This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

With recent production projections pointing to a record sugar crop, buyers are in no rush to come to the market. But sales and deliveries are continuing at a steady pace as the market awaits the August 12 Crop Production report from the USDA.

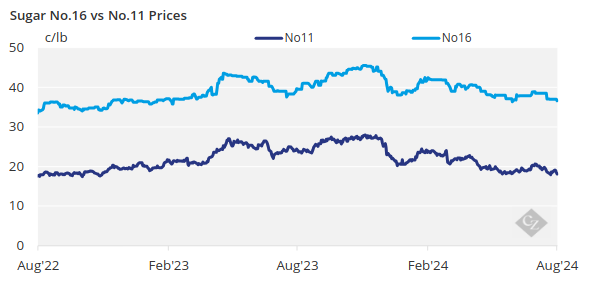

Sugar Prices Weaken

Price weakness in 2025 beet sugar persisted as forward sales advanced on a steady basis during the week ended August 2. Spot values were unchanged. Sugar beet and cane crops were progressing well with beet harvest set to begin in some areas later in August.

Bulk refined sugar prices for 2024-25 were lowered 2¢/lb in the Midwest, although some processors maintained current offers while others remained out of the market. The decline reflected ongoing weakness, even though some processors were able to sell above the bottom of the range, depending on volume, location and other factors. Refined cane sugar price offers for 2025 were unchanged, as were spot beet and cane sugar values.

All Signs Point to Large Crop

All indications point to good if not bumper sugar beet crops with harvest less than a month away in some cases. Some growers were expected to begin beet harvest early, if possible, to accommodate a large crop.

The US Department of Agriculture will issue its initial 2024 sugar beet and sugar cane crop forecasts in the August 12 Crop Production report, along with revised 2024-25 beet sugar and refined cane sugar projections in the World Agricultural Supply and Demand Estimates report.

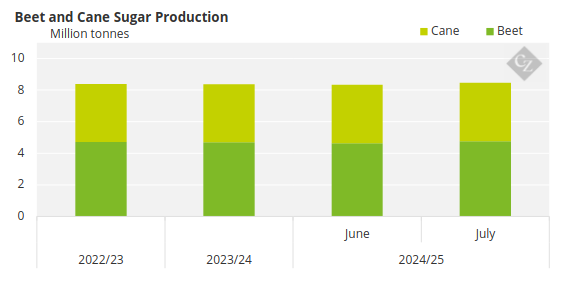

In its July WASDE report, the USDA forecast record-high total sugar production for next year, with beet and cane sugar forecast the second highest on record.

Source: USDA

Good-to-excellent beet ratings as of July 28 were 80% or above in five of the seven reporting states and above 90% in two states, according to USDA state office reports. Ratings slipped from a week earlier in

three states but remained above year-ago levels in five states. Louisiana sugar cane, meanwhile, had a good-to-excellent rating of 87% as of July 28, the highest since at least 2015.

Sales, Deliveries Progress

Sugar sales for 2025 continued at a steady pace, especially compared with last year when sales for 2024 mostly were completed in a rush during March and April 2023. One beet processor has been out of the market for several weeks, having reached a comfortable sales level, but most others continued to sell steadily. Buyers were not rushing to complete 2025 coverage amid indications of ample 2024-25 sugar supplies.

The spot market was quiet with most sellers still active. Most activity was of a fill-in nature in the final two months of the marketing year.

Deliveries of contracted sugar for 2023-24 were mixed but notably improved from the October-March period.

The USDA in the August 2 Federal Register said it reallocated domestic sugar cane state allotments, cane processor allocations and allocations for beet sugar processors that will allow complete marketing of 2023-24 sugar under the US sugar program.

The 2023-24 beet sugar allotment was reduced by a net 250,000 tons (227,000 tonnes) as five processors were unable to fill their prescribed allocations. That amount was reassigned to raw cane sugar imports. The cane sugar allotment was reduced by a net 600,000 tons (544,000 tonnes) as three cane processors fell short of their allocations, with that amount reassigned to raw cane sugar imports.

Corn sweetener markets were quiet with negotiations for 2025 expected to gain momentum after the August 12 USDA Crop Production report.