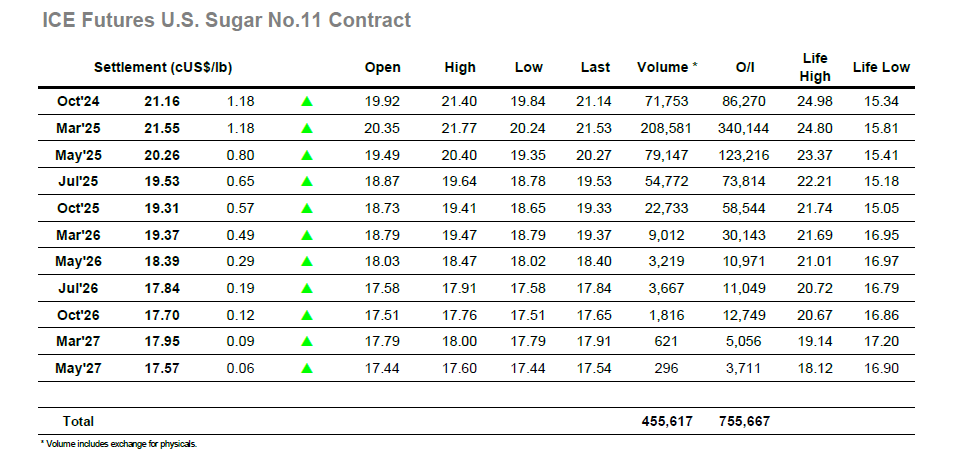

There was a calm start for March’25 as yesterday’s gains were consolidated, with buying limited through the early part of the day as the usual array of hedge lifting / consumer pricing falls away at the higher levels. Having set back to 20.24 during the early stages there was some impetus being generated back into March’24 by the middle of the morning and specs were again at the forefront of the action with their buying taking the price through yesterday’s highs and on to 20.75. A pause ahead of the US morning did not last with the arrival of US specs/funds bringing another wave of buying which pushed the market to challenge the early July mark of 21.00, with prints briefly made just above at 21.02 before again pausing for breath. With the market on the run the specs were enthused to maximise the opportunity and so additional waves of buying followed into the clear air above 21.00, the dry weather in Brazil which generated the move no longer the main focal point with the technical picture now driving the momentum. Volume for March’25 was vast, with strong buying also being seen for the spreads to reflect the potential Q1 supply deficit. March/May’25 saw the greatest volumes across the day and at one stage widened out to 1.47 points, some 0.70 points above its starting point for the week, while the spread impact was starker when looking to the longer dated prompts. A high-volume push to 21.67 represented the highest prices for March’25 since April, and while some positions were closed out to lock profit the general appetite was to remain long in hope that this momentum can continue beyond 22.00. A final push heading into the close to achieve a strong settlement saw new highs at 21.77 (1.40 points above last nights close) before a sharper burst of position squaring sent the market back as settlement was made at 21.55.

London whites have lagged the No.11 this week with the physical supply concerns for Q1 raws not being replicated to the refined sector, and the moderate gains seen through the first hour remained a byproduct of the raw sugar strength. Across the morning the price edged up through the recent highs to trade at $542.00, though this did not generate technical interest, and the market remained a passenger to the movement elsewhere. The calm was broken once US traders reached their desks with the buying which flowed to No.11 drawing spec interest to our own market. Consumers were largely absent as the opportunity of recent weeks and months has left them well priced for the near term but that in no way hindered the afternoon momentum which extended the gains to $561.20 over the next few hours, a net gain of more than $25. March’25 was keeping better pace than the Dec, but still the arbitrage value was creaking with afternoon trade seeing the value drop back to $82.50, while at the top of the board the Dec’24/March’25 spread had moved to a discount at -$2.00. The market remained to the upper end of the range across a calmer final hour, leading to a solid close at $555.50, though still some way shy of the July highs which need to be broken if the market is to find its own momentum.