Insight Focus

Turkiye recently imposed protectionist measures on wheat imports. The market looks oversupplied. The measures will mean there will be about 9 million tonnes of Russian wheat looking for a home.

Turkiye Bans Wheat Imports

Last month, the EU announced it would slap fees on imports of Belarusian- and Russian-origin cereals, oilseeds and animal fodder. This was intended as a kind of sanction on Russia over the Ukraine invasion due to reports it was stealing Ukrainian grain and reselling it as its own.

However, just a few weeks after the announcement was made, the Turkish government said it would stop wheat imports until at least mid-October in an effort to protect domestic wheat prices.

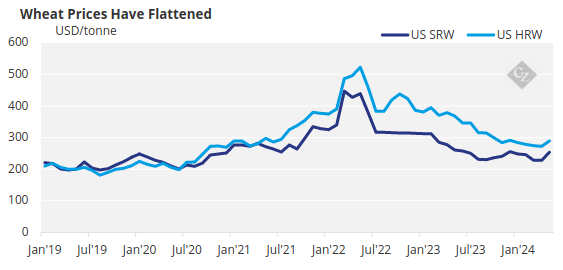

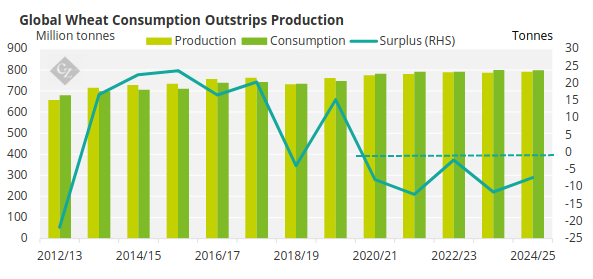

Since 2022, wheat prices have softened due to seemingly high wheat production.

Source: World Bank

Russia Feels the Pressure

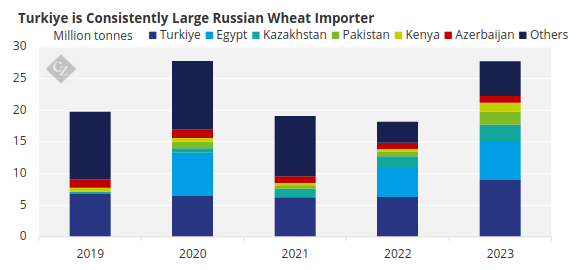

This is a major problem for Russia in particular, given that it is now locked out of two key markets for sales. Turkiye is Russia’s single biggest market for wheat sales, with almost 9 million tonnes sold in 2023.

Source: UN Comtrade

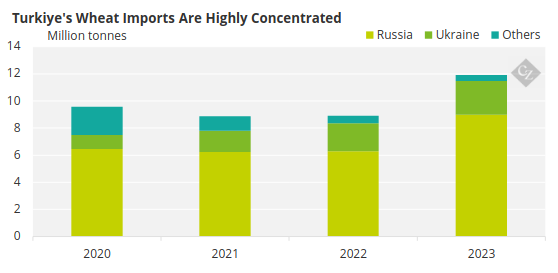

And Russia accounts for about a third of all Turkish wheat imports.

Source: UN Comtrade

With low global demand, protectionist measures in Turkiye and what looks like a surplus of wheat coming from Russia and looking for a home, this looks bearish for the wheat price.

India Could Seek Wheat

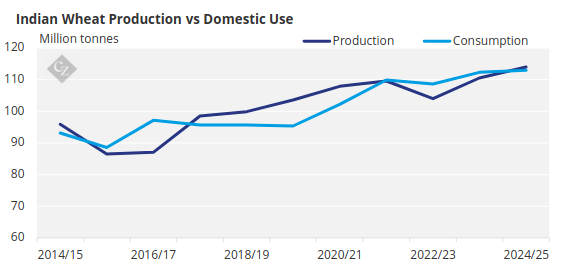

However, the market may not be as oversupplied as it looks at first glance. At the other end of the spectrum, India is one of the world’s largest wheat producers and consumers. It is generally self-sufficient, but recently production has been dipping below consumption.

Source: USDA

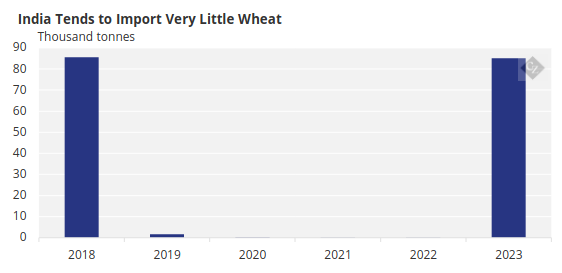

Because it is usually self-sufficient, the country tends to import very little – and only does so when domestic production falls short of expectations. In 2023, it began to import some wheat and it looks like it may be forced to do the same again.

Source: UN Comtrade

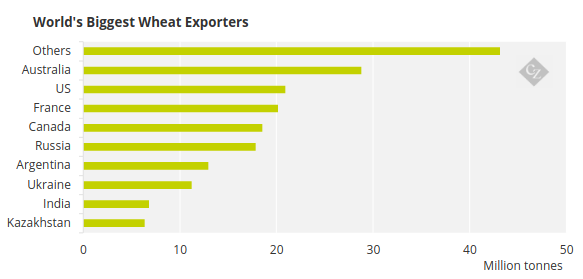

India also accounts for about 4% of global wheat exports. If domestic consumption outweighs production, the government may be forced to restrict these exports in favour of domestic use.

Source: FAOSTAT

This could potentially strip about 7 million tonnes of wheat from the global market.

Concluding Thoughts

Although the wheat market currently looks oversupplied, consumption has outstripped production for the past few years.

Source: USDA

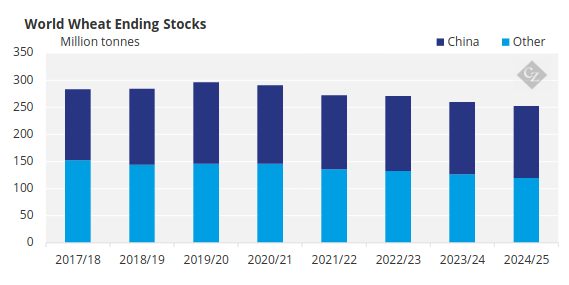

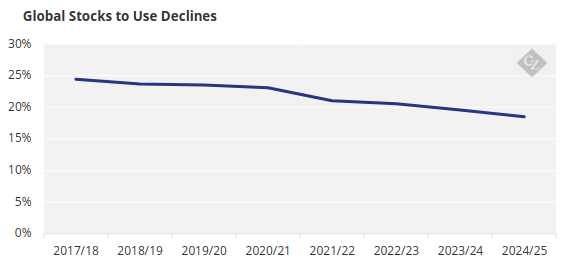

And while global stocks look healthy, China is a major factor in this. China tends to hold huge amounts of stocks that will not make it to the export market.

Source: USDA

This means that, when we take out China from the equation, global stocks are actually extremely low.

Source: USDA

This is a factor that those in the wheat market should keep in mind, and it could lead to even more volatility in the months ahead.