Insight Focus

Since the US wheat harvest began, the market has plummeted. The 2024 dramatic price moves demonstrate market fragility.

Introduction

The first half of 2024 has seen rapid wheat price drops as well as a significant and volatile rally. This is a minefield to navigate as a buyer or a seller, but some cool heads may see recent months as opportunity to enhance margins and profitability.

Considering the current state of the world, with conflicts, politics, weather extremes and economic woes, it seems an appropriate time to consider whether the market may be experiencing some long-term change.

The Markets

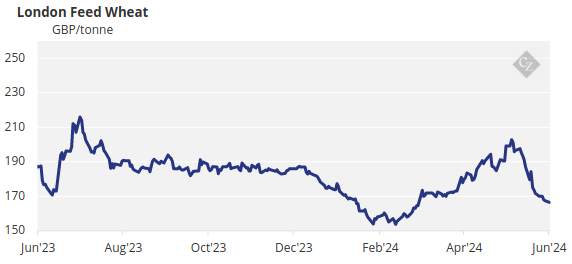

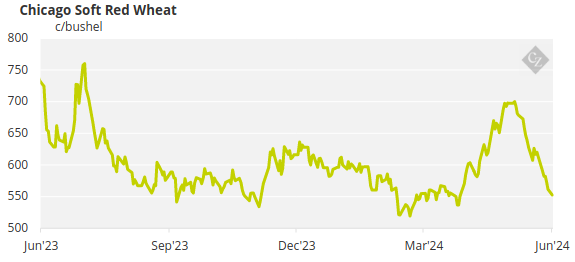

Looking back over the last couple of years, since the upheaval in global wheat trade, instigated by Russia’s invasion and continued war in the Ukraine, wheat values have experienced some extremes.

With Russia the largest and Ukraine the fourth largest exporting countries in the world prior to the invasion, market turmoil was inevitable. Nonetheless, the trade of wheat was maintained and despite huge hurdles these shipments have been extraordinarily resilient.

Price records were smashed in May 2022 and volatility has been an ongoing feature, as demonstrated by the charts below.

But war has not been the sole driver of volatility.

1. Russia’s War

Although much of the blame for market turbulence (across many commodities – not just wheat) lies squarely at the door of Russia’s President Putin, there have been other factors impacting prices.

2. Climate Change

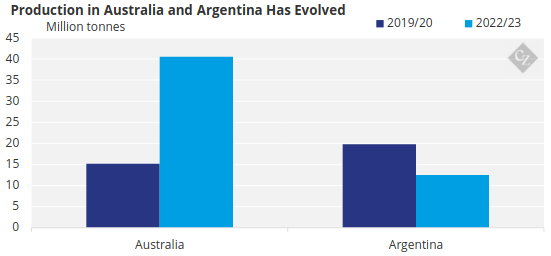

Regardless of views on climate change, there is no question weather extremes are an increasingly regular occurrence.

These weather stories, as well as being a political hot topic, have been suppressing wheat production around the world.

Australia and Argentina, both important global wheat exporters, are good examples. While Australia produced over 40 million tonnes of wheat in 2022/23, its output was less than 16 million tonnes in 2019/20. Meanwhile, Argentina produced almost 20 million tonnes in 2019/20, but less than 13 million tonnes in 2022/23.

Source: USDA

3. Populations

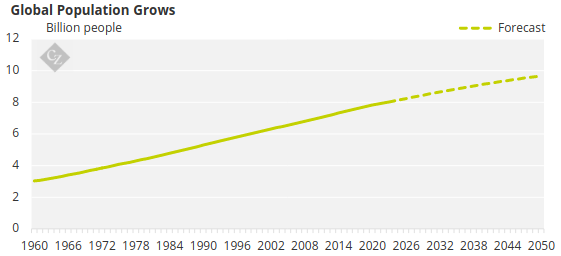

The world’s population has been growing, which unsurprisingly leads to a greater need for food.

Source: World Bank

4. Economics

Several countries with big populations, not least China and India, have become more affluent over recent decades, leading to a desire for more westernised diets. This has required increased amounts of wheat than previous, more basic meals.

5. Politics

Government taxes or bans on imports or exports have both helped and hindered domestic and international values. Subsidies and how politicians distribute them also have impacts on markets.

6. Market Participants & Funds

The large swings in investment fund positions across wheat markets over the last couple of years have unquestionably driven prices, both up and down, faster and to greater extremes than might otherwise have been the case.

7. Supply & Demand Balance

The combination of war, climate issues, population and economic growth has increased wheat demand while supply has been unable to keep pace.

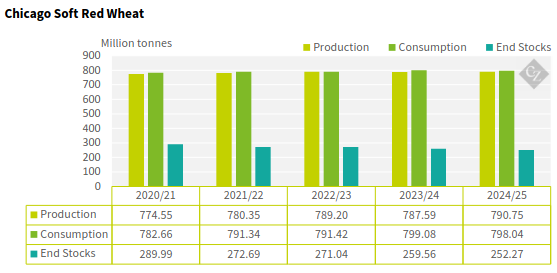

Looking at the USDA estimations below, this situation looks set to continue for at least the 2024/25 harvest and marketing season.

Fundamental Concerns for World Wheat End Stocks

Global demand for wheat is outstripping harvest production year on year. World wheat end stocks are at their lowest in nearly 10 years.

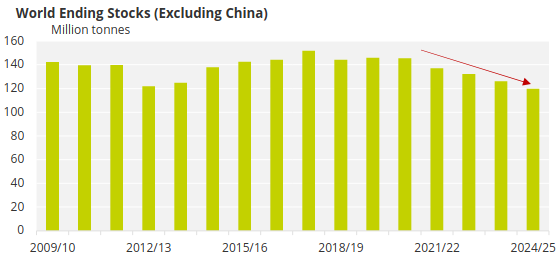

China, despite being the largest importer of wheat, is also by far the largest stockholder, with over 50% of total world end stocks. Stripping out China, world end stocks are at their lowest since 2007/08.

Source: USDA

Conclusions

- The world wheat market has been a volatile place in 2024.

- This turbulence has been caused by a multitude of factors.

- News headlines travel faster and more freely than in the past.

- The last weeks have taken many by surprise, primarily by the pace and magnitude of the moves.

- There will be more unknowns appearing around the corner.

- Keep a calm head, as discussed in our last article.

- Ride the market waves, make good decisions for your business and do not be shocked if the fragility and volatility keep coming for a while yet!