Insight Focus

Strong EU butter and SMP prices are pushing New Zealand suppliers to prioritize fat production over WMP. While WMP remains undervalued, demand spikes could cause prices to surge. Bluetongue virus in Europe could lead to significant milk production losses and force anomalistic pricing spreads to remain for longer.

NZ Suppliers Prioritise Fat Production

Right now, SMP/Butter and SMP/AMF is trading at a premium to WMP products, meaning all New Zealand suppliers are maximising SMP/Fat production, with most having locked in plans for rest of 2024 already. At the same time, strong European fat pricing is supporting continued increases in Oceania Butter and AMF pricing.

However, if WMP demand comes in strongly, then New Zealand being relatively undersupplied could cause WMP prices to explode. Fonterra may be planning to produce less than 900,000 tonnes of WMP for the first time in many years.

Last month, we mentioned the link between WMP and New Zealand dairy processors’ financial performance. One thing to note is that, if it wished to manage earnings rather than compete for market share of milk supply, Fonterra could still quell any WMP rally by pivoting its production plan to WMP. A switch now from January production could still add around 200,000 tonnes of WMP to global supply… if needed.

However, New Zealand SMP and Butter/AMF values are statistically very cheap in comparison to other origins, which begs the question: how much does WMP have to go up in price to generate a meaningful increase in supply?

Earlier Holidays May Drive Continuation of Old Seasonality

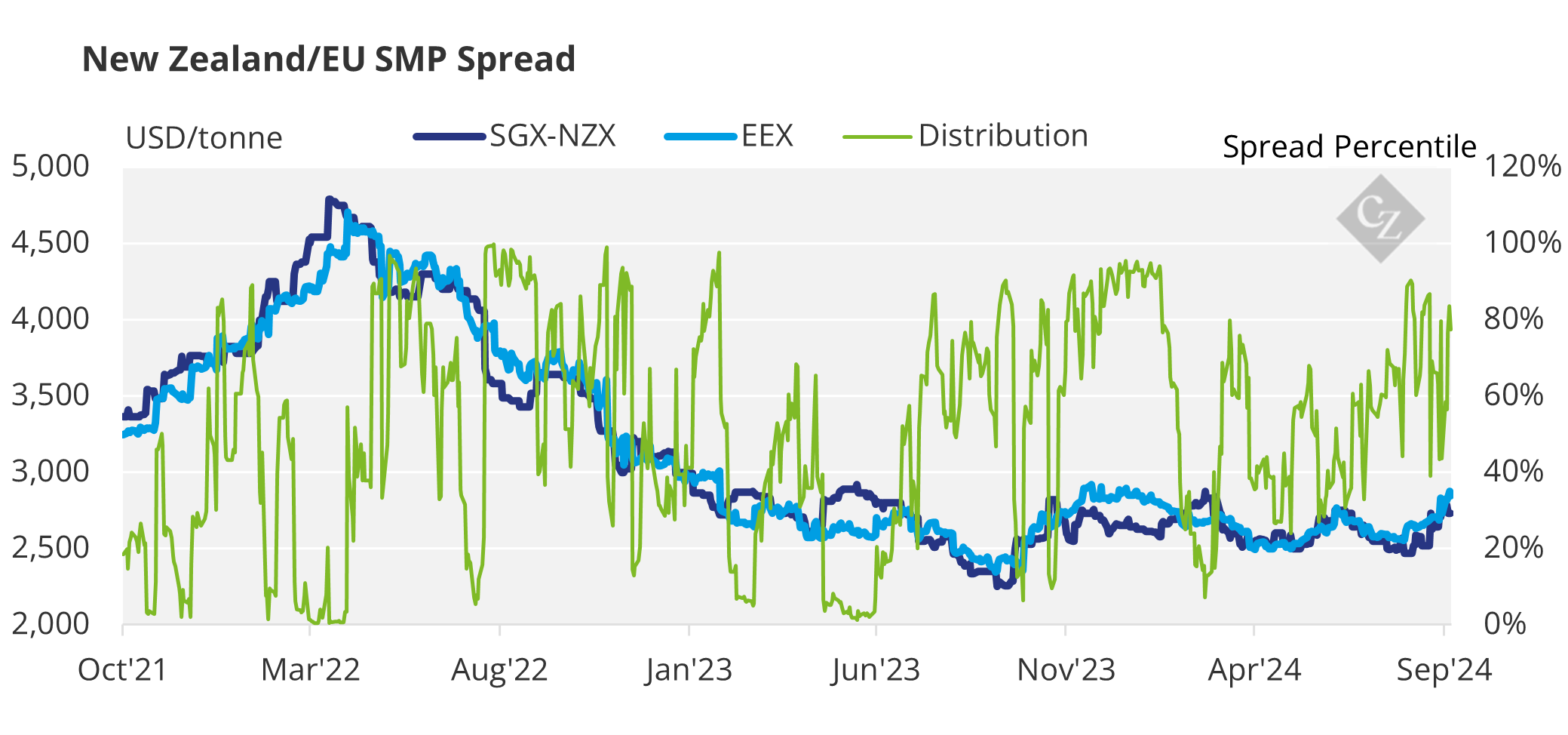

New Zealand WMP is significantly undervalued, while the EU fat pricing is ripping upward. SMP should be seen more and more as a by-product in the EU, and yet EU SMP pricing is trading at a premium over New Zealand. With this in mind, I wanted to look at the cross-commodity spreads.

SMP is at the 94th percentile when considering “all-time” data but only the 77th percentile when we consider post-Covid data. The EU is overvalued relative to New Zealand.

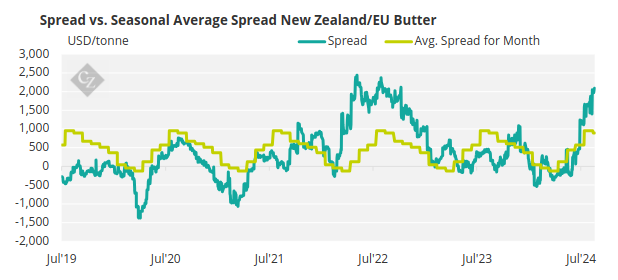

Butter is at the 98.7th percentile, with the EU being overvalued relative to New Zealand. It should be noted that while this is extreme, that the spread does tend to reach its widest point in August each year and then steadily close until April before jumping wider again.

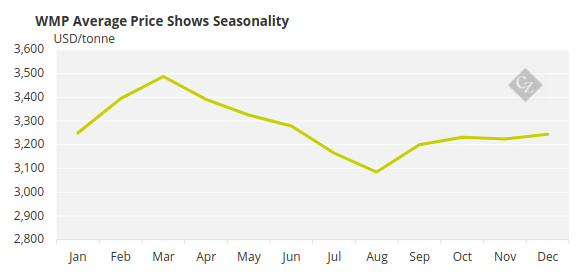

August is typically the seasonal low point for WMP pricing. Historically this seasonality was driven in part by Chinese buying to target the new Tariff Free Quota volumes from New Zealand to start each calendar year.

A continuation of this pattern in 2024 could be supported by the earlier Ramadan (beginning February 28) and Chinese New Year (beginning January 29) in 2025.

In the latest dairy auction (GDT Event 363), we saw continued robust demand from China across most products. MENA buyers stepped in in force during Event 362 in August but backed away quickly in the following event. This is one to watch as we approach Ramadan. Buyers will be requiring physical shipments during 2024 to have product in the market in time for Ramadan.

EU Hit by Bluetongue Virus

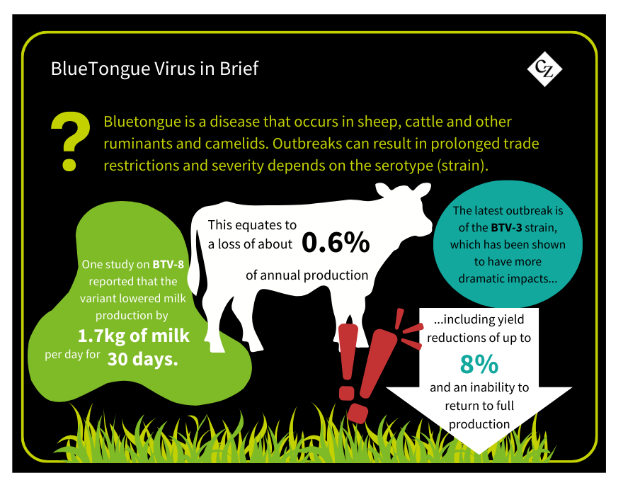

Bluetongue BTV-3 may be having an impact on milk collections in the Netherlands and Northwestern parts of Germany. Bluetongue is a non-contagious, insect-borne viral disease.

A previous study on BTV-8 carried out by the Journal of Dairy Science reported that infected cows had a decrease in milk production of about 1.7kg of milk per day for a period of 30 days, or a loss of approximately 0.6% of the annual production of that cow.

However, many anecdotal reports of the impact of BTV-3 are of much larger yield reductions (up to 8%) for infected cows and an inability for that cow to return to prior production levels again once infection free. If true, this BTV-3 outbreak will be significantly more impactful to global milk production levels. Cull rates will also be important to monitor as this develops.

Liquid cream pricing continues to outperform EU butter and AMF, so production and prompt supply of both commodities is becoming a major risk. Pricing will have to come to some equivalence to stem this issue, which most market participants believe means Butter and AMF pricing in EU have further scope to run up.

However poorer yields and outright loss of supply from BTV impacts may mean that the reality of processing cream might take longer than the market expects.

LRM Expected to Dip

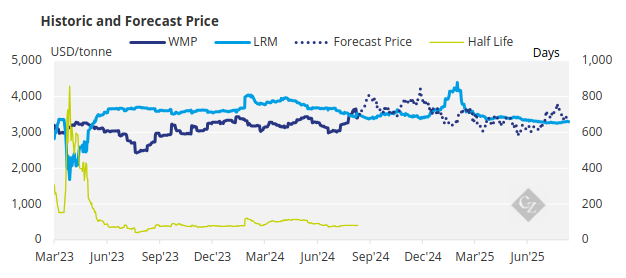

We have just touched the calculated long run mean (LRM) for WMP for the first time since May 2023.

Given that we are essentially at the LRM, this method of analysing price is less useful, as there is no “pull” toward LRM being exerted on pricing.

LRM itself is expected to reduce from approximately USD 3,500/tonne FOB to approximately USD 3,250/tonne FOB over the coming year (with a brief spike in between).

Non-Fonterra Market Share Grows

The latest milk collection figures for the month of July have been reported by all dairy processors. The mild winter seems to have led to solid collections, with nationwide milk up 9.21% for July year over year. However, July is one of the smallest milk production months, so we should not read too much into this yet.

The full Fonterra Financial Year New Zealand milk production thus ended at 1.879 billion kgMS, up 0.32% on the prior financial year. Fonterra itself ended the year down 0.89%, while the non-Fonterra group ended up 4.89%.

The non-Fonterra group also returned to growth in market share after a blip in the (relatively meaningless) June numbers. The full Fonterra Financial Year market share reached by the non-Fonterra bloc was 21.9%. This is up 1% from the year prior and marks impressive growth.

Waikato Weather Volatile

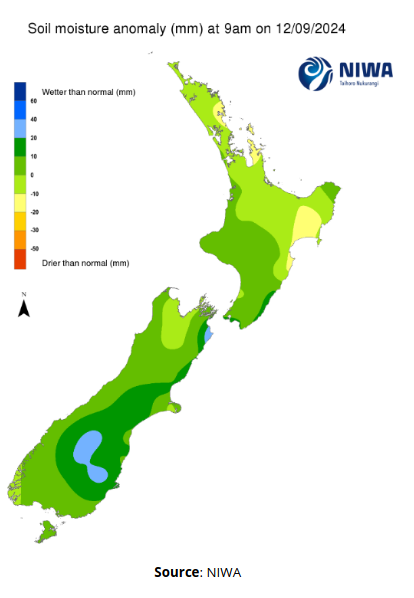

New Zealand’s average temperature in August 2024 was 9.8°C. This was 0.8°C above the 1991-2020 August average and closes out a mild winter. These favourable conditions will have pastures in great conditions for growth in Spring and will have also led to an easier transition of cows back to milk platforms from wintering.

It has been wetter than normal in the west and central parts of New Zealand, and drier in the east.

The main dairying region (Waikato in North Island) is seeing both sides of this weather. This is something I will be watching closely in September.

At time of writing, the lower South Island is being blanketed in snow. This may have an impact on milk production and tanker access for collections in Southland.