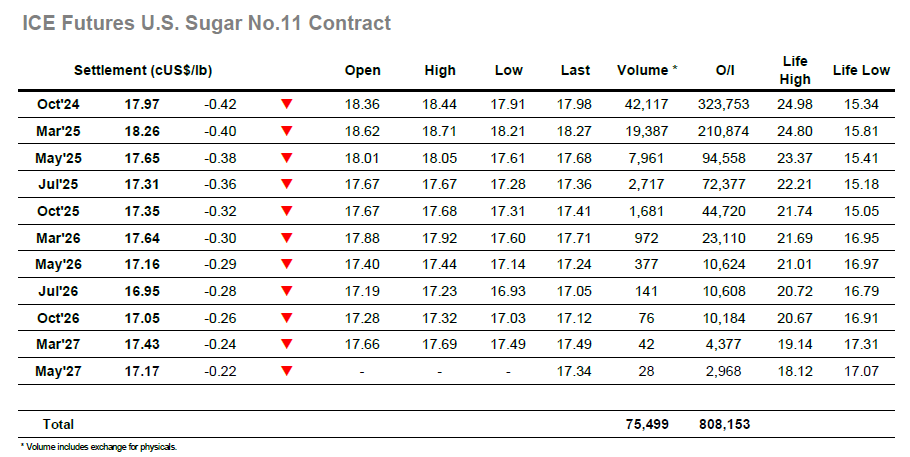

There was little to get excited about in the market today with buyers proving few and far between and an early nudge up to 18.44 providing the only glimpse of upside enthusiasm. Trading initially centred around unchanged levels but across the first few hours saw a couple of dips lower, breaking this week’s lows to leave Oct’24 nestling in the teens as we reached noon. Volumes remain extremely light and though the arrival of Americas based traders drew a little morning buying in, it merely provided an interlude for the downward trend which resumed as the afternoon moved forward. There was an assortment of light scale buying in place as Oct’24 worked towards 18.00, though with specs/algos now happily pushing the short side the price edged through it to a low of 17.96. Nearby spreads narrowed by a few points along the way although the selling was such that the whole board was descending, and the spread impact remained light. Heading into the final hour values remained near to the lows, with a late burst of selling sending Oct’24 to a new low at 17.91 ahead of the close as shorts looked to maximise the possibility of testing the recent lows as we move forward. There was the usual end of day position squaring on the call though the top of the board remained beneath 18.00 with settlement recorded at 17.97.

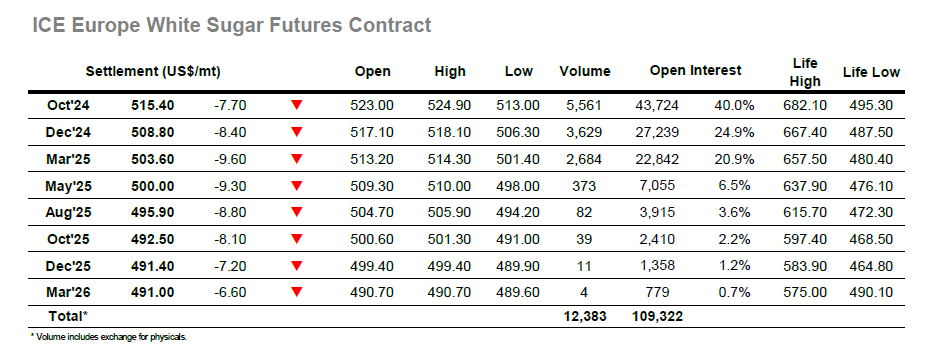

There were some brief early gains for Oct’24 as light overnight hedging was concluded, however once that had passed the market struggled to find any significant interest/traction as so began to work lower. By late morning Oct’24 had lost almost $6 despite not seeing any significant selling, impacting sentiment with buyers retreating on fear of further decline. There was a period of consolidation through the middle of the day, however that was not sustained and the negative sentiment resumed to extend the losses with Oct’24 reaching a late afternoon low at $513.00 as small traders played the short side. There was moderate spread activity today with the nearby Oct’24 and Dec’24 spread values showing gains, possibly a sign that we are starting to see some rolling of nearby positions with little more than a month now until the Oct’24 contract expires. The Oct/Oct’24 continues to show stability and was trading around $119.00 late in the afternoon, not particularly symptomatic of a market likely to collapse. Oct’24 ended the day away from the lows at $515.40 following some short covering, bringing another day within the recent broad range to a conclusion.