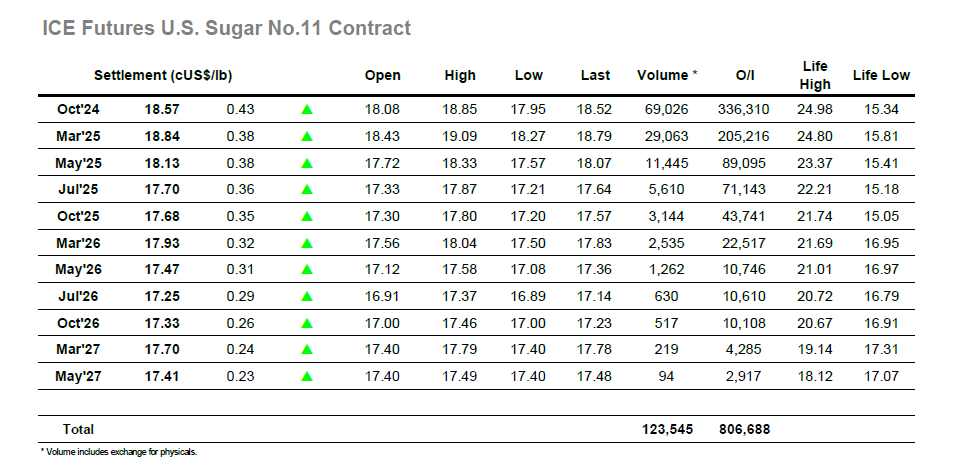

It was another inauspicious start to today’s session with Oct’24 quickly dipping back beneath 18.00 to find support at 17.95 through the early stages. There was little to stir the interest through this period and though the later morning saw the price recover towards 18.20 to show small gains there was no suggestion that this was anything more than the usual rangebound shenanigans. The picture started to change as we moved through noon with a push up to fresh daily highs, movement which then gathered momentum as the wider spec community in the US entered proceedings. Their efforts combined with an element of short covering / position reduction to bring the market consistently upward over several hours recording highs in the upper 18.70’s before pushing on impressively to 18.85 just ahead of the close. This may well have been a push too far from the smaller traders with nobody following behind to hold things during the final stages, and so some of their work was the undone with a pre-close washout back to 18.50. The call was rather mundane following this and left Oct’24 closing at 18.57 with the Oct’24/March’25 spread also former at -0.27 points, a still positive conclusion as the market looks to continue rebuilding.

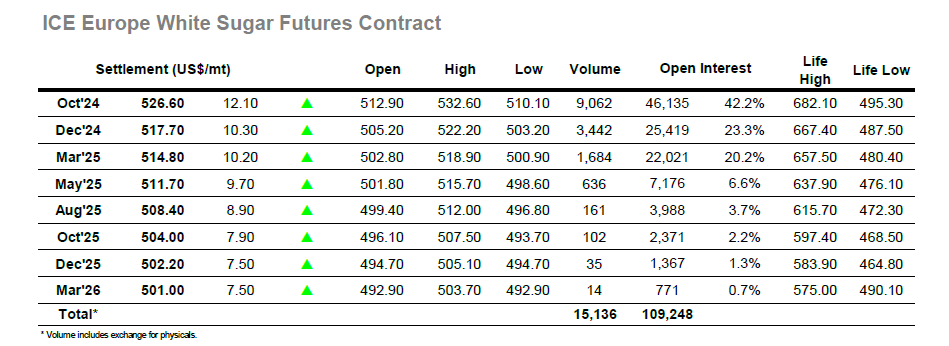

There was fresh pressure being applied to nearby positions when we opened this morning, sending Oct’24 back down towards $510 and bringing the recent $506.50 lows back into focus. Movement was still being driven by small traders and with some scale interest having been raised to sit ahead of the lows the market soon drew position covering which raised the price back into the low teens and averted some concerns. Additional buying followed and by late morning we were nudging back towards yesterday’s highs and feeling a bit more secure. Breaking above $519.50 sparked a touch more spec/system interest and freed the market to further pursue the upside through the afternoon with some quiet but steady accumulation taking Oct’24 up to $528.00. This aided the spreads with Oct/Dec’24 trading up to $11.40, and unlike yesterday’s efforts the gains were sticking a bit more today. The final couple of hours saw the range extend yet further to eventual highs at $532.60, an impressive effort though one which was not fully sustained as end of day profit taking kicked in. This left Oct’24 still closing healthily at $526.60, while Oct/Dec’24 went out at $8.90 and the Oct/Oct’24 arb at $117.20.