Insight Focus

All signs are pointing to plentiful wheat supply from Russia and the US, which sent prices sinking. Some revisions were made to corn forecasts in the USDA’s latest WASDE report but it should be enough to keep the price above USD 4/bushel for the time being.

The July WASDE report reduced corn carry while boosting wheat ending stocks. It was a negative week for all grains, but especially for wheat. Black Sea wheat yields still could bring surprises. We continue to see a strong floor around USD 4/bushel for corn in Chicago, with weather volatility continuing.

Now we have all the cards on the table with the new corn acreage but also new demand data showing a US corn environment that is not as oversupplied as it looked just two weeks ago. Nevertheless, the expected yearly stock build of 220 million bushels between the old and new crop is still significant. There is also still a lot depending on weather dependent, but we think most of the positive news is priced in already. This means any weather impact can only have a positive influence on prices.

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop to average USD 4.6/bushel with a downside bias towards USD 4.4/bushel. The average price since September 1 is running at USD 4.52/bushel.

Wheat Supply Plentiful

Last week began negative for wheat side with Russian production upgraded by several analysts after the crop had been hit by late frosts followed by a heatwave and then finally rains bringing relief.

The Russian agricultural ministry is forecasting 85.5 million tonnes, while private analysts are in the range of 82 million tonnes to 86 million tonnes. This is up significantly on the range of between 78 million tonnes and 82 million tonnes after the weather issues. It is also only down slightly from the original projection of 92 million tonnes.

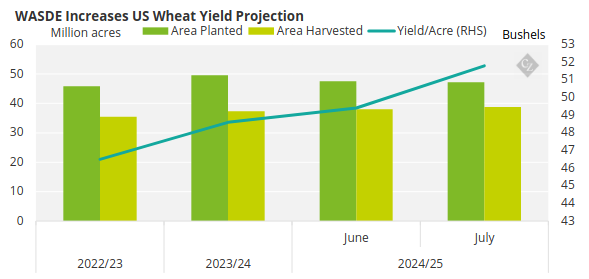

The July WASDE was then released, and increased US wheat ending stocks for the old crop by 14 million bushels. New crop acres and yield were increased too. The USDA projected a higher harvested acreage at 38.8 million acres versus 38 million acres previously. The projected yield rose to 51.8 bushels per acre versus 49.9 bushels per acre before. This all resulted in 133 million bushels of higher production.

Source: USDA

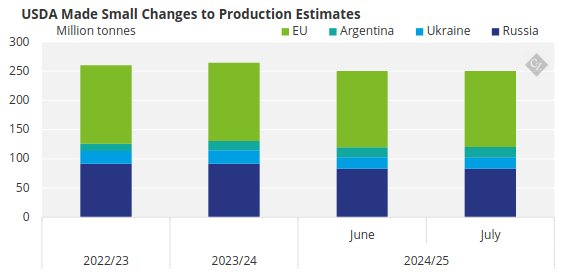

Global ending stocks for 2024/25 were increased by 5 million tonnes, which will result in a 3.75-million-tonne stock draw during the year. Some small downward revisions of about 500,000 tonnes were made to Argentinian and EU production, while Russian and Ukrainian production were left unchanged at 83 million tonnes and 19.5 million tonnes, respectively.

Source: USDA

US winter wheat is 63% harvested, ahead of 43% last year and above the five-year average of 52%. Area under drought condition stood at 20%, up 1 point week on week. Spring wheat condition was 75% good or excellent, up 3 points week-on-week and versus 47% last year.

Russian wheat is now 21.5% harvested and yields are just 1% higher than last year. The previous week, yields were up 19% year on year so the deterioration in just one week has been significant and is due to the start of the harvesting in regions impacted by the frost and subsequent drought.

Ukrainian wheat is 33% harvested and yields are up 3% year on year. The French wheat condition is 57% good or excellent, down 1 point on the week and versus 80% last year. The crop is 4% harvested, significantly behind 26% last year and the five-year average of 19%.

Higher Corn Acreage Offset By Use

On the corn side, the USDA surprised the market again in its July WASDE report. The higher corn acreage for the new crop published three weeks ago was plugged into the supply and demand projection and would have resulted in the highest stock to use ratio of the last 20 years.

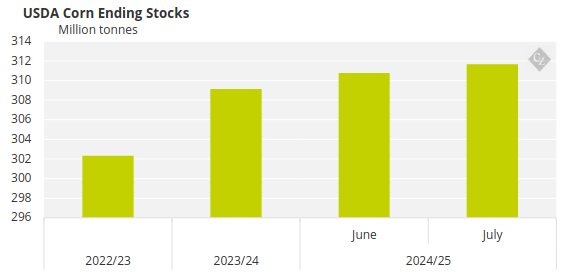

However, this large oversupply was resolved by reducing end stocks for the current crop by a sizable 145 million bushels due to higher demand from feed and residual, and higher exports.

For the new crop, as well as using revised acreage figures, the USDA projected 75 million bushels of increased demand and 25 million more bushels of exports. The result is a carry of 2.1 billion bushels versus 2.35 billion bushels previously. This resulted in a stock to use ratio of 14.1%.

Source: USDA

The stock to use ratio would have been 15.8% if not for the revisions to demand and exports. This is a big change as the possible 15.8% stock to use ratio for the new crop would justify a sub-USD 4/bushel market while the 14.1% stock to use ratio should be enough to keep prices in Chicago above USD 4/bushel on average for the new crop.

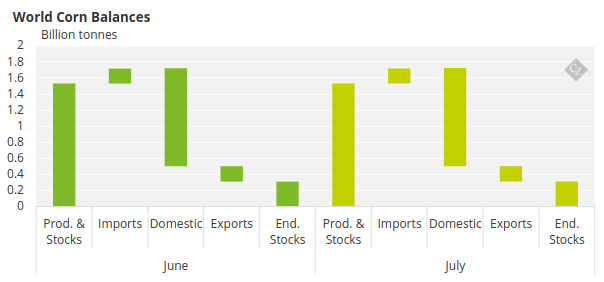

Global ending corn stocks were increased by 1 million tonnes with a 4-million-tonne increase in production but 3 million tonnes less of beginning stocks. The lower production was shared between Russia, the EU and Canada.

Source: USDA

Brazil’s CONAB increased its corn production forecast to 115.8 million tonnes, up from 114.1 million tonnes thanks to an upward revision of the Safrinha (second) corn crop. This is still far below than the 122 million tonnes projected in the July WASDE report.

The US corn condition was 68% good or excellent, up 1 point week on week and versus 55% last year. The area under drought condition stood at 7%, up 1 point week on week. Argentinian corn is 70.2% harvested, ahead of the 58.1% recorded last year. Brazil’s Safrinha corn is 61.1% harvested. The French corn condition was 83% good or excellent, up 1 point on the week.

Hurricane Beryl Benefits Crops

On the weather front, the US benefited from Hurricane Beryl, which became a tropical storm and left ample rains in some areas of the Midwest. The forecast for this week is for hot and dry weather.

In Brazil, the awaited rains came last week but were less than expected and dry weather is expected to return this week. Northern Europe is expected to have dry weather but accompanied by rains, and the Black Sea region is expected to be dry and very hot.