Insight Focus

PTA futures ease higher as fundamentals keep balanced and crude oil prices strengthen.

Chinese PET resin export prices steadily increased, before facing higher volatility on supply tightness.

Major producers increasingly sold-out due to larger breakbulk orders and production shutdowns.

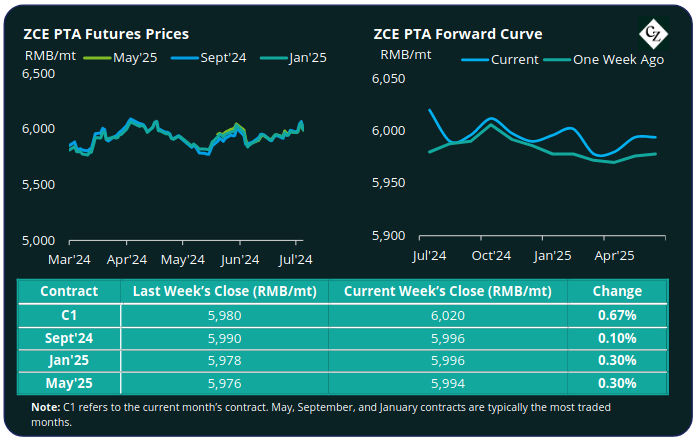

PTA Futures and Forward Curve

PTA futures showed minimal gains last week, with forward contracts up by 0.1-0.3%, despite crude strengthening through the week.

Brent crude oil was driven above USD 87/bbl Friday by a combination of positive US demand indicators, geopolitical tensions in the Middle East, and increasing optimism for US interest rate cuts in September.

Downstream the PX-N spread narrowed by around USD 8-10/tonne with increased domestic and international supply following the end of maintenance season.

PTA-PX CFR spread kept steady at USD 89/tonne with market fundamentals relatively balanced. However, late July is expected to see higher PTA production following delayed restarts and other returns.

Polyester rates, on the other hands, have eased over the last couple of weeks, the combination of which could pressure and lengthen the market late July-August.

Overall, the forward curve has begun to move into slight backwardation, moving from flat in recent weeks. The Sept’24 contract now holds a RMB 24/tonne discount to the current month with Jan’25 at the same level.

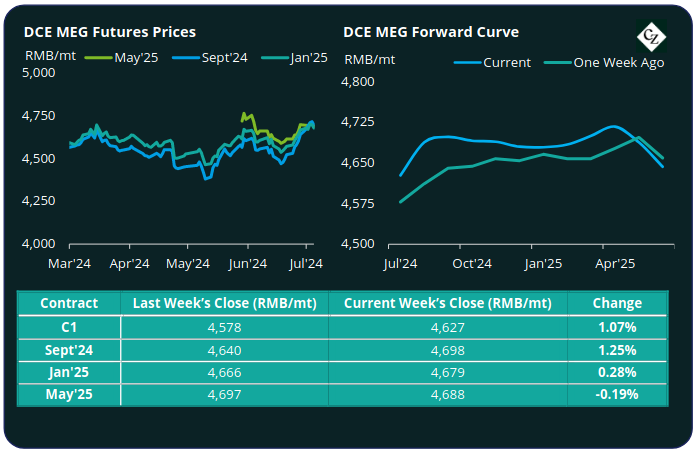

MEG Futures and Forward Curve

MEG Futures displayed near-term strength with current month and the main Sept’24 contract increasing by over 1% last week, as falling inventories boosted bullish sentiment.

East China main port inventories decreased by around 4.8% to 671k tonnes last Friday, with slower arrivals offsetting a dip in daily offtake.

Although import arrivals have been slower than anticipated, domestic producers are seizing on higher prices and raising operating rates.

Inventories may fall further in the near-term keeping prices firm. However, the combination of higher domestic production and softer demand, on lower polyester operating rates, is likely to seed buyer caution.

The MEG forward curve remains in slight contango, with the Sept’24 contract holding a RMB 71/tonne premium over the current month; the Jan’25 premium over the current month is RMB 52/tonne.

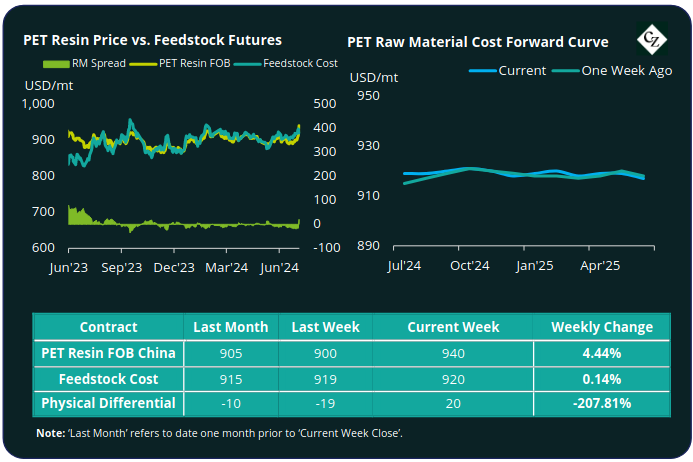

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices steadily increased, before leaping upwards at the end of last week.

Buyers faced price volatility with prices averaging USD 940/tonne by Friday, up USD 40/tonne on the previous week, the largest weekly price movement so far this year.

The PET resin physical differential against raw material future costs increased USD 7/tonne to average minus USD 9/tonne last week. However, the late week price surge meant that by Friday, the differential was had swung to a positive USD 20/tonne.

The raw material cost forward curve has now flattened entirely, with no flat premium through any of the forward contract months.

Concluding Thoughts

The current Chinese PET resin export market is in flux. The combination of larger buyers rushing to switch from containers to breakbulk, coupled with producers switching off lines and reducing operating rates, has produced a supply squeeze.

Over the course of last week prices surged, and so did producer profitability. Many Chinese PET producers are now claiming to be sold-out for July and August, having previously reported high inventories as recently as early June.

However, in the case of breakbulk, orders have simply been brought forward rather than changing fundamentals. The likelihood is that any further price surge may see a sharp correction once the current order rush is complete and supply returns following off-season turnarounds late Q3.

As mentioned last week, over 1.8 million tonnes of capacity could come on-stream during June-July; the general over supply in the market will come back into focus once the supply squeeze is exhausted.

With orders having been brought forward, and container prices remaining elevated, PET resin export demand is also expected to face significant weakness in Q4.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.