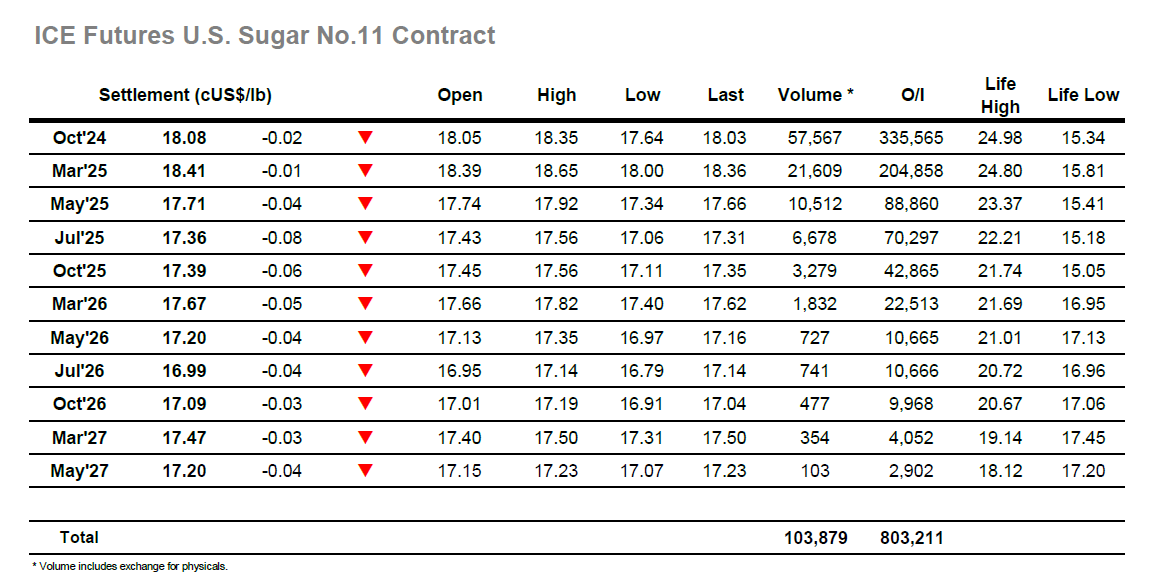

Opening prints were a few points lower however it soon became clear that the market was in trouble as the price dropped down through 18.00. This quickly encouraged more selling from specs and algo systems with lows following at 17.64 with less than 30 minutes having passed, before settling down to hold the mid 17.80’s following some short covering. This early movement likely made another small increase to the net spec short holding, which stood at -40,478 lots in the latest COT report. The report being based upon a market above 19c did not include activity across the sharp decline at the end of last week, and so the reality is a live position much shorter than that shown. Having held quietly into the early afternoon the market received a lift with some fresh buying (end user?) appearing to take the price back above 18.00 and set day trader covering in motion. Oct’24 extended up into the 18.20’s, and then onto 18.35 with the picture reinvigorated, however the momentum didn’t last and reaching the final hour the price had dropped back into the range. Additional pressure was applied during the closing stages which sent Oct’24 down towards 18.00 once again, establishing a settlement price at 18.08, just 0.02 points down on the day as the market attempts to dig in and stem the losses.

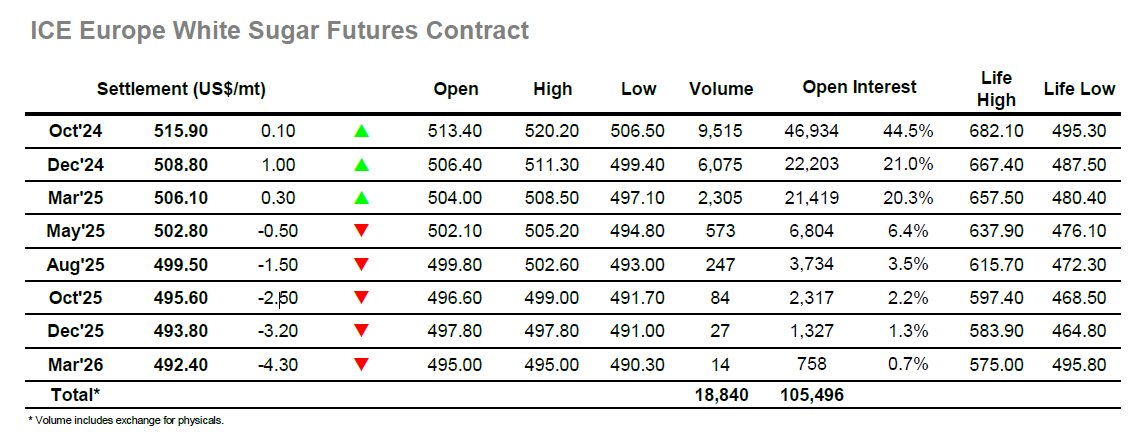

Lower No.11 values set the tone for Oct’24 whites to plunge down to $506.50 during the opening minutes, marking the lowest price traded for the contract since March last year and the lowest spot month value since March 2022. It proved to be short-lived as the market duly lifted by a few dollars to hold calmly within the range through the morning, though there was no sign of a more significant reversal with only those holding pricing orders showing with any buying. It was into the afternoon before any new momentum was generated, and on this occasion, it marked a recovery as the front month erased the morning losses and moved back into credit. Much of the buying came through short covering, while some pricing orders were also raised, and over the following hours this combined to take the price back to a daily high at $520.20. The movements did lead to some small changes in the white premium value, although in the main Oct/Oct’24 pivoted either side of $117.00. It appeared that they session would end near to the highs until pre-close position squaring sent Oct’24 back down by a few dollars to settle at $515.90, showing only a 0.10c daily change to conclude another unconvincing performance.