Insight Focus

Raw sugar futures traded between 18-19c/lb. Speculators closed out a large volume of long positions. The No.5 refined sugar futures expired last week.

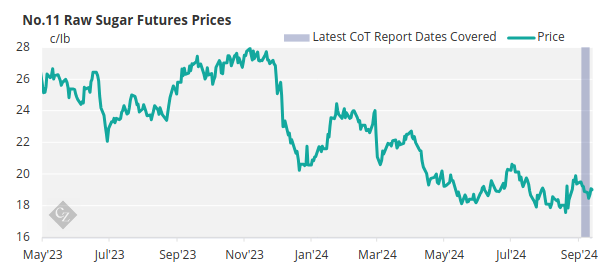

New York No.11 Raw Sugar Futures

The raw sugar futures market traded between 18-19c/lb last week and closed at 19c/lb on Friday.

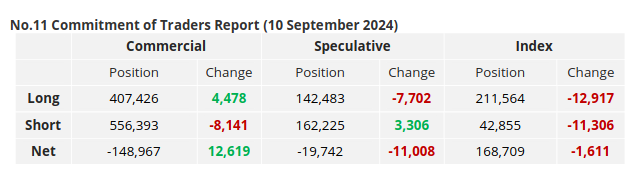

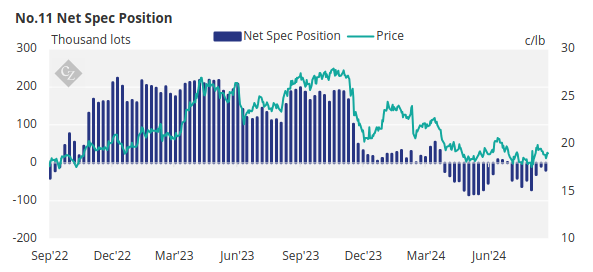

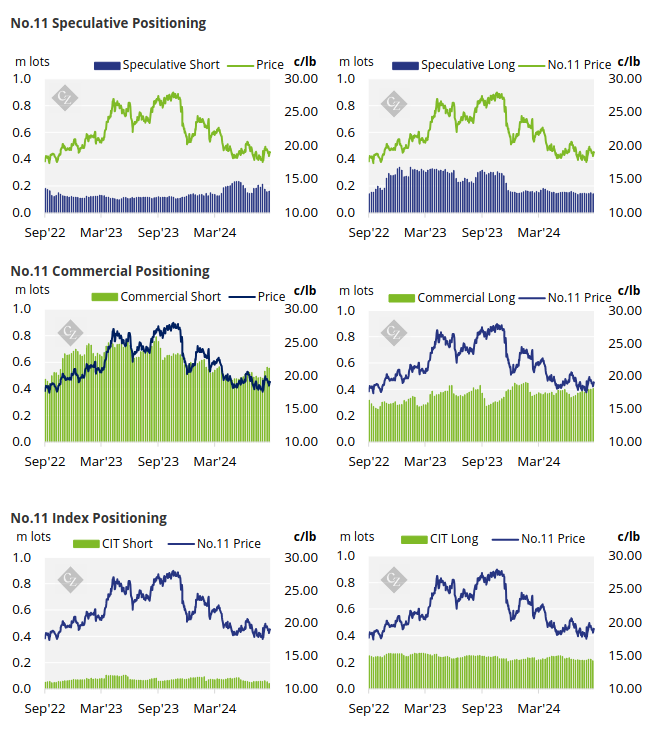

Speculators closed out 7,700 lots of long positions and opened a smaller volume of 3,300 lots of short positions.

Speculators are now net short in the sugar market by -19,700 lots.

Looking over to the commercial side, producers have reduced their short position by 8,100 lots of shorts. Whereas end-users have opened 4,500 lots of long positions.

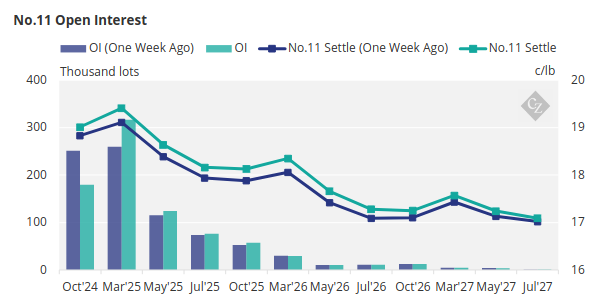

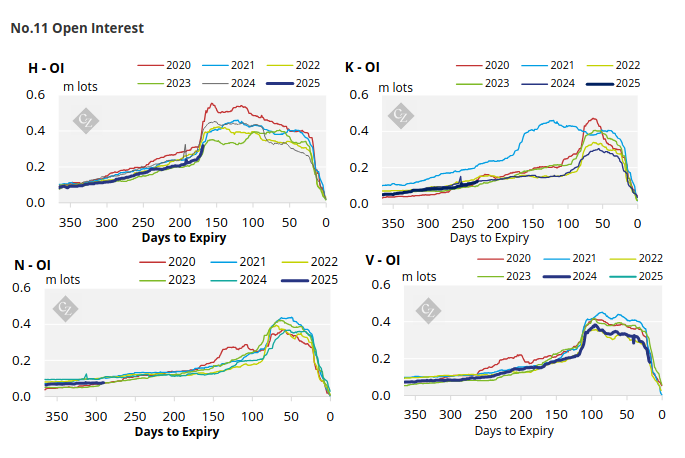

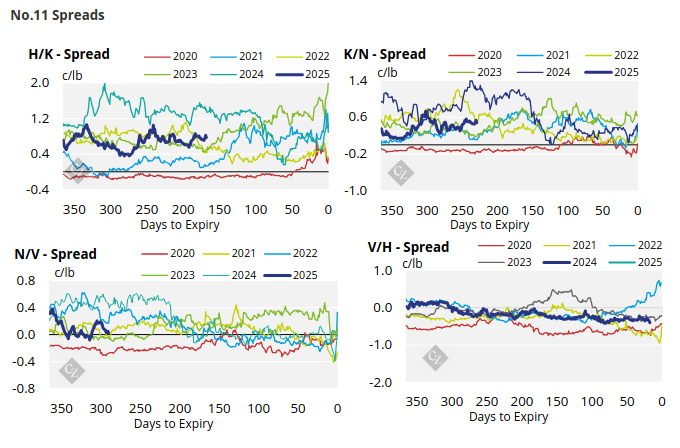

The No.11 futures curve has strengthened across the board and remains in backwardation.

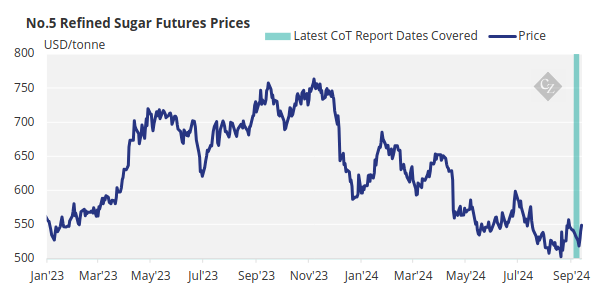

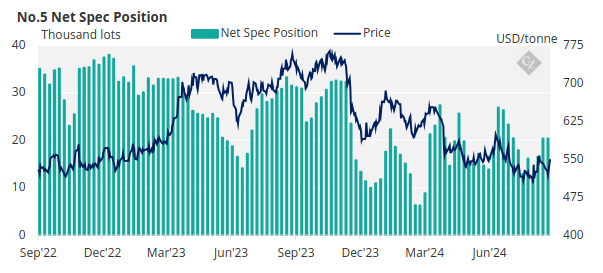

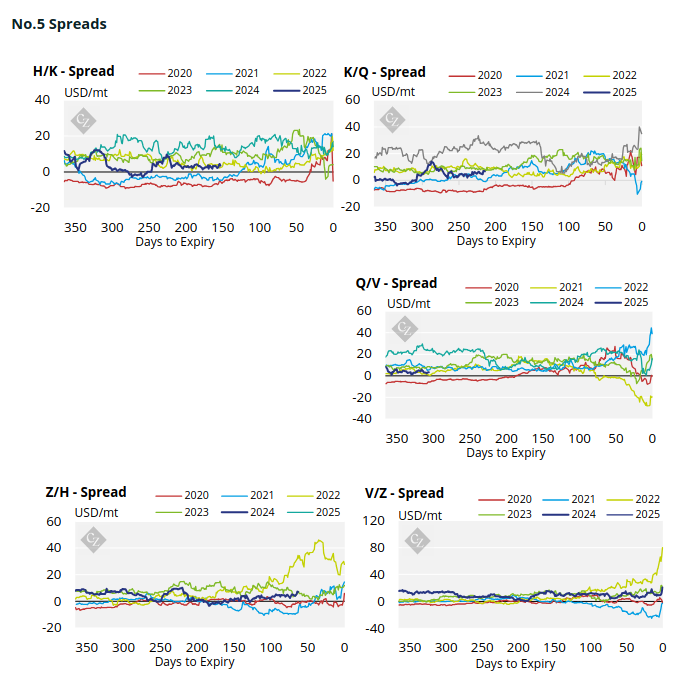

London No.5 Refined Sugar Futures

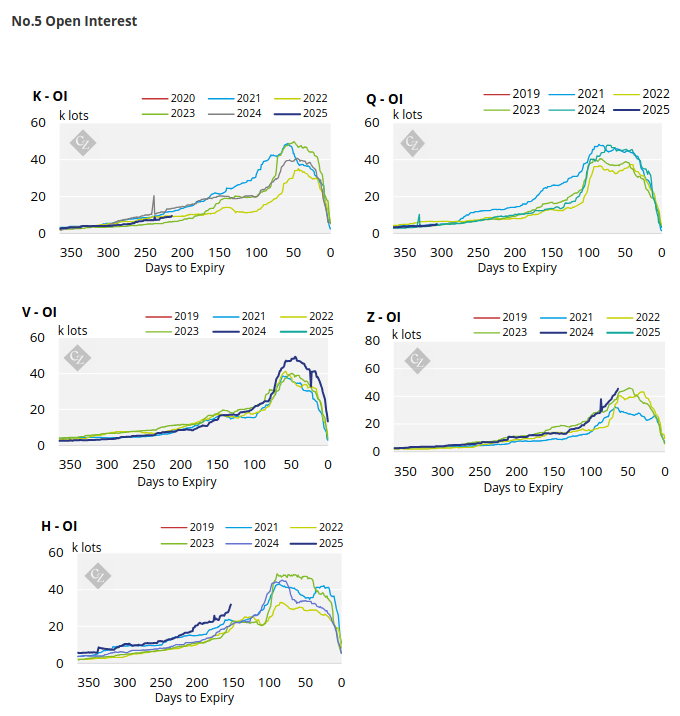

In the days leading up to the No.5 futures expiry, refined sugar futures traded between USD 518-549/tonne and closed at USD 548.6/tonne on Friday.

During this time, speculators closed out less than 50 lots of longs, bringing the net spec position down to 20,300 lots.

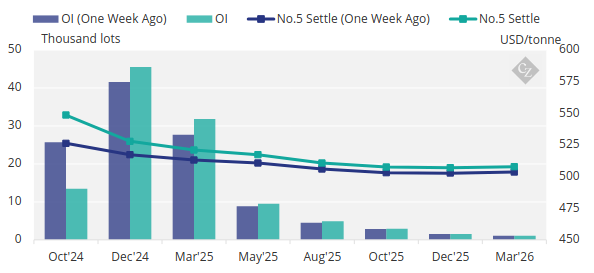

No.5 Open Interest

Following a similar trajectory to the No.11 raw sugar futures curve, the No.5 refined sugar futures curve has also strengthened across the board.

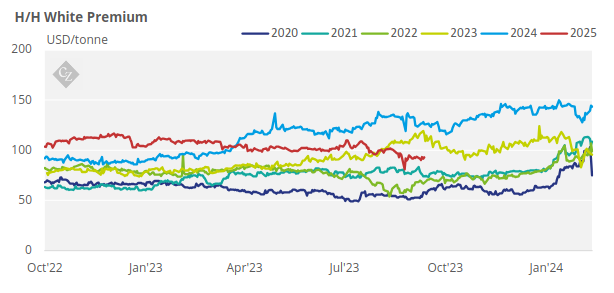

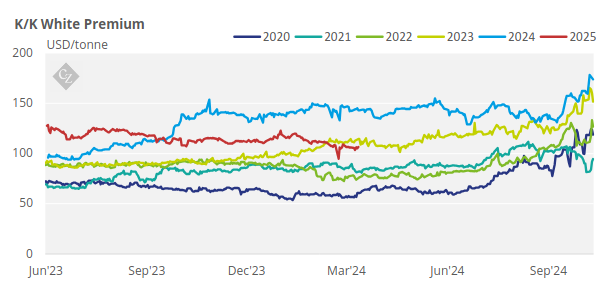

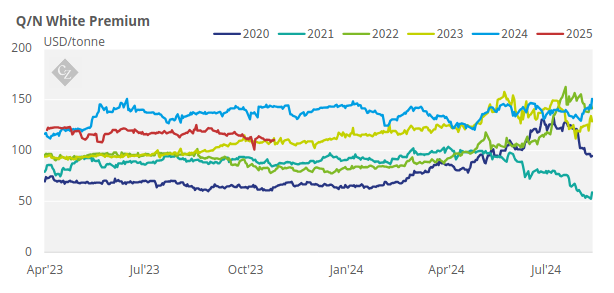

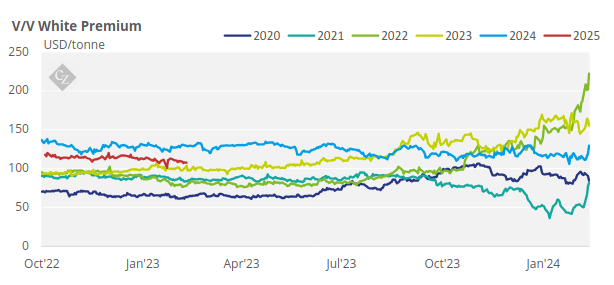

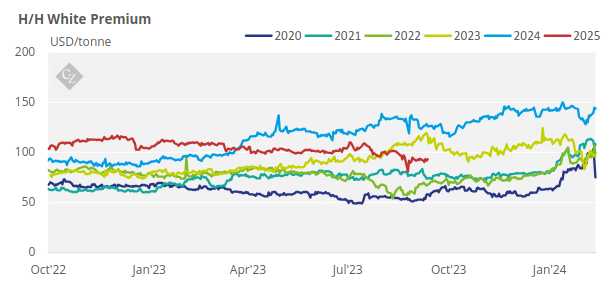

White Premium (Arbitrage)

The V/V white premium, traded between USD 111-130/tonne over the past week, and expired at USD 129.6/tonne on Friday.

The H/H white premium currently stands at USD 93/tonne.

Many re-export refiners need around USD 105-115/tonne above the No.11 to profitably produce refined sugar. The current white premium is below this level.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix