Insight Focus

Brazil is causing concern due to unusually dry and hot weather. The US and Mexico are also facing production challenges, including lower yields. Despite progress made with greening disease, orange supply issues are expected to last into the next crop.

Brazilian Orange Crop Down

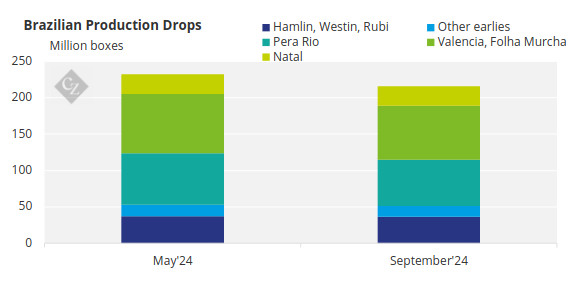

Brazil’s orange juice production will drop by almost 30% compared to the previous season, according to the latest projections by Fundecitrus. The Brazilian research firm said that production will now total 215.78 million 40.8kg boxes, marking a 7.1% decrease from the initial forecast in May.

Source: Fundecitrus

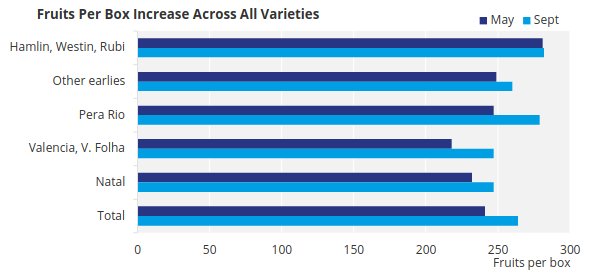

Early, mid, and late-season varieties have all been impacted, with reductions of 33%, 35% and 24%, respectively. The key factor behind this sharp decline is the hot and dry weather, which not only reduced fruit size but also accelerated ripening, leading to a quicker harvest pace.

By mid-August, 45% of the crop had already been harvested — much faster than previous years, when only about 30% would typically be harvested by this time.

The smaller fruit size has also affected overall production output. The current estimate suggests 264 pieces of fruit are needed to fill a 40.8 kg box — an increase from the 241 pieces initially expected.

Source: Fundecitrus

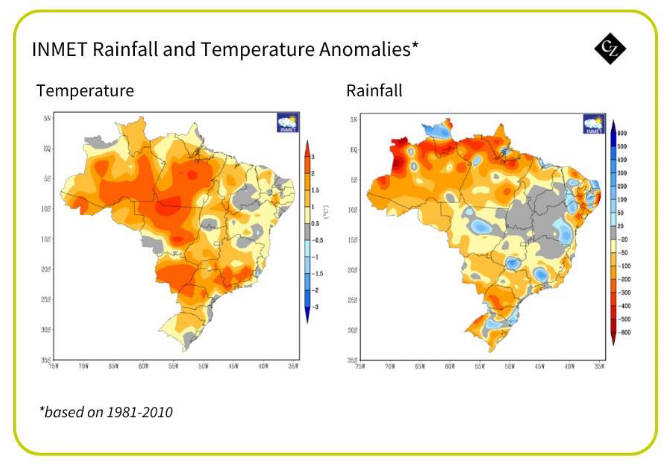

This reflects the challenges caused by extreme weather conditions. During the three-month period of June, July and August, INMET data shows that temperatures were higher than the average, while rainfall was 31% lower than expected, exacerbating drought conditions in the region.

Source: INMET

Prices on a Rollercoaster

From August 12 to August 16, the average price of Pera oranges on the tree reached BRL 98.79 per 40.8 kg box — a 2.51% increase from the previous period. By late August, Pera orange prices hit BRL 100 per box.

These price hikes are driven by a tight supply and continued high demand from juice processors. The strong demand for oranges, particularly from industrial buyers, is keeping market prices elevated.

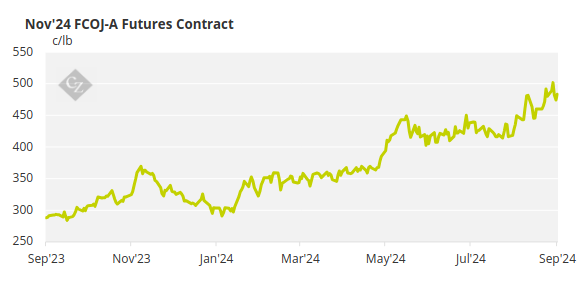

This is also reflected in the futures market for frozen concentrated orange juice (FCOJ), which has reached record highs, trading at USD 5.49/lb solid. This spike is largely attributed to Brazil’s poor crop outlook and low inventories.

Source: ICE

The market remains volatile, with traders anticipating that orange juice prices could fluctuate between USD 4/lb and USD 5/lb, barring any significant supply disruptions. The tight global supply of oranges, particularly among major producers like Brazil, continues to fuel price uncertainty in the futures market.

US, Mexico 2024/25 Supply Concerns

In the US, Florida’s 2023/24 orange crop concluded with a final estimate of 17.96 million boxes, an increase on 15.8 million boxes last year.

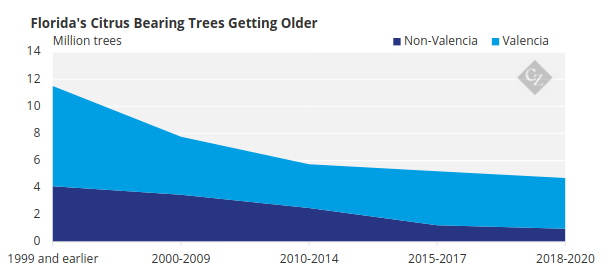

However, there is concern for the 2024/25 crop due to shrinking output and a continual reduction in the number of bearing trees, despite relatively favourable growing conditions. This reduction in trees is limiting yield potential.

Source: USDA

In Mexico, last year’s orange crop saw a 39% increase in juice production compared to the previous year. However, the upcoming crop is expected to face substantial reductions due to adverse weather conditions, leading to concerns about fruit quality and size.

The Mexican market is currently experiencing tight supply, with no frozen concentrated orange juice (FCOJ) available. Recent FCOJ offers ranged from USD 6,950/tonne to USD 7,150/tonne, highlighting market pressures.

Market Deficit Expected

The 2024-2025 orange season faces considerable challenges across Brazil, the US and Mexico, with adverse weather conditions and reduced crop volumes straining the market. Brazil, in particular, has seen significant declines in production, driving prices higher due to supply shortages.

In the US, Florida’s output remains constrained, and Mexico is bracing for a weaker crop. On the futures market, FCOJ prices are expected to remain high, reflecting the ongoing supply-demand imbalance. However, the citrus industry has made progress in managing the spread of greening disease, offering hope for improved conditions in the future.

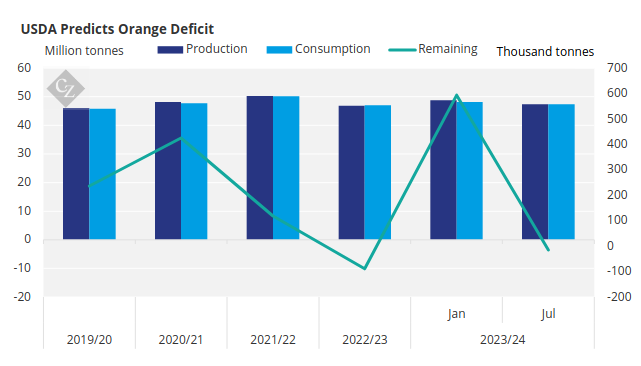

In fact, globally, orange consumption is largely on par with production, meaning any supply issues will likely cause price shocks. The USDA in July dropped its global orange juice production estimates from 48.8 million tonnes to 47.4 million tonnes. Even with slightly lower consumption, this still means the market will be in deficit by roughly 15,000 tonnes.

Source: USDA

Fundecitrus reported on August 6 that the spread of the greening disease had slowed significantly. A 54% reduction in disease incidence was observed compared to the previous year, attributed to higher temperatures in late 2023 and early 2024, which may have hindered the bacteria responsible for greening. Improved control measures, such as more effective insecticides and shorter application intervals, have also helped contain the disease.