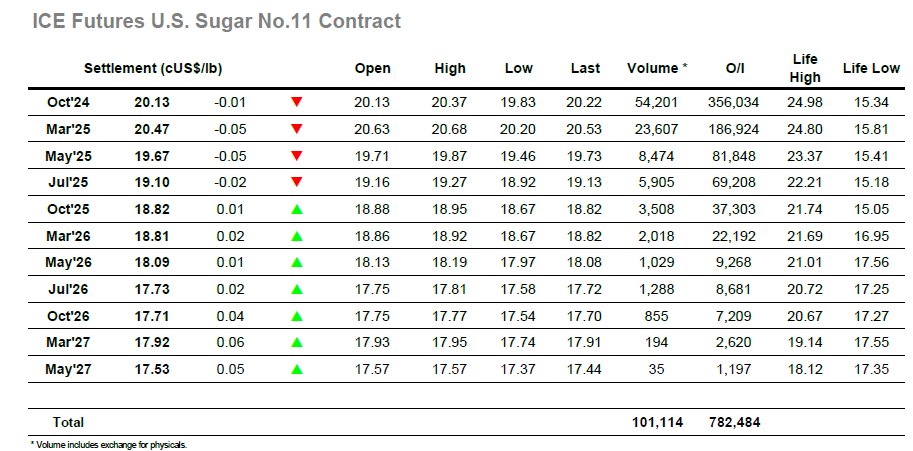

There were some small losses to start the day off however the No.11 was determined to try and dig in above 20.00, rebounding from the early 20.02 low mark to spend the morning 10 points either side of unchanged. Early afternoon saw some fresh buying arrive as traders looked to reverse Friday’s losses and the price quickly rallied to 20.37 before stalling as soon as the buyers slowed their volume. A short consolidation followed but buyers were proving hard to find, possibly due to weakness in the whites where the arb values were narrowing, and so it was inevitable that something had to give. The tracking back to morning lows was quite orderly but there was a bigger reaction when Oct’24 dropped through 20.00 as some heavier liquidation sent the price back to 19.83. Most activity was still being driven by small traders / algos and so as they swung around the market was able to work away from the lows, although for a period it seemed that it may prove tough to hold back over 20.00 and maintain some psychological strength. The price flitted either side of this mark during the final couple of hours, however MOC buying was in place to defend recent longs and eventually settlement was made just a single point lower at 20.13. Tonight see’s the delayed COT report published with many expecting the specs to have closed remaining shorts and moved to a small net long position, potentially providing some short term direction given that sectors current dominance of daily activities.

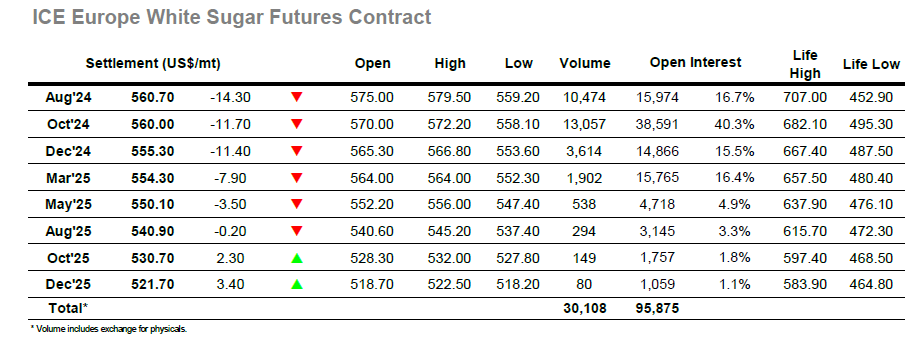

It was a calm start to the week despite the market starting a few dollars lower, with Oct’24 levelling out to hold either side of $570.00 through the early part of the session. By later morning there was a slightly larger dip however resent sentiment has meant that there are a few more participants invested from the long side and the early afternoon saw defensive buying which brought the price back to $571.00. These efforts soon proved to be in vain as selling returned and sent the market down to new session lows, setting off a far bigger reaction through the afternoon. Buying was proving to be limited and so long liquidation into a vacuum sent the market quickly through $560 before any attempt was made to dig in and find a base. It was not just the October contract under pressure with Aug’24 also suffering ahead of next weeks expiry, the lack of any obvious receiver to squeeze things enabling the Aug/Oct’24 spread to stumble again with trades beneath $1.00 premium later in the afternoon. Lows were recorded during the final hour at $558.10, though with some better end user pricing interest in this area there was no danger of a further collapse for today at least. The usual array of day trader position squaring into the close drew prices away from the lows, leaving Oct’24 to settle at $560.00 and Aug/Oct’24 at just $0.70c. White premiums were significantly weaker with the nearby losses in stark contrast to the more resilient No.11 market, Oct/Oct’24 concluding the session all the way back at $116.20.