Insight Focus

CBAM enters full implementation in 2026, when free EUA allocations will start to shrink. EU industry is facing difficulties in accurate reporting of “imported” carbon emissions. A new report proposes a delay to the phase out of free EUAs until the CBAM design can be improved.

CBAM Poses Risk to EU Industry

Europe’s Carbon Border Adjustment Mechanism represents a risk to the region’s industry, as the success of the carbon tariff is not guaranteed while it could raise costs significantly for European manufacturers, according to a new report.

The report, “The Future of Europe’s Competitiveness,” was compiled by former European Central Bank chief Mario Draghi, who urged the European Commission to closely monitor the CBAM and make changes if necessary to ensure it does not disadvantage EU-based industry.

“While CBAM is an important instrument for European companies to stay competitive against their international peers that face lower or no carbon prices, its success is still uncertain,” Draghi’s report said.

“The EU should closely monitor and improve the CBAM design during the transition phase and consider postponing the phase out of free ETS free allowances for energy-intensive industries if implementation is ineffective.”

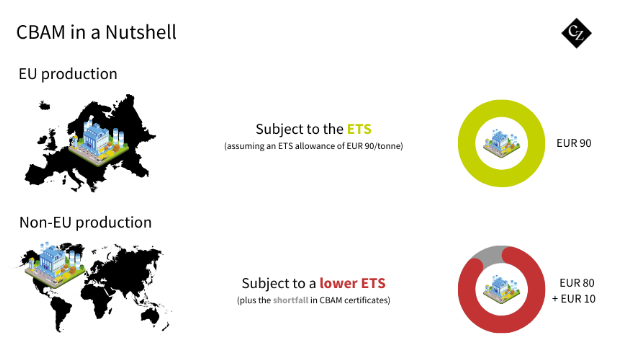

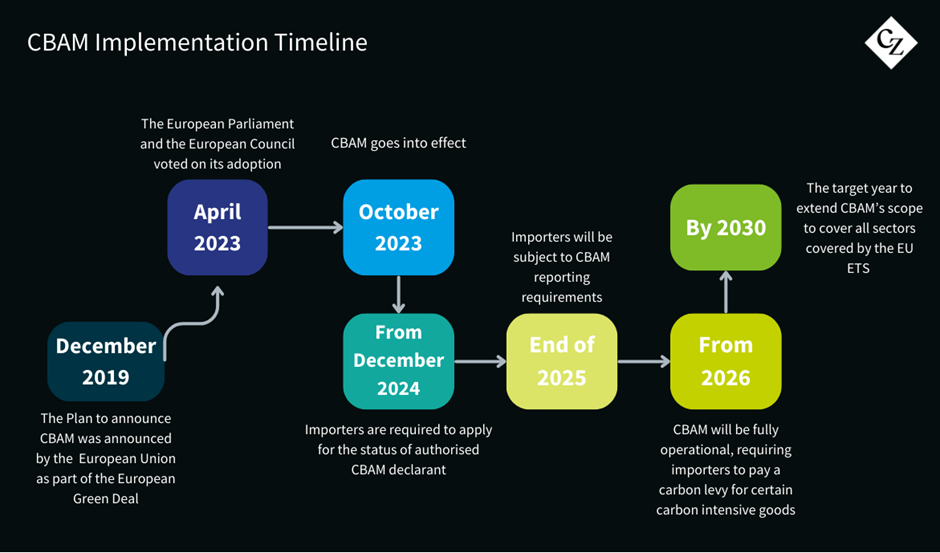

CBAM took legal effect last year and the mechanism is in a transitional, reporting-only phase until 2026. Importers must declare the carbon content embedded in imports of a selected group of materials including steel, aluminium and fertilisers. From 2026 they will be required to buy and retire “CBAM certificates” equivalent to the total embedded carbon.

And as CBAM begins to impose a cost of carbon on products from countries where there is no carbon price, or in which the cost of emissions is lower than Europe’s, the EU will start to reduce the quota of free carbon allowances that it gives to energy-intensive EU manufacturers.

The roll-out of CBAM has been dogged by technical problems, with more than 90% of importers missing a January deadline to declare the embedded carbon content of their imports.

Some national governments within the EU are considering whether to redraw the thresholds for CBAM compliance to exempt small and medium sized enterprises, while there are also doubts over whether importers should be required to use emissions data from the source manufacturers.

Many stakeholders have said that acquiring this data is proving very difficult, and transitional rules that set default carbon intensity values on imports may need to be extended, the report suggested.

High Energy Costs Weigh

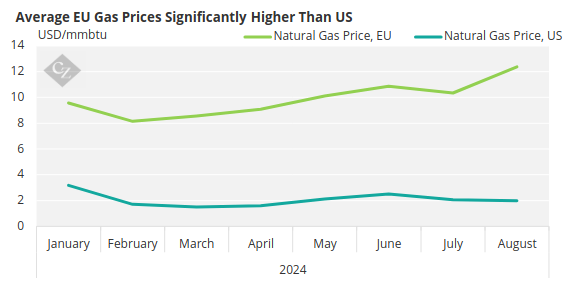

The Draghi report also dovetailed its warning on CBAM with concern over energy costs for European industry. “Even though energy prices have fallen considerably from their peaks, EU companies still face electricity prices that are two to three times higher than those in the US,” the report asserted. “Natural gas prices paid are four to five times higher.”

Source: World Bank

The root of these higher costs lies in the energy market structure, the report alleged. The rapid growth of low-cost renewable energy is not leading to lower bills for consumers, since the market price is set by the marginal supplier, which is most often still a fossil-based generator.

“Without a plan to transfer the benefits of decarbonisation to end-users, energy prices will continue to weigh on growth,” the report said.

With European industry facing high energy costs and the threat of higher carbon costs as the free allocations are reduced after 2026 under current plans, “if we fail to coordinate our policies, there is a risk that decarbonisation could run contrary to competitiveness and growth,” Draghi warned.