Insight Focus

China’s direct imports of white granulated sugar in 2024 will fall to a 10-year low. However, imports of liquid sugar and premix hit a new high in July for the same period.

Direct Imports of White Sugar Fall to 10-Year Low

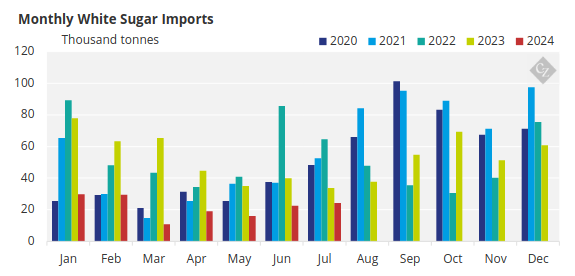

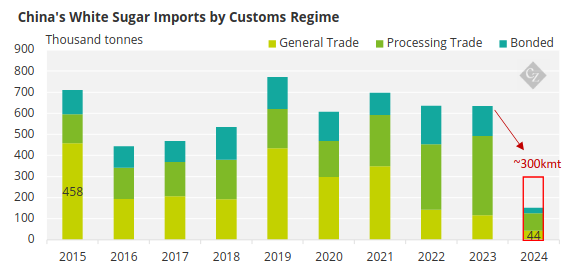

China’s white sugar imports remained low in July. This makes the cumulative import volume of white sugar from January to July 2024 only 152,000 tonnes, a decrease of 208,000 tonnes from the same period last year, and the lowest in the past decade. This means that the full-year import volume is at the bottom of our previously assessed range, about 300,000 tonnes, less than half of that in 2023.

We are not surprised as it has been discussed in our previous reports that Chinese Customs has implemented new measures to control the import of white sugar in the Comprehensive Bonded Zones (CBZ), so the production of premix or liquid sugar in the CBZ is no longer feasible.

In addition, imports of general trade (A quotas and AILs) have shrunk significantly to 44,000 tonnes so far in 2024, comparing to the record of 458,000 tonnes of imports in 2015.

Note: 2024 is updated until end of July; red box indicates how much we’d expect to see imported by this time of year.

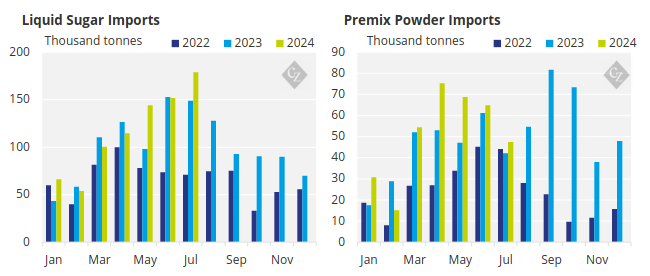

Imports Of Liquid Sugars and Premix Hit New Highs

China’s demand for white sugar has been switched to demand for liquid sugars and premix.

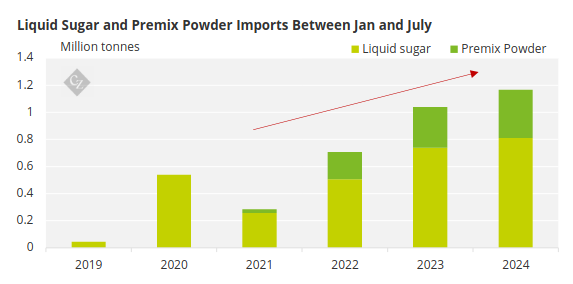

The noise in the market about the control policy has not seemed to affect the import of these two products. Imports of liquid sugar and premix in July hit a new high of 179,000 tonnes and 47,000 tonnes, respectively. For the remainder of 2024, there is no reason to see a reduction in imports, although the sugar industry is still seeking measures to control the product.

This brings the cumulative import volume of the two products from January to July 2024 to 1.17 million tonnes, compared to 1.04 million tonnes in the same period last year. We now estimate that the annual import volume could be close to 2 million tonnes, compared to China’s 1.81 million tonnes in 2023.

These two products are converted into a dry weight of about 1.4 million tonnes of white sugar equivalent, which has become the most important way for China’s current white sugar demand.

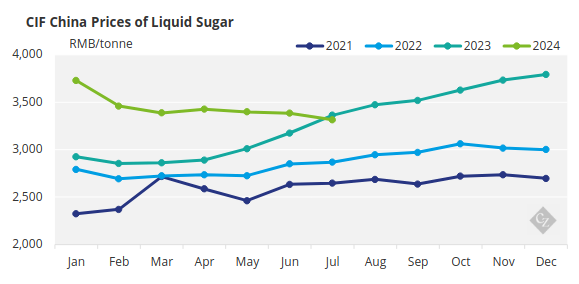

The Average Import Price Fell Below Last Year

The CIF price of imported liquid sugar fell below last year’s curve for the first time in July, at RMB 3,315/tonne, 2% lower than the same period last year.

This price is converted into a dry weight after tax price of RMB 5,590/tonne, compared with the current domestic price of white sugar about RMB 6,300/tonne (Guangxi). This means that the import of the product should remain profitable.