Insight Focus

Raw sugar futures traded between 18-19c/lb. Speculators closed large number of short positions. The July’24 raw sugar futures expire this week.

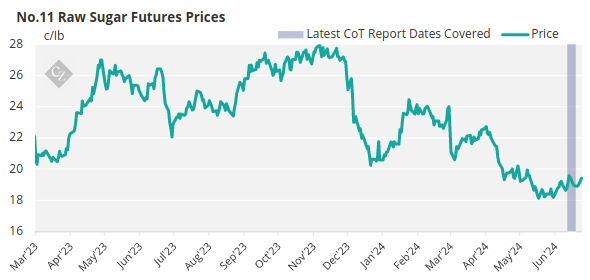

New York No.11 Raw Sugar Futures

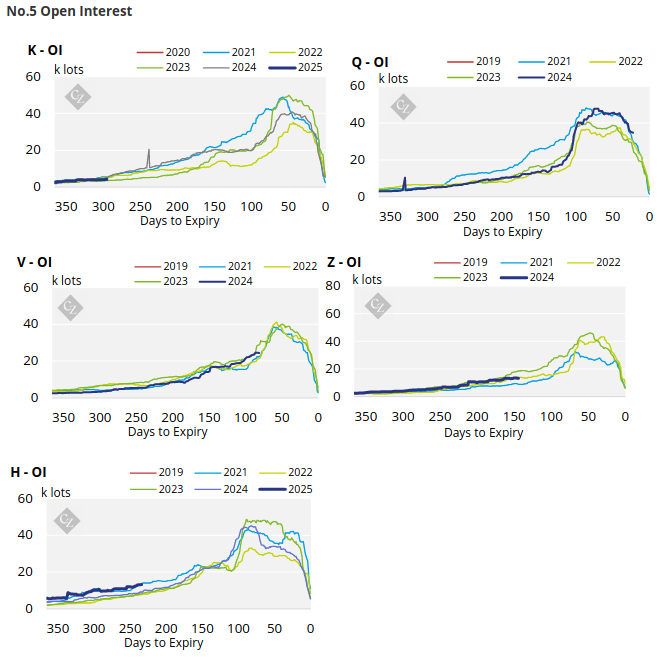

The raw sugar futures market traded in the 18-19c/lb range, closing just under 19c/lb on Friday.

The July’24 raw sugar futures expire this week; expiries are often consequential events in the sugar market. Raw sugar prices are within 2024’s downward trend and it will be interesting to see if the expiry brings a change of character to the price action.

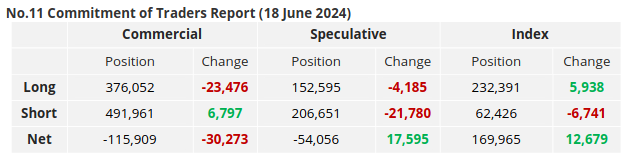

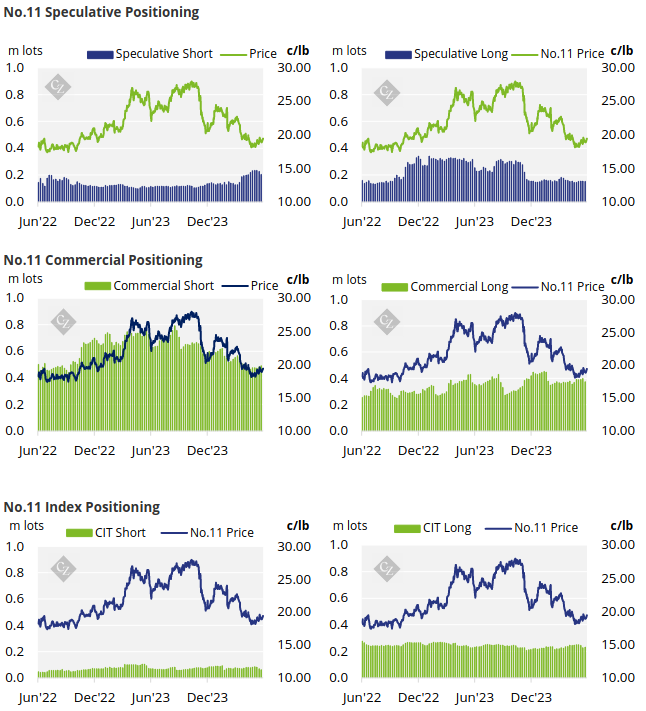

Producers are currently poorly hedged and have opened a small volume of 6.8k lots of short positions. On the other hand, end-users have closed out 23.5k lots of long positions.

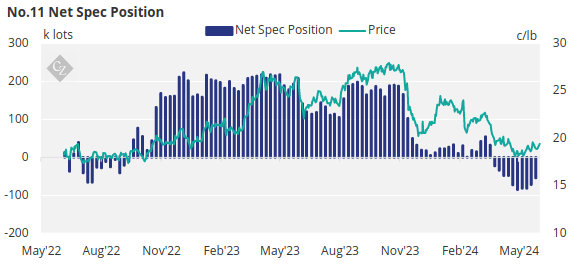

Speculators have closed out 21.8k lots of short positions as well as 4.2k lots of long positions. The net spec position remains short at -54.1k lots.

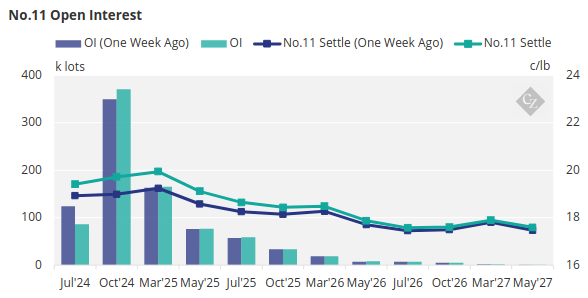

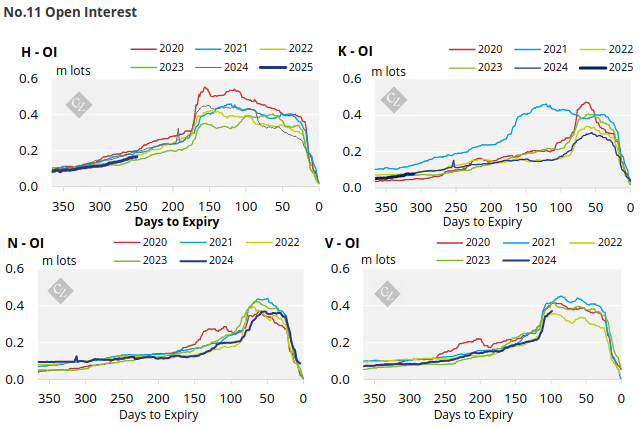

The front of the No.11 futures curve has strengthened over the past week but remains flat across the board.

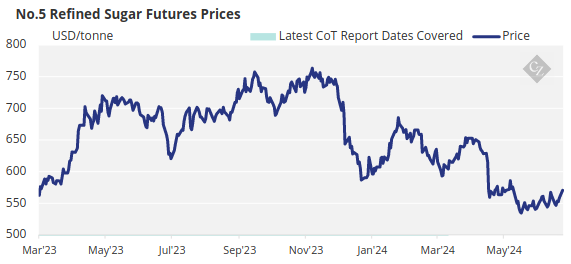

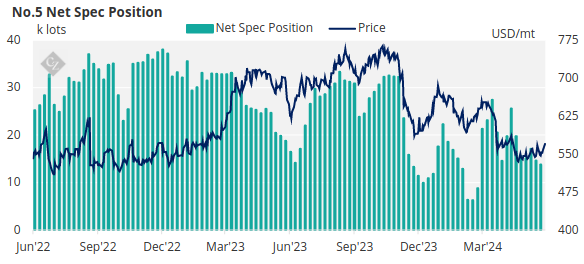

London No.5 Refined Sugar Futures

The No.5 refined sugar futures traded lower in the past week, closing at 558.2 USD/mt on Friday.

Speculators closed out less than 1k lots of longs, bringing the net spec position down to 13.8k lots.

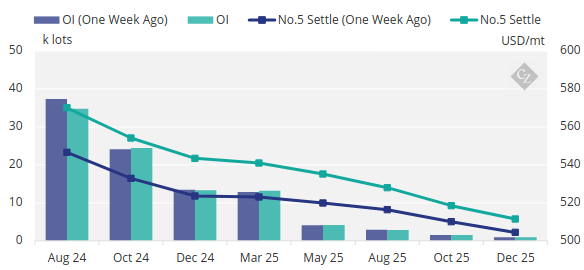

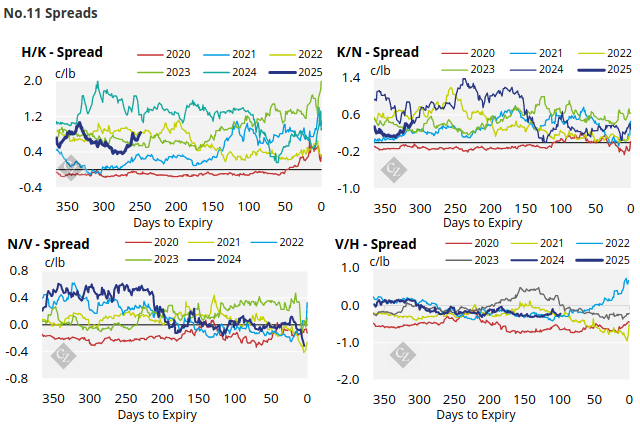

No.5 Open Interest

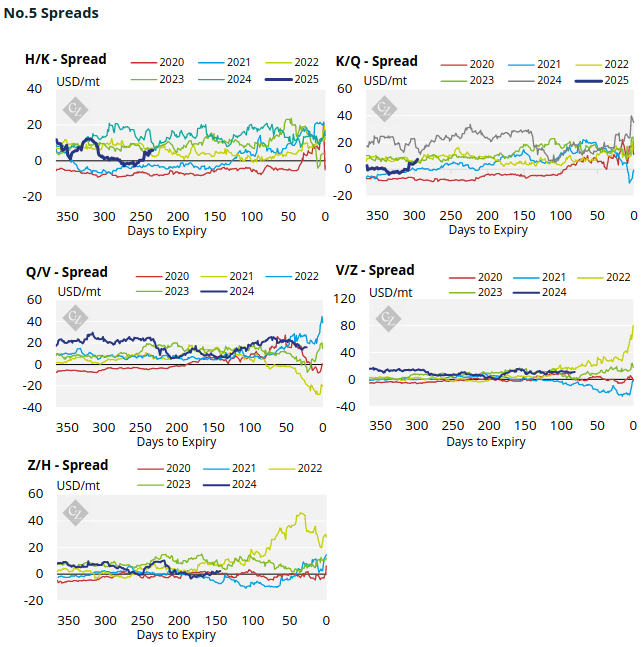

The refined sugar futures curve has strengthened across the board but remains in backwardation through to Dec’24.

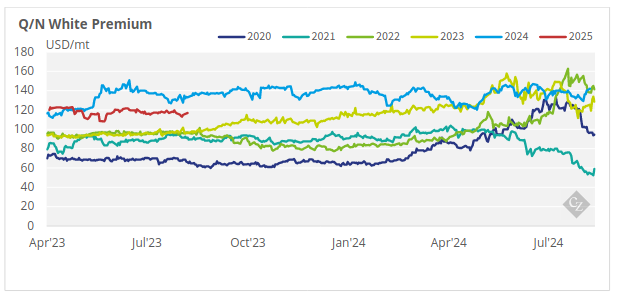

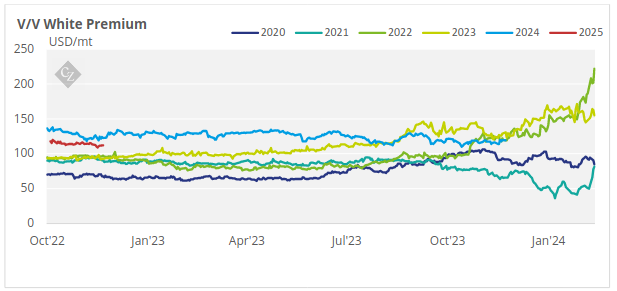

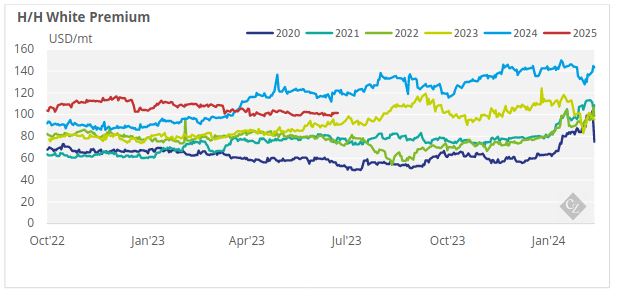

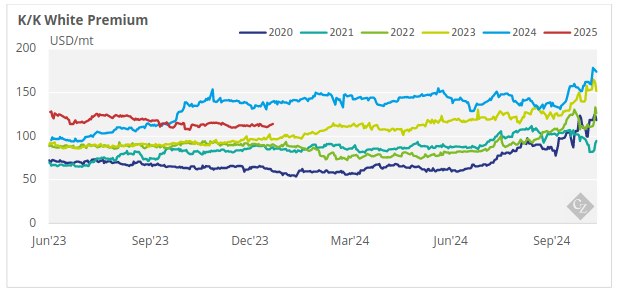

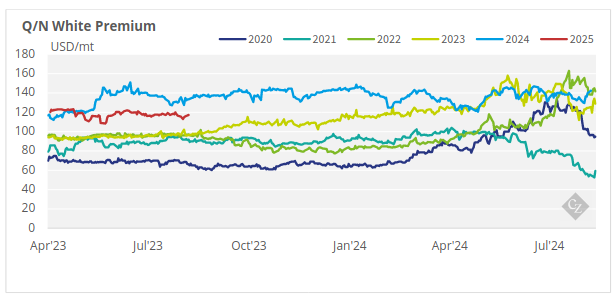

White Premium (Arbitrage)

The Q/N white premium has traded higher last week, closing at 140 USD/mt on Friday.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar. The current white premium is well above this level, which means we should theoretically see a pick-up in demand soon.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix