Insight Focus

PTA and PET resin futures saw further weekly declines before rebounding. This is due to pressure from weak crude. Asian PET resin export prices firmed late last week following large volume orders at low prices. There is a potential market bottom appearing, although crude volatility creates uncertainty.

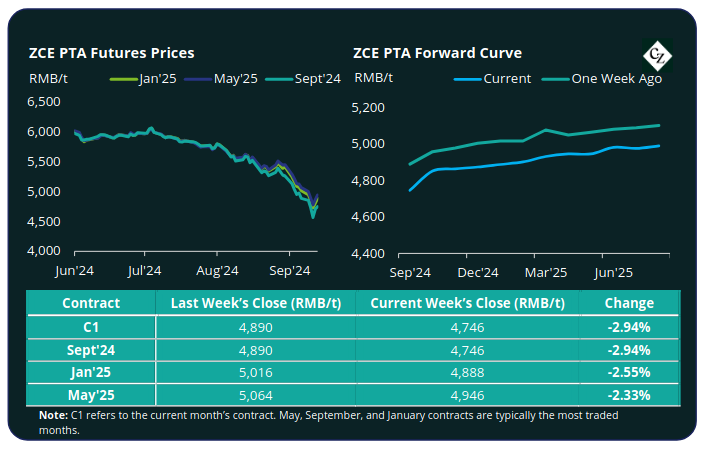

PTA Futures and Forward Curve

PTA futures continued to tumble last week, shedding a further 3%, before turning fortunes around with rebounding crude prices.

Following a wild ride earlier in the week, oil prices recovered to eke out a weekly gain, ending a three-week losing streak, largely due to Hurricane Francine’s disruption of US Gulf Coast production.

Brent crude ended the week at around USD 72.50/bbl, up 2% from the previous week’s close, having dipped below USD 70/bbl mid-week.

The average weekly PX-N spread contracted by a further USD 27/tonne on weaker gasoline demand and ample supply. Whilst the PTA-PX CFR spread remained relatively steady, with the weekly average around USD 76/tonne.

Although PTA inventories have eased, stock remains relatively high and spot availability sufficient.

Near-term expectations are for PTA fundamentals to remain steady as the peak polyester season approaches, with pricing to be dictated by upstream costs.

The PTA forward curve premium increased modestly; Jan’25 had a RMB 142/tonne premium over the Sept’24 contract, with Mar’25 at RMB 200/tonne premium over Sept’24.

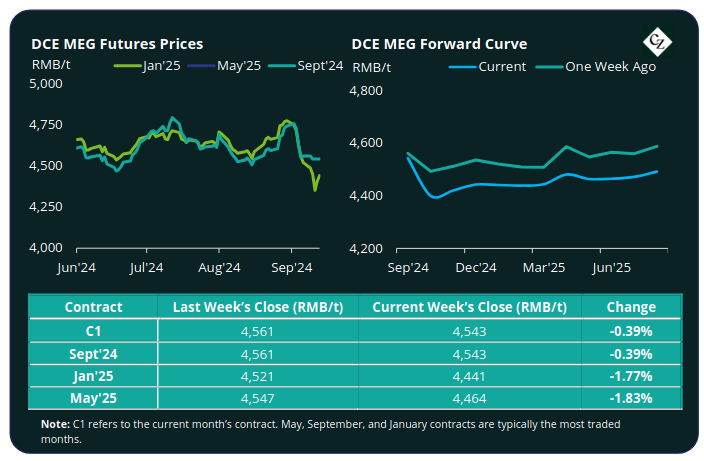

MEG Futures and Forward Curve

MEG Futures also faced declines with the next main contract months, Jan’25 and May’25, dropping by around 2% tracking the fall in global commodities.

However, East China main port inventories decreased by around 5.8% to 549,000 tonnes by last Friday, the lowest levels since late-2021.

Whilst limited import arrivals in the first half of the month have aided the decline in port inventories, deep-sea arrivals are expected to now increase with inventory reduction likely to slow.

Coupled with rising domestic production, supply is expected to increase amid potentially lacklustre peak-season demand. As a result, MEG fundamentals are expected stable-to-soft.

Beyond the current month, the MEG forward curve remained relatively flat through to Q2’24. The Jan’25 contract holds a RMB 102/tonne discount over Sept’24, and May’25 a RMB 79/tonne discount.

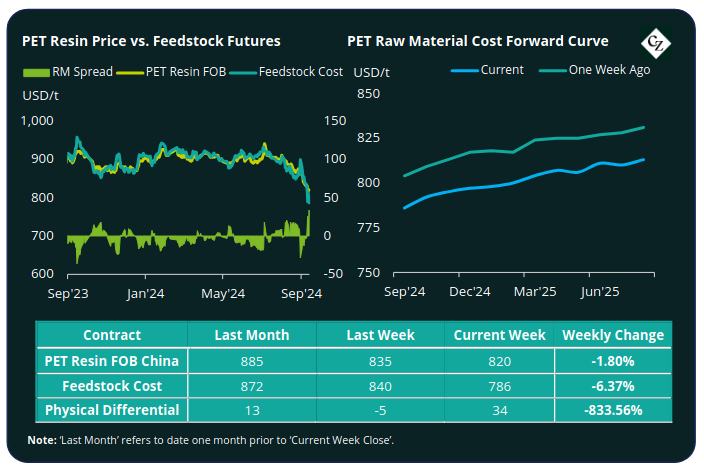

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices decreased by as much as USD 30/tonne last week, looked close to testing the USD 800-level. Prices then firmed to USD 820/tonne by Friday, USD 20/tonne down on the previous week.

The average weekly PET resin physical differential against raw material future costs increased by USD 27/tonne to plus USD 27/tonne last week. By Friday, the differential had increased to plus USD 34/tonne.

The raw material cost forward curve maintained its modest forward premium, with Jan’25 feedstock costs holding a USD 12/tonne premium over Sept’24, and May’25 a USD 20/tonne premium.

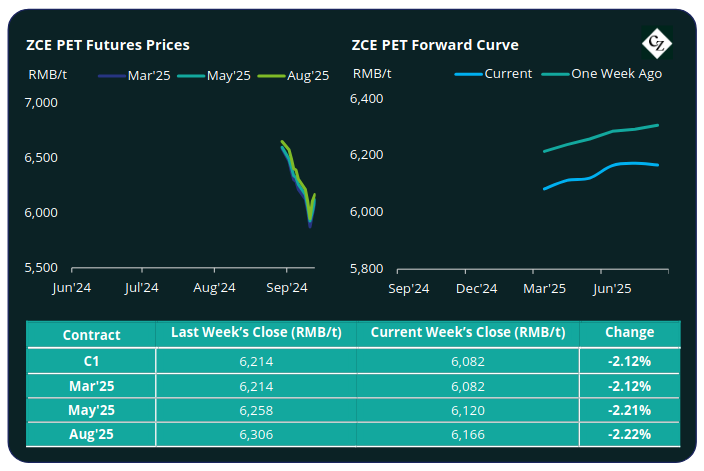

*NEW* PET Resin Futures and Forward Curve

Mar’25, the first contract month of the new PET Resin Futures, closed the week down around 2% tracking overall declines in raw materials.

The average weekly premium over Raw Material Futures kept relatively steady at USD 14/tonne.

The PET Resin Futures forward curve flattened slightly, with May’25 showing a small RMB 38/tonne premium and Aug’25 a RMB 84/tonne premium. However, current trading volume for contacts beyond Mar’25, the first contract month, is still extremely limited.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

Concluding Thoughts

Asian PET resin pricing has a rollercoaster of a ride last week. However, ended the week on a cautiously optimistic footing with prices firming.

PET resin producers also received a flurry of enquires, some booking large single-day volumes. Although buyers pushed for sub-USD 800/tonne FOB levels, producers resisted and the subsequent rebound in upstream values led to a firming of PET resin prices.

In the short-term, much will depend on the direction of the crude markets, with a potential market bottom in Asian PET resin export prices now forming. This is also supported by the fact that the raw material forward curve is also indicating a forward premium.

Next week’s mid-Autumn Festival in China, and October’s Golden week may also give the market opportunity to stabilise.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.