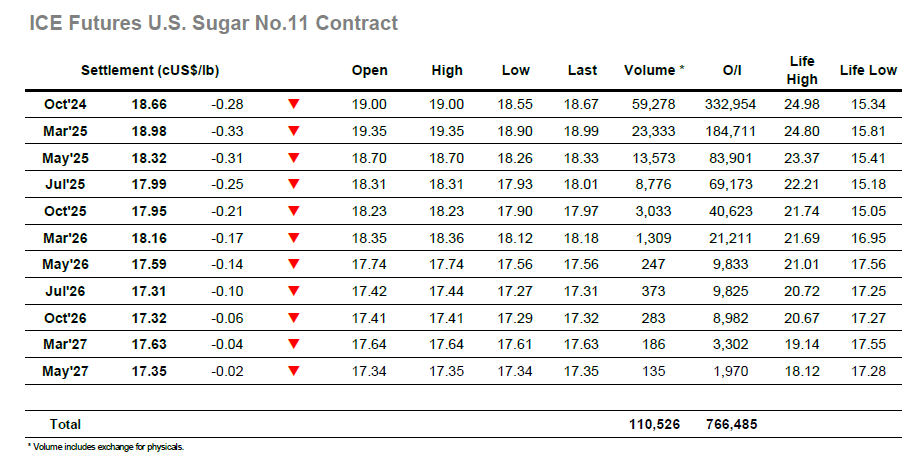

A higher start at 19.00 was quickly forgotten as the market settled down and sat near to 18.90 through the early stages, the lack of any real efforts from the long side suggesting that this weeks 18.81 low would again be tested. Morning trading proved slow and while Oct’24 did drift downward to match the 18.81 mark on numerous occasions there was no sign of the necessary volume required to push through. This situation changed as US specs joined the fray with the market descending to new lows and tracking all the way down into the 19.50’s over the next three hours. The steady decline came on light volumes with only some assorted scales in place to the downside, while specs and algo’s drove the short as producers continue to stand away since falling away from recent highs. Despite the falling value there was some contrarian movement being seen for the front month spread where Oct’24/March’25 worked up to -0.31 points, though it did wasn’t able to signal a flat price recovery. End of day short covering lifted Oct’24 by a few points to settle at 18.66, though it did not mask another disappointing performance.

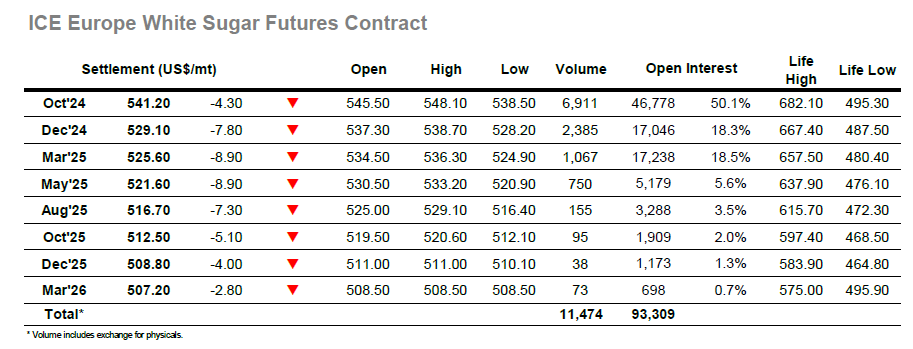

Oct’24 shot ahead to $548.10 on the opening however it was a brief foray to positive ground as prices soon returned to sit around overnight levels. The reversal of Monday’s rally over the past three sessions has killed confidence amongst many participants and so a gradual decline through the lower $540’s across the rest of the morning was expected and brought Mondays $539.00 low back into view. The pressure ramped up a notch after lunch with specs selling in conjunction wit the No.11 market to test the underlying support, with Oct’24 working to a 4-week low as it traded through to $538.50. There were no sell stops present beneath the market and so the picture calmed over the final couple of hours, holding nearer to $540.00 though still without appearing particularly strong. There was some position squaring ahead of the weekend which pushed Oct’24 up slightly to settle at $541.20, with Oct/Oct’24 valued higher at $129.80, though overall it remained another poor showing and sends the market into the weekend negatively.