Insight Focus

Gas, coal and lignite generation is down 14% in 2024 to date. Renewables reached a record 49% of all power generated this year. Carbon prices rely on the coming winter and industrial recovery for a potential demand uptick.

Fossil Fuel Power Generation Dips

Power generation from fossil fuel sources has extended its decline in 2024 as electricity from renewable sources continues to grow, damping demand for EU carbon allowances as a recovery in industrial production is proving elusive.

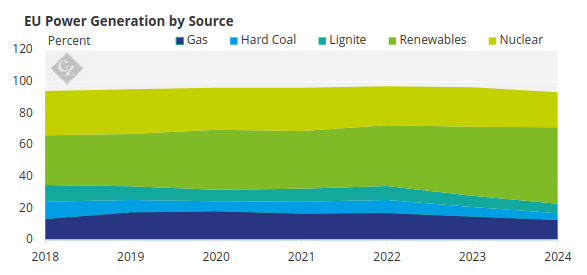

Data from the EU’s transmission grid agency ENTSO-E show that the amount of power generated by natural gas so far in 2024 is down 14% compared to the January-August period last year.

Similarly, hard coal-fired electricity output is nearly 30% lower than last year, while lignite-based power production is nearly 12% lower than in 2024.

By contrast, renewables generation in the eight months to August is more than 13% higher year-on-year and even nuclear generation is up by almost 4% despite the closure of three reactors in Germany in 2023.

This leaves power generation from gas, coal and lignite with their smallest shares of overall power production in the current year since at least 2018 – 12.7%, 4.1% and 6%, respectively.

In contrast, wind, solar and other zero-carbon sources of power have risen to represent a record 49% of public electricity generation in the year to date.

Emissions Drop Drives Down EUA Price

Utility emissions fell by at least 24% in 2023, their largest annual decline to date, and this number looks set to be challenged by the fall this year, which will be published once verified data is collated by the European Commission in April 2025.

The drop also means a steep fall in demand for EU Allowances and is one of the main reasons behind the fall of more than 30% in EUA prices since their record EUR 101/tonne in early 2023.

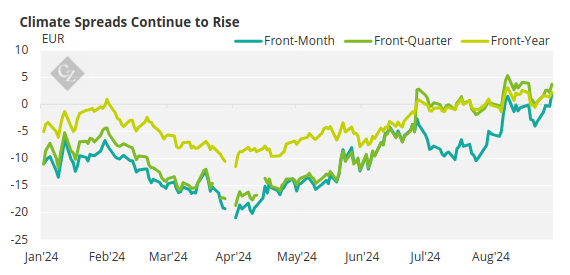

Note: Chart shows the difference between the clean dark spread (coal) and clean spark spread (gas). A positive reading indicates the clean dark spread is more profitable than the clean spark spread

Note: Chart shows the difference between the clean dark spread (coal) and clean spark spread (gas). A positive reading indicates the clean dark spread is more profitable than the clean spark spread

Analysts are careful to point out that the trend away from fossil fuels in power generation means that EUA demand is likely to continue falling, but these same sources point out that a strong macroeconomic resurgence in Europe could quickly see fossil power back in favour if industrial demand increases. Meanwhile, recovering production in carbon intensive industrial sectors like steel and cement would also play into a potential rise in demand.

In addition, the recent widening of the EU ETS to encompass emissions from maritime transport is likely to provide a layer of modest demand, and the end of free allocation of EUAs to airlines will also force more compliance buyers into the market.

Fundamentals Remain Weak

But for the moment, fundamentals are not playing a central role in the market’s price evolution. Far more influential is the role of investment funds and other speculators, who have amassed record long positions in TTF natural gas futures, and until recently held record net short positions in EUAs.

This net short position has been significantly reduced from nearly 40 million EUAs at the start of the year to around 6.7 million EUAs, while over the same time long positions in natural gas have risen to their record height.

This shift in speculative positioning in carbon may herald an uptick in demand as the winter season approaches and renewables generation declines, but much will also depend on the sentiment in the natural gas market as well as the performance of the EU’s industrial sectors.