Insight Focus

Recommendations are being updated by numerous organisations as a result of recent bad press about voluntary credit markets. Organisations such as the ISO, and even the US government have also added guidelines as UN work continues.

Heading

Stakeholders in the global carbon credit markets are continuing to strive to improve the reputation of the market after a steady stream of negative press articles affected the market in 2023. A growing list of influential organisations is refreshing rules, guidelines and recommendations for the largely unregulated voluntary carbon markets (VCM).

Some heavyweight global regulators like the International Standardisation Organisation are stepping up to offer guidance and set standards that they hope will boost confidence and uptake of carbon credits as a valid component of corporate net zero efforts.

CCP Provides Credibility

Earlier this year the Integrity Council for the Voluntary Carbon Market (ICVCM) confirmed the first set of project types that conform to its Core Carbon Principles (CCPs).

The CCPs are intended to set benchmarks for the attributes of carbon credits, including accurate accounting, permanence, strong governance, transparency and “additionality” – that is, that the credits represent emissions reductions that are additional to business-as-usual.

The ICVCM’s initial set of CCP-tagged project types cover the capture and use of landfill gas and ozone-depleting substances. Analysts at MSCI called these projects “low on beauty, high on integrity”, conceding that while these projects don’t have the “glamour” of reforestation or carbon capture, landfill gas is a well-understood and mature project type.

Since then, the ICVCM also announced that three carbon crediting programmes, run by ACR, the Climate Action Reserve and Gold Standard, have all been assessed to meet the organisation’s CCPs. Credits from eligible project types issued by these programmes will be permitted to use the CCP label.

Stakeholders believe the establishment of the CCP label will bring greater confidence that carbon credits represent real, verifiable and permanent reductions in emissions, and in conjunction with a corporate’s internal reductions, are a strong step towards achieving net zero status.

More Agencies Step Up

Other global regulators are offering further guidance and standards. The International Standardisation Organisation (ISO) last week said it is working to build the first international standard for net zero. ISO published its Net Zero Guidelines at the end of last year as a guide to best practice but is now backing this up with an official standard.

And in May, the US government released its Principles for Responsible Participation in Voluntary Carbon Markets. In a statement the White House acknowledged that there is evidence “that several popular crediting methodologies do not reliably produce the decarbonisation outcomes they claim” and that often “credits do not live up to the high standards necessary for market participants to transact transparently and with certainty that credit purchases will deliver verifiable decarbonisation.”

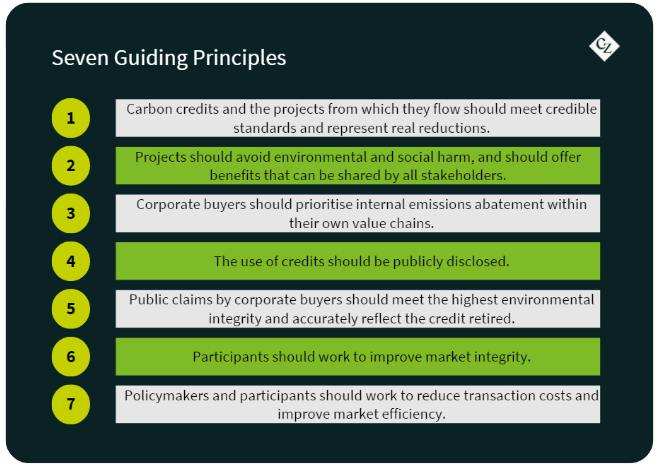

To rectify this, the Biden administration has issued seven guiding principles.

Carbon credit stakeholders were delighted by the White House’s statement, with many pointing out that this represents a powerful voice in support of the VCM where few other governments have taken such a position.

Scope 3 in the Crosshairs

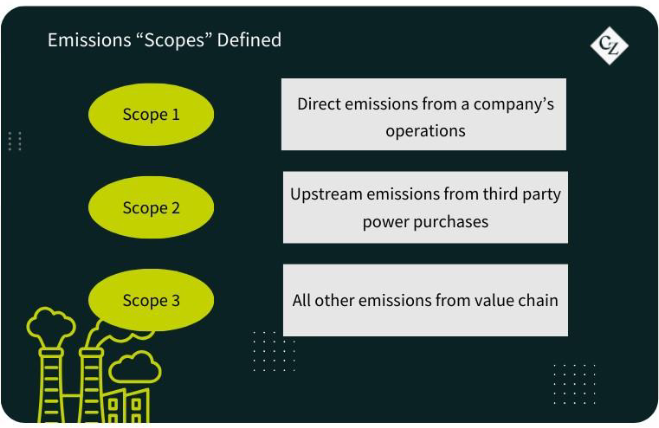

A number of other important guidelines have also been updated: the University of Oxford’s Principles for Net Zero Aligned Carbon Offsetting were re-issued in February, while the highly influential Science-Based Targets Initiative (SBTI) recently said it would soon update its own net zero standards to allow the use of carbon credits towards offsetting Scope 3 (supply chain) emissions.

The SBTI announcement triggered a storm of protest from environmental advocates who warned that including Scope 3 emissions would allow companies to offset their supply chain emissions without taking any steps to reduce them first.

Meanwhile diplomats at the United Nations are also working to flesh out the rules and regulations that would govern international trade in carbon credits that countries will use to meet their own national targets. It’s likely that the UN and voluntary markets will both use credits from broadly similar project types, and that it is simply the regulatory framework that will be different for both markets.