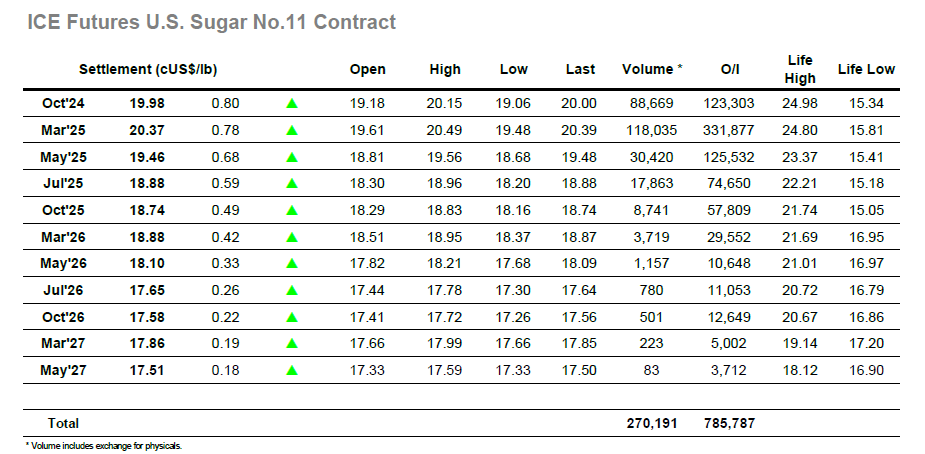

March’25 saw a 20-point opening range on low volume before settling down to hold in the lower 19.60’s through the early part of the day. Now that the index roll and Oct’24 option expiry have passed the volume was lower, though that may have been attributable to the narrow range prevailing through the morning which gave no encouragement to bring traders into the fray. Approaching noon there was a little more buying beginning to emerge and this continued through the early afternoon to bring the price to the 19.80’s and sit just beneath the 2-week highs. This milestone was soon passed with 20.00 becoming the next psychological mark to be challenged, something which was achieved soon afterwards. By now the specs were far more positive and a combination of short covering and fresh buying enabled the market to accelerate with pace once through 20.00, working quickly ahead to 20.49 while at the same time seeing the soon to expire Oct’24 contract also move through 20.00. There was strong volume on this push with the solid buying filling in a host of opportunistic sell orders from producers as they seized the best pricing opportunity in more than two months, the pricing stretching down through the middle months also. Naturally, there was some profit taking seen at the higher levels, but the market generally held firm through to the end of the session which resulted in a strong conclusion at 20.37. Oct’24/March’25 close at -0.39 points to leave Oct’24 at 19.98 and provide the strongest close since early July.

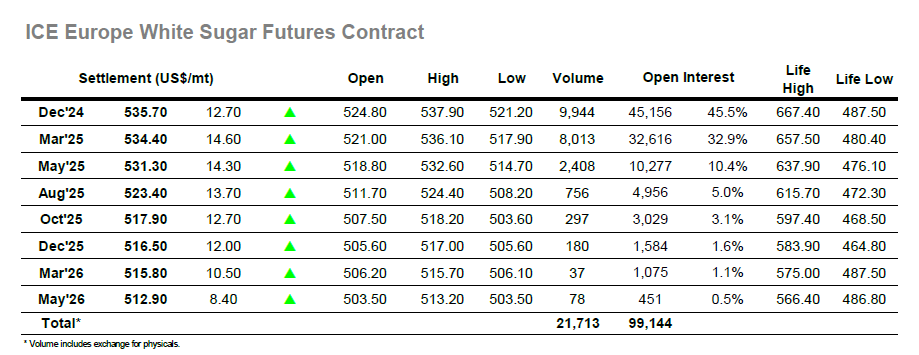

It was a slow start to the session as nearby values posted light gains through the first hour on volume which barely registered. Volume remained low through the morning, and it was only as noon approached that interest began to pick up with some fresh buying pulling the market up a little. The higher movements were again being directed by the direction of travel for the No.11, and though Dec’24 was largely keeping pace the rest of the board was not proving quite so strong, and spreads were widening. Progressing into the afternoon the momentum continued to grow at the top of the board and step by step the price climbed upwards to sit in the $530.00 area. Another more aggressive push followed to eventual highs at $537.90, with specs by now adding to longs and keen to try and maximise the opportunity to finally break from the current range. Their efforts were not enough to reach the $541.20 August high, however the price remained solid through the closing stages and this level will certainly remain in focus when we resume as the longs look to benefit from technical strength. Dec’24 settled at $535.70, with Dec’24/March’25 giving up its earlier gains to end at $1.30. White premiums remained lower of the day as the market lagged the rate of progress for No.11, March/March’25 settling at $85.20.