Insight Focus

Brussels has issued over 76% of free 2024 EUAs, with industries likely to retain permits due to expected supply tightening. The market now anticipates news on auction supply adjustments.

EU Hands Out Free EUAs

European governments have begun the process of handing out free EUAs for 2024 to industrial companies across the region under an altered set of rules that has seen the annual compliance cycle shift to summer from spring.

According to data published on Friday, EU countries have issued more than 392 million EU Allowances (EUAs) out of a total budget for the year of 513 million – more than 76% of the total.

The free allocation is intended to ensure that there is no additional cost to producers that could render them uncompetitive and encourage them to relocate their production abroad.

In previous years, some industrials might have been expected to sell some of these allowances to raise short-term cash, but there appears to be little appetite to liquidate what are coming increasingly valuable allocations.

Part of this growing reluctance to sell stems from a gradually decreasing allocation of free permits. With the EU’s Carbon Border Adjustment Mechanism now in effect, EU producers will start to see their allocations shrink faster as levies on imported materials increase.

With free allocations having historically been equivalent to as much as 100% of industrial emissions and in some cases even more, there has for many years been an incentive for producers to sell surplus emissions, but as the CBAM coverage increases, so will industrial allocations fall.

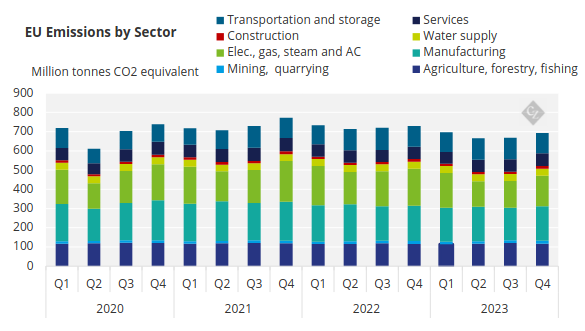

Data from the Commission show that the bulk of emissions reductions made under the EU ETS have come from the power generation sector, which cut CO2 by nearly 38% between 2013 and 2020, while industry reduced by just 9.2%.

Source: Eurostat

The upshot of this is that industrials are likely to hold on to freely issued EUAs, further tightening the liquidity in the market and perhaps forcing prices higher as those participants with deficits are forced to pay up.

Internal Emissions Cuts Incentivised

And as prices rise, industrials may find that making internal investments to cut greenhouse gases are increasingly cost-effective, thereby proving the case for emissions trading.

The next major deadline will fall at the end of September, when the more than 11,000 participating installations will need to have surrendered EUAs matching their verified emissions for 2023. Prior to 2024 this deadline fell at the end of April and generated a surge of buying activity as companies rushed to complete their buying and aid financial penalties for non-compliance.

But with the calendar shifting this year, these companies will have had 17 months to amass the required EUAs for compliance and market participants therefore do not expect a big surge in activity this summer.

Equally, the new September deadline means that the height of the compliance buying season now falls in July and August, but since this coincides with Europe’s peak holiday season, a lot of companies are expected to finish their buying beforehand.

European Commission to Make More Announcements

There will be other major announcements in the coming month as well. The European Commission announced in June that the Market Stability Reserve will remove 266 million EUAs from auction supply between September 2024 and August 2025, and the revised auction schedule for that period is anticipated before the end of July.

Equally, the Commission needs to analyse the results of its extraordinary injection of additional EUAs into the auction reserves to help fund its Recovery and Resilience Fund. Under the REPowerEU initiative, the EU ETS is generating EUR 20 billion for the fund by selling extra EUAs brought forward from the 2027-2030 period.

Data show that the sales of extra EUAs had generated a total of EUR 5.5 billion by last week, and based on the Commission’s modelled price of EUR 75/tonne, the programme is about EUR 350 million behind schedule. This may force the Commission to inject even more EUAs into the programme in order to meet the EUR 20 billion target by the 2026 deadline.

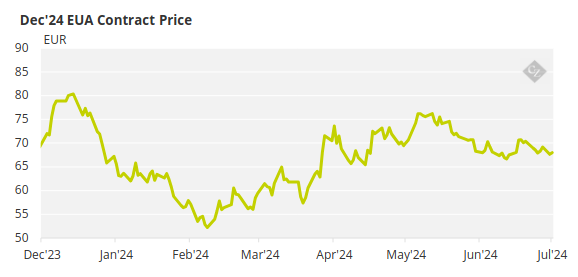

With the competing forces of tighter supply through the MSR, and looser supply through the REPowerEU programme, the EUA market has been holding steady in the EUR 65-70 band over the past month, and may well remain steady until the new supply adjustments for 2024-25 have been made.

Source: ICE