Insight Focus

Chinese PET resin exports continue to sTaiwan Bottle-Grade PET Resin Marketet monthly record despite shipping difficulties in May.

Indian producers make more volume available to export, freight advantage to Middle East.

Taiwanese exports slow in Q1; whilst Indian imports continue their surge.

China’s Bottle-Grade PET Resin Market

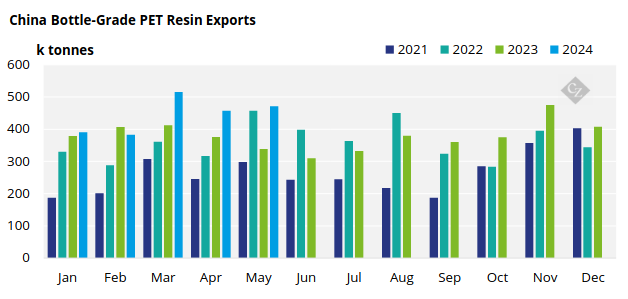

Monthly Exports

- Chinese bottle-grade PET exports (HS 39076110) increased 3% month-on-month to around 471k tonnes, 39% above levels a year earlier.

- Despite the rapid escalation in freight costs, order intake in May and June kept strong above 450k tonnes.

- Whilst the ability to export in the late May/early June may have been hampered by continued freight rate increases, large brand buyers also began switch over to breakbulk shipments.

- South Korea was the largest end destination for Chinese PET resin in May, with around 31k tonnes, up 108% from the previous month, and up 128% from April 2023. This comes despite the on-going antidumping investigation.

- Russia the second largest export destination, and traditional sink for Chinese PET resin, also saw sharp increases with 29k tonnes, up 54% on the previous month and 60% on the year.

- Nigeria ranked third, with exports to the country having increased strongly since the end of 2023, averaging around 20k tonnes per month (21.6k tonnes in May).

- Similarly, Chinese PET resin exports to India also continued strongly in May, averaging around the same levels of over just over 20k tonnes per month.

India Bottle-Grade PET Resin Market

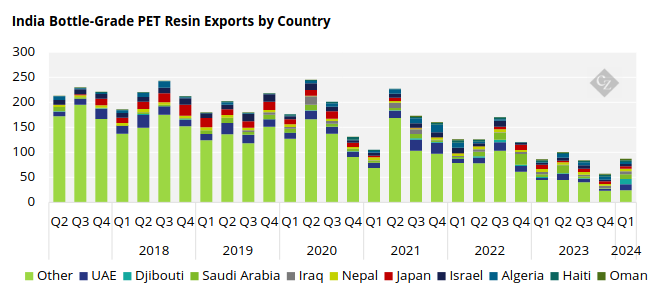

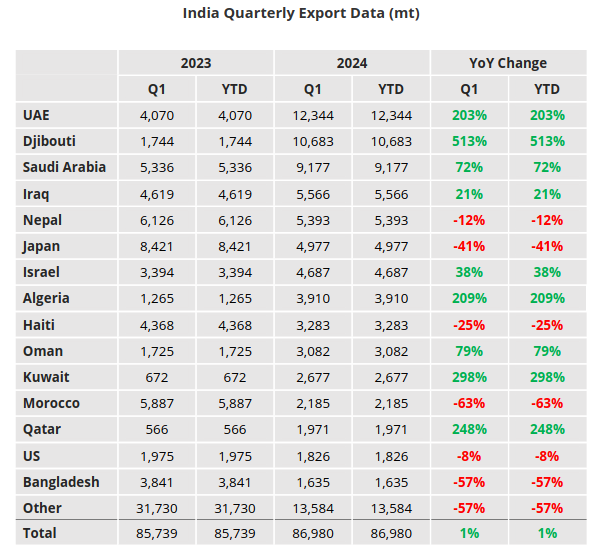

Quarterly Exports

- Indian bottle-grade PET exports snapped their losing streak, rebounding 52% in Q1’24 to 87k tonnes, around 1% higher than Q1’23.

- Indian exports benefitted from Red Sea disruption due to ease of access into the Middle East, with other Asian suppliers initially avoiding the area following vessel attacks.

- The UAE was the largest destination for Indian exports with 12.3k tonnes in Q1’24, up by around 350% from the previous quarter, and 203% compared to Q1’23.

- Volumes to Djibouti, Saudi Arabia also surged, increasing 1500% and 1240%, to 10.7k tonnes and 9.2k tonnes respectively.

- Although volumes were smaller, around 4-5k tonnes, Algeria and Iraq were also key destinations with annual increases of 21% and 209% respectively.

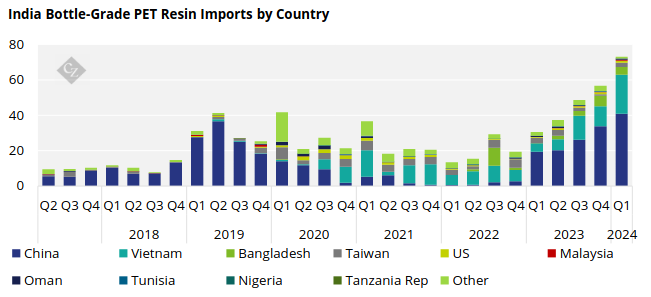

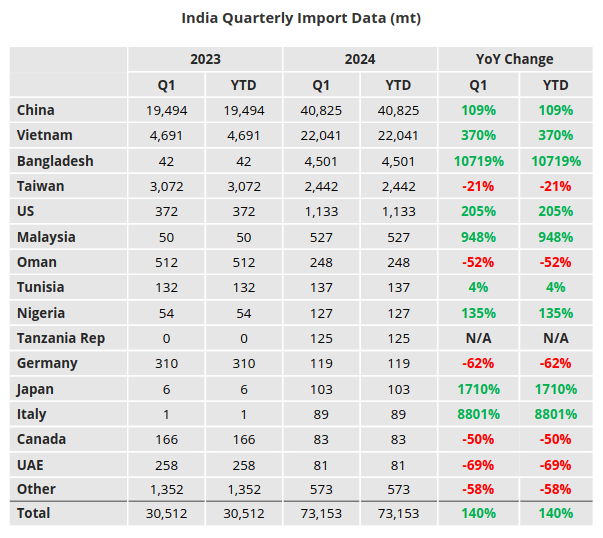

Quarterly Imports

- Indian bottle-grade PET imports continued to grow exponentially, up a further 29% on the previous quarter, totalling 73.2k tonnes, 140% above levels seen a year earlier.

- Despite anti-dumping duties (ADD) on Chinese PET resin, and a fresh review in the works specifically into imports from the most advantaged Chinese producer, imports continue to rocket.

- Indian PET resin imports from China increased a further 21% in Q1’24 to over 40k tonnes, up 109% versus the same period a year earlier.

- Imports from Vietnam also surged, doubling in Q1’24 to over 22k tonnes, 370% up on the previous year.

- Chinese and Vietnamese PET resin represented around 56% of total Indian imports in Q1’24.

Taiwan Bottle-Grade PET Resin Market

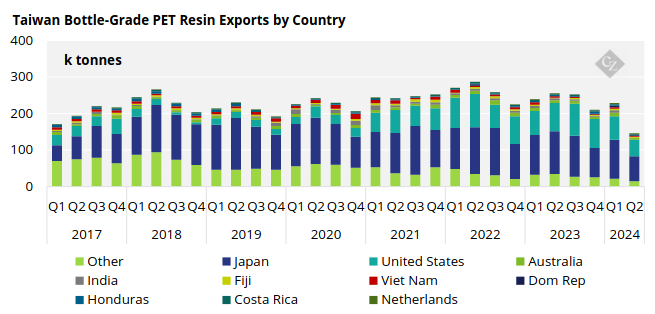

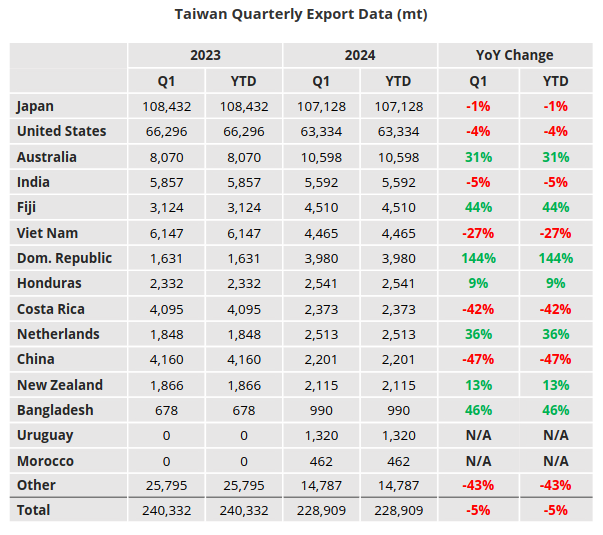

Quarterly Exports

- Taiwanese PET resin exports totalled 229k tonnes in Q1’24, up by around 9% on the previous quarter, yet down 5% year-on-year.

- Japan remained the largest destination for Taiwanese resin recording around 107k tonnes in Q, rebounding 33% from the previous quarter, and representing around 47% of total exports.

- As is typical, the United States was the second largest export market for Taiwanese PET resin, at around 63k tonnes, or 27% of total exports, in Q1’24.

- However, volumes to the US have steadily decreased over consecutive quarters since Q3’23, dropping a further 20% in Q1’24, down 4% versus the same period a year earlier.

- Although lesser in volume compared to these two major markets, exports to Australia (10.6k tonnes) and Fiji (4.5k tonnes) surged in Q1’24, up 58% and 116% respectively, and 31% and 44% on Q1’23.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com