Insight Focus

Brazilian milk powder prices show limited correlation with global markets. CZ has developed a basis hedging strategy for Brazilian WMP with a high historical correlation. This may offer participants an effective tool for price risk management in this market going forward.

In recent discussions, we’ve been asked if we can offer price risk management solutions for the Brazilian Milk Powder Market. Brazil, being one of the largest milk producers globally, has a domestic dairy demand that creates a relatively isolated market for milk powder prices.

For instance, the Brazilian Whole Milk Powder (WMP) price, when converted to USD/tonne, shows only a 46% correlation with the SGX-NZX WMP futures market.

This low correlation highlights the need for specialized hedging strategies to manage price risk in this market.

What is a Basis Hedge?

A basis hedge is when a commodity with a traded derivatives market is used to hedge the price of a related and correlated commodity that has no traded derivatives market.

Basis risk can exist due to a difference in location of the traded derivative being used to hedge and the location of the exposure. For example, FOB WMP exports from Australia could be hedged using SGX-NZX WMP contracts that are FOB New Zealand.

Basis risk can also exist due to differences in the product or quality. In this case a contract for one product or quality is used to hedge another product or quality. A common example of this is jet fuel being hedged with crude oil, because crude oil contracts are far more liquid than jet fuel derivatives.

Companies making a basis hedge trade generally view them as risk reducing and thus willingly accept the risk instead of not hedging at all.

Conceptualizing a Basis Hedge Trade

You can conceptualize a Basis Hedge trade exactly like a cross-commodity spread.

While they are very similar, a cross-commodity spread trade seeks to profit from a mispricing in two paired products that both have derivatives markets, whereas a basis hedge seeks to reduce price risk for a product that does not have a derivative market by using a related product (or group of products) that are listed on an exchange.

So, how do we find the component or components of our basis hedge?

Step One: Select related products

Given that you are seeking to reduce risk by hedging one product with another related product (or bundle of products), you must ensure that your hedge is rooted in reality. It is best to start by selecting a group of products which, without having done any analysis, you expect could be related to your target product.

For example, it is widely known that corn is a common feed for dairy cows. So, if looking to construct a basis hedge on some unlisted dairy product such as Brazilian WMP, it would be much more sensible to include corn derivatives in your set of commodities than nickel derivatives, which have no discernable link to dairy in real life.

The products in your set could be relevant to the type of product being looked at — such as dairy derivatives for a dairy product — or the market under investigation. For instance, sugarcane is the largest crop in Brazil, so raw sugar could be sensible to look at.

Step Two: Get comfortable with your choices

Consider the drivers of the price in the markets that are included in your set and ensure that you are comfortable that these will likely impact on the product under investigation.

Before running the analysis, you should decide if you want to allow any products in the basis hedge to be allowed to have a negative weighting. To cover a long exposure, you would short that particular product as part of the wider basis hedge.

Step Three: Aim for liquidity

Select products that themselves are relatively liquid. You don’t want to create a problem for yourself in getting in and out of a basis hedge. It should be able to be quickly entered and exited as required, especially if for some reason you have identified that the hedge is not performing as it should and needs to be exited in a hurry.

The weightings of each component in the hedge must be meaningful. At a minimum you must ensure that your weightings round to the nearest lot size.

Step Four: Examine the fees

Investigate implicit and explicit trading fees. Your analysis is likely to have been done using last traded prices. However, sometimes the brokerage for one lot or the typical bid-ask spread in a market might mean that in practice the addition of that particular product is not useful to your basis hedge.

Once you have determined the product set and the weightings for each product in that set, you can use an analytical model to suggest some optimal combinations.

Step Five: Check your work

It is extremely important to critically review the output from the analytical model and remove any combinations that you think are illogical.

You may need to scale the output up such that the minimum basis hedge volume is 100 tonnes rather than one container to ensure that you can actually execute the hedge in full lots.

Applying these analytical methods, let’s consider a practical scenario to illustrate the potential benefits of a basis hedge on Brazilian WMP:

The trade of WMP in Brazil is large, both domestically and in terms of imports. Many market participants have long wanted a tool to manage their price risk on this trade.

Milk Point publishes monthly Brazilian WMP pricing in BRL, so I have used this series as the index for which we are looking to construct a basis hedge in this analysis.

So, following step one, we consider potentially relevant products for constructing a basis hedge:

a) All dairy derivatives are initially in scope.

b) Key Brazilian crops with listed derivative markets include coffee, sugar, soybeans, corn, cotton and wheat.

c) Other commodities which may impact the BRL/USD cross include iron ore and crude oil.

Steps two: We refine the above list, removing products with insufficient liquidity or that don’t meet the “sniff test” of being sensible to include. This step is somewhat subjective to the analyst but important in the context of developing a hedge that is not esoteric. Select your weightings. Based on the set I have selected, these are only positive and I round to the nearest 5%.

I then ran my model and got three possible combinations of eight to 10 commodities with interesting results. However, in many cases over half have only a 5% weighting.

All three had three products with much higher weightings than others. I re-modelled based on only these three products and yielded a similar result with much less complexity.

Following another logic test on the combinations, we have to be sure we are comfortable that we have included products that fall into one of these categories:

a) Brazil is major global exporter.

b) Where they are agricultural, crops should be geographically located in regions near dairy production and thus impacted in similar ways by prevailing weather conditions.

c) Are a common feed for dairy cows in Brazil. This if the cost of feed increases, the production cost of milk and consequently WMP rises.

d) Bring in a useful degree of sensitivity to the BRL/USD foreign exchange rate cross.

e) Market conditions in Brazil, such as production costs, domestic demand, local interest rates, internal logistics costs and export capabilities (like port congestion) are likely to have synchronized impacts on the prices of these products and their export value at the same time as Brazilian WMP.

I then round to the nearest lot size for each and realise that this tool can now only be applied to minimum clips of 100 tonnes of Brazilian WMP in order for full lots to be executed in the basis hedge. With step three in mind, this is still a very workable volume!

Lastly, I inspect the distribution between the Milk Point series and Basis Hedge Index series. This shows that some add-on is required to the basis hedge to bring notional levels into balance on average over time.

Review the correlations and the distribution of the difference between the hedge index and the product being investigated. Even if the two series are correlated and the average difference between the two is zero, if the distribution of the difference often reaches beyond USD 1,000 USD/tonne, would you be comfortable that this is risk reducing? Does your index require some adder or subtractor in the formula to give you improved protection?

Putting Theory into Practice

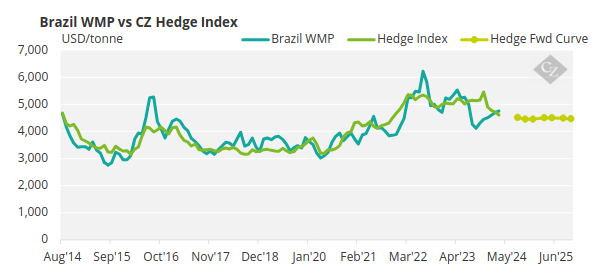

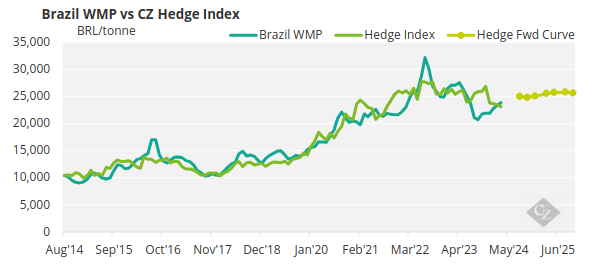

The result has surprised even me! We have developed a basis hedge for Brazilian WMP that has an 84% correlation over the past 10 years.

If manufacturers or consumers of Brazilian WMP are now willing to enter long term deals linked to either Milk Point or CZ’s index itself, then they can unlock powerful price risk management capability which they were previously precluded from!

This includes the ability to hedge forward, using the combined futures market of the component commodities of the basis hedge.

Manufacturers or consumers of Brazilian WMP can also price in USD or BRL. That is, by using forwards on the BRL/USD FX market, we can add another layer of relevance to users of this tool by pricing it locally.

You can see below the historical series and forward curves of the Milk Point WMP versus CZ’s Brazilian WMP index in both USD and BRL.

Be Aware of Risks

- Data mining a correlation: correlation does not mean causation. Remember that your model must make common sense.

- Risk to the position: This still exists even though total risk is reduced. This is because the imperfect correlation between the index you are seeking to hedge and the commodities in your basis hedge creates the potential for excess gains or losses in the hedging strategy.

- Market liquidity, timing and positioning: structure your basis hedge in such a way that you are confident that you can get out when you need to.

- Fundamental factors: keep close awareness of what is driving the price in the hedge index and the pricing in your basis hedge commodities. If there is a specific material factor impacting one of these then the basis hedge is likely to break down quickly.

Do you want access to tools to help manage your Brazilian WMP price exposure? Or perhaps you want to construct a basis hedge in another untraded dairy market? Call us!