Insight Focus

Singapore port has experienced severe congestion over the past few weeks. This is leading to substantial vessel delays for ocean carriers and a sharp increase in container rates for shippers.

The Red Sea region has been a high-tension zone for the shipping industry in recent months. Recently, another significant pressure point has emerged in Singapore.

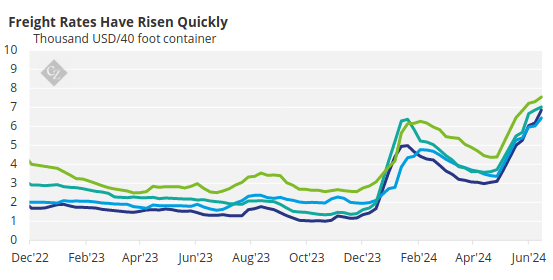

Meanwhile, container rates are expectedly resuming their upward trajectory due to the congestion at the port of Singapore, one of the world’s key container ports. The primary cause of these bottlenecks is the diversion of ships away from the Red Sea, which has escalated shipping costs and created ripple effects throughout the global shipping market.

The Shanghai Containerized Freight Index (SCFI) rose from USD 2,305/TEU on May 10 to USD 3,475 on June 21. Similarly, the China Containerized Freight Index increased from USD 1,237/TEU to USD 1,829/TEU over the same period.

Source: Drewry

Singapore Struggles with Changes

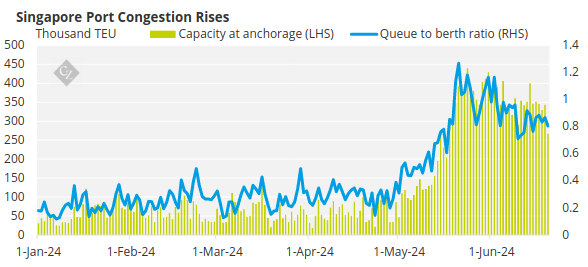

Reports indicate that nearly 500,000 containers are currently stuck at the port of Singapore, while at the end of May congestion at the major container port had reached 2 million TEUs. Singapore is seen as the epicentre of this logistical crunch and shipping experts are not optimistic about the development of the congestion at the port.

According to Drewry’s Ports and Terminals Insight, in the first five months of the year, throughput at the port of Singapore grew 8% year-on-year, representing a strong start to the year but not enough on its own to challenge existing handling capacity.

However, the rerouting of container vessel services away from the Red Sea in response to the Houthi attacks resulted in a 22% increase in average parcel sizes in the period between January and May, with a significant knock-on impact on port productivity, according to the analysis.

Drewry estimates that the average time taken to handle 1,000 TEUs rose 10% over this period to 0.32 days, meaning that the average time to complete the larger operations for a typical Ultra Large Container Vessel (more than 18,000 TEUs) leapt 41%, from 1.1 days in January to 1.7 days in May.

Source: Lynerlytica

Singapore Congestion Spreads

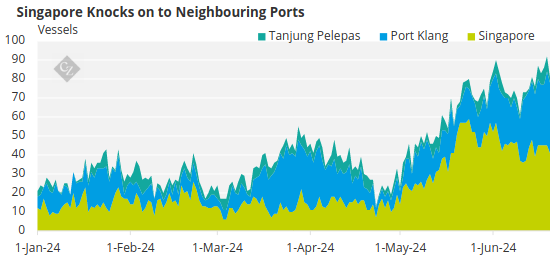

Since mid-May, the congestion at Singapore’s port has persisted, and there are now indications that neighbouring ports are also beginning to feel the impact. The situation is worsening as Houthi threats extend further into the Indian Ocean, severely impacting ports across Asia.

“Congestion at Southeast Asia’s main hub ports remain elevated, with the initial congestion at Singapore spreading to Malaysia’s Port Klang and Tanjung Pelepas as carriers shift part of their volumes away from Singapore to the other hubs,” said Hua Joo Tan, Consultant at Linerlytica.

Source: Lynerlytica

Actions to Ease Congestion

From January to May, container ship calls in Singapore have risen by 13% year-on-year. To address the bottlenecks that have persisted since the start of 2024, the Maritime and Port Authority of Singapore (MPA) has reopened the previously shuttered Keppel Terminal. This move has increased weekly throughput from 770,000 TEUs to 820,000 TEUs, offering some relief to the port terminals and yards.

To alleviate the severe congestion, Singapore also plans to expedite the opening of new berths. In addition to the eight existing berths on the north side of Tuas Port, the global terminal operator PSA will inaugurate three new berths later this year to boost overall port handling capacity.

The MPA and PSA are collaborating closely with liner operators and regional feeder operators, providing them with updates on berth availability and advising them on arrival times in an attempt to minimise delays.

By the 2040s, all of Singapore’s container port operations will be consolidated at Tuas, with an annual throughput estimated at 65 million TEUs. Alphaliner, a container shipping analysis company, reported that the south side of Tuas Port received its first cranes in March, and about 1,000 metres of pier equipped with eight cranes is expected to be operational soon.

However, in May, during the peak of the congestion, the new pier had not yet handled any vessels except for Hapag-Lloyd’s latest 24,000 TEU ship, Singapore Express, which was christened at the berth without loading or discharging cargo.

Last week, however, Alphaliner noted the first calls at the south side of Tuas 1, primarily from smaller vessels such as the 2,732 TEU MSC Tania.