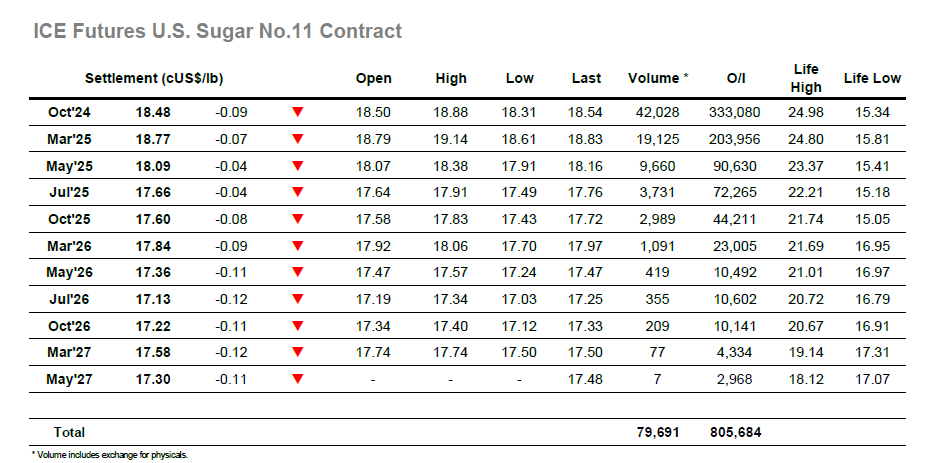

A slow start to the session will have pleased any bulls, providing further hope that the market has bottomed. Early lows at 18.45 were gathered and a morning spent in the 18.50’s / lower 18.60’s to maintain the rediscovered stability was unspectacular, though with so little going on it did raise questions as to whether things may settle into a range for the time being rather than continue pushing. The early afternoon drew a little more movement although it was still being generated on minimal volume. First the market dipped back towards the morning lows before finding some more spec buying (short covering) which spiked the price through yesterdays highs to reach 18.88. This mark was only short-lived though and such is the fickle nature of the market in the thin conditions that within 20 minutes we were trading back in the red. Having looked in no trouble previously the market now found itself on the back foot and with selling reappearing the price continued down to 18.31. A little short covering pulled the price away from the lows with a more stable position established through the closing stages and leading Oct’24 to a close at 18.48.

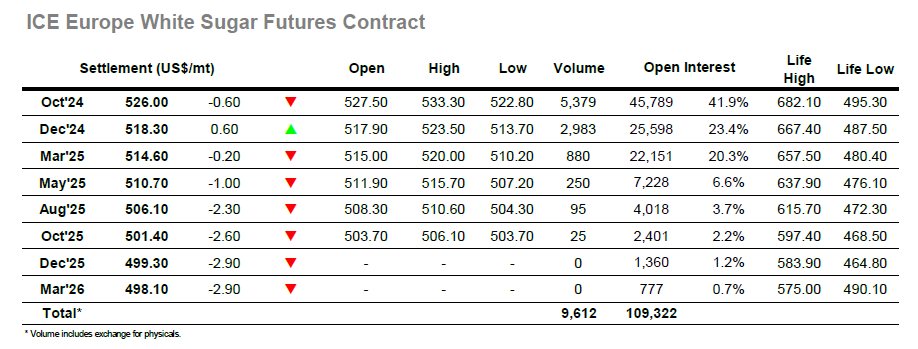

It was a slow start to today’s session with Oct’24 calmly consolidating its recent gains, occasional lower prints being picked up and generally sitting in the upper $520’s. we moved into the afternoon before there was any change to this mundane situation, with some fresh buying starting to emerge to continue the recent progress and take prices further up. Oct’24 moved on to $533.30 before reversing at a rapid pace at the first sight of profit taking, which will be a concerning factor to longs with the market not attracting much buying away for the specs and algos. The fall saw two waves of selling send the price back to $522.80 before looking to stabilise again with the losses being reduced during the last couple of hours. White premium movement will have provided some encouragement to longs with the value moving up by almost $2 on the day as it printed towards $119.50, and this was helping to keep the market away from the lows later in the afternoon. A stable closing period left Oct’24 settling only marginally lower at $526.00, while the Oct/Oct’24 was valued at $116.60 heading into the weekend.