This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The new data released this week pointed toward a bumper US sugar crop for 2024/25, triggering bearish sentiment. Some farmers plan to start harvest early to get the record crops out of the ground.

US Sugar Market Softens

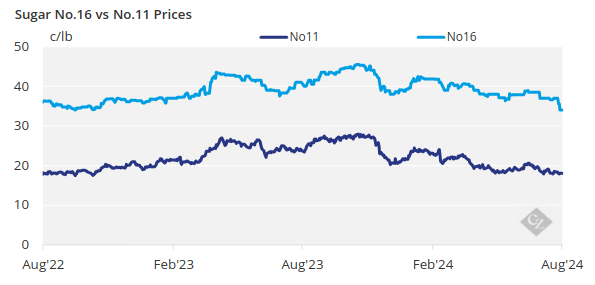

USDA forecasts of record-high US sugar production in 2024-25 and lower sugar deliveries this year and next year kept pressure on forward sugar prices during the week ended August 16.

Sugar sales for 2025 continued at a modest pace. Most buyers had a good amount of coverage on the books, but with the beet crop seemingly getting bigger, most processors have more sugar to sell than earlier expected. One processor that had been out of the market was softly re-entering.

Bulk refined sugar prices for 2024-25 were weaker at 45¢/lb to 49¢/lb FOB Midwest. Refined cane sugar price offers for 2025 were left unchanged at 56¢/lb to 57¢/lb Southeast and 59¢/lb Northeast, although it was thought cane sugar could be bought below those levels. Spot beet and cane sugar values were unchanged. With only a month and a half left in the current marketing year, the spot market was quiet and mostly nominal, although sugar was available.

Earlier Harvest Expected

Some sugar beet cooperatives will start harvesting early to account for the large crops so they can get beets out of the ground before a chance of frost. Michigan growers started August 19, about three weeks earlier than last year.

Weekly Crop Progress reports continued to indicate stellar conditions and progress for most sugar beet crops. USDA offices said ratings as of August 11 mostly were unchanged from a week earlier, and all but Colorado and Oregon were at 79% good-to-excellent or above, with North Dakota and Wyoming above 90%. Smoke remained an issue, limiting sunshine on the Idaho crop.

Sugar cane crops in Louisiana and Florida were equally outstanding, with the good-to-excellent rating in Louisiana the highest in at least 15 years.

Barring an early frost in sugar beets or a hurricane affecting sugar cane or cane refineries, it appears the US sugar market will be well supplied through 2024-25. Coupled with weakness in deliveries, buying opportunities for sugar users are the best they have been in the past few years.

Data Projects Record Production

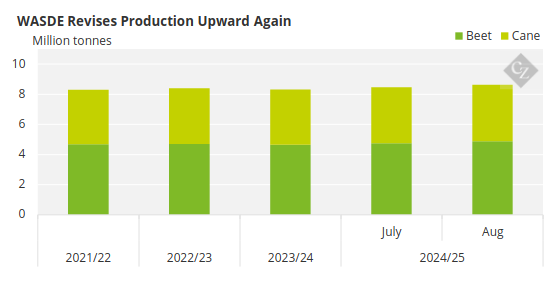

In the August 12 Crop Production report, the USDA raised its forecasts of 2024 sugar beet and cane production from 2023, which contributed to record-high forecasts for 2024-25 beet and cane sugar production in the WASDE report.

Note: Values converted to metric tonnes

Source: USDA

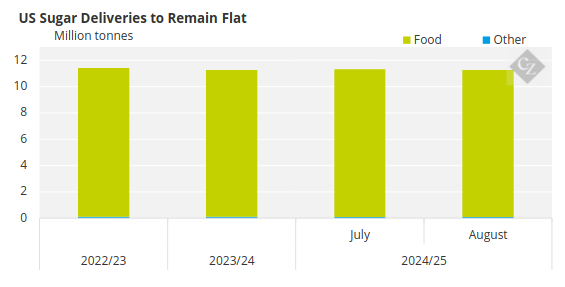

At the same time, the USDA lowered its forecast of sugar deliveries for food for 2023-24 and carried that lower number into 2024-25. The changes put the ending stocks-to-use ratio for 2023-24 at 16.1% and for 2024-25 at 15.9%, both above the USDA’s target range of 13.5% to 15.5%.

Note: Values converted to metric tonnes

Source: USDA

That being said, the 2024-25 ratio is supposed to be adjusted back to 13.5% in September under the US-Mexico suspension agreements. Most of the adjustment is expected to come from imports from Mexico.

The USDA in its Sweetener Market Data report indicated June sugar deliveries for human consumption were down 11% from June 2023, with October-June deliveries down 2.1% from the same period last year, mainly because of weak deliveries from non-reporters. Beet sugar deliveries have been on the weak side, while cane sugar deliveries have been strong.

Corn sweetener markets were quiet with 2025 negotiations expected to gain momentum later in August and early September.