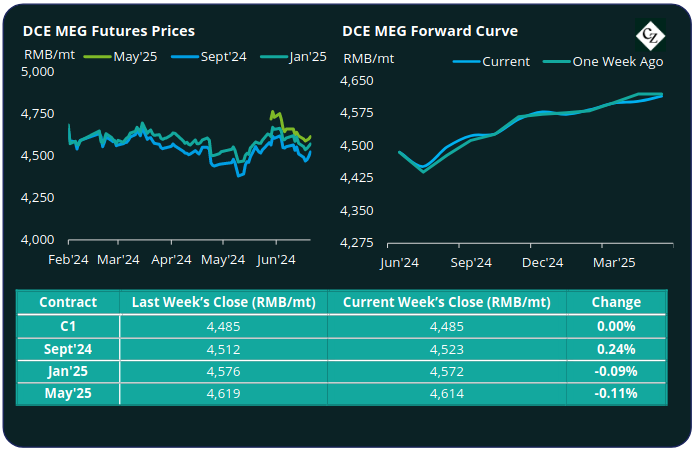

MEG Futures and Forward Curve

MEG Futures also averaged relatively flat through the main contract months, there was some modest near-term strength in the Sept’24 contract, and a slight lowering on the Jan’25 contract.

Although offtake remined at good levels, East China main port inventories increased by around 3.3% to 767k tonnes last Friday, as deep-sea arrivals intensified.

Domestic production recovery remained slow following several plant turnarounds and continued low operating rates at some units.

However, several major Chinese MEG units are still to restart, and import arrivals are expected to increase later in the month, potentially ratcheting up supply-side pressure.

Polyester operating rates moved slightly higher last week, with no signs of further production cuts going into July, providing fundamental support.

The MEG forward curve kept its shape last week, with the Sept’24 contract holding a RMB 38/tonne premium over the current month; the Jan’25 premium over the current month at RMB 87/tonne.

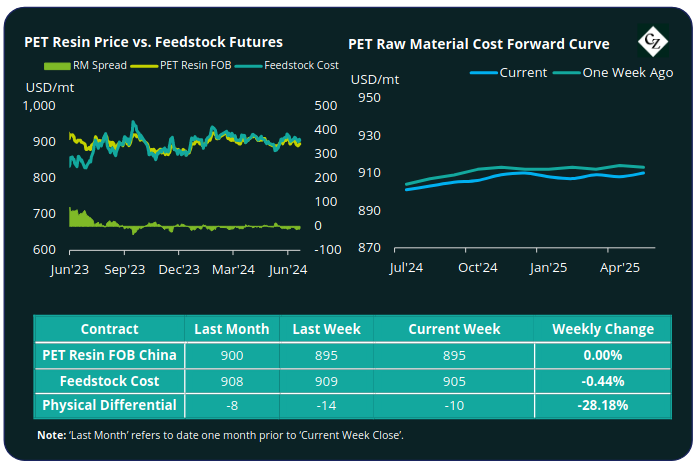

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices finished flat last week, with the average price steady at USD 895/tonne by Friday, the same level as the previous week.

The PET resin physical differential against raw material future costs also decreased USD 3/tonne to average minus USD 12/tonne last week. By Friday, the differential was minus USD 10/tonne.

The raw material cost forward curve showed little change from the previous week, flat through to year end. The Sept’24 contract shows a USD 4/tonne premium with the current month, Jan’25 just a USD 7/tonne premium.

Concluding Thoughts

Although only in June, the peak buying season for Asian PET resin exports is now in the rear-view mirror, with little chance of a recovery in producer profitability in the coming months.

At best, the physical differential may remain steady through to mid-August, before the traditional seasonal slump into Sept.

However, there is no sign that freight rates will ease before then, leading most buyers to remain cautious and take local and regional supply instead. Some ex-Asian routes are expecting a further USD 1000/TEU uplift in July.

In many cases, Asian exports have also lost competitiveness versus local supply, with European, Middle Eastern, and North American suppliers benefitting from less attractive import pricing.

As anticipated, shipping delays and container shortages are also resulting in a buildup of inventory through the supply chain, including at the Chinese PET resin factory level.

If Chinese PET resin operating rates remain steady, and new capacity comes on stream without delay, the physical differential between feedstock and current PET resin spot prices is projected to deteriorate through Q3, with PET resin export prices falling into modest backwardation.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.