Insight Focus

India’s overlapping urea tender is likely to raise global prices. However, there are whispers that China could surprise and enter the market. DAP prices in India are increasing due to strong demand, while potash prices in Brazil are declining amid Indonesia’s scrapped tender.

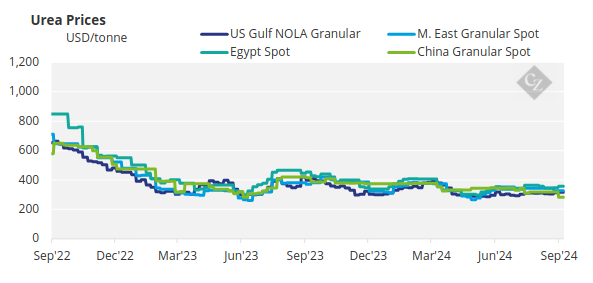

Urea Market Shows Promise

In a surprise move, the Indian purchasing agency, RCF, issued a tender notice on September 19, for a urea tender closing on October 3, with offers valid until October 14 and the latest shipment date on or before November 20.

It was sarcastically mentioned in the trading community that a tender could be expected with a Middle Eastern cargo selling at USD 350/tonne FOB, up around USD 10-15/tonne from previous spot sales. On several occasions in the past, a Middle Eastern urea cargo has been sold within hours of an announcement of a tender in India, and always at a substantially higher price than before.

Leading up to the tender, the international urea market showed some signs of softness and dormancy, but Egypt has now sold a 10,000-tonne parcel at USD 367/tonne FOB, up USD 2/tonne on previous sales.

Gas supplies have also returned to three Egyptian urea producers that halted output earlier this week. The three plants have a combined capacity of 1.85 million tonnes per year, and any prolonged absence from the market could have had a significant impact on prices.

Algerian producer Sorfert is also set to cut production at its 1.19 million-tonne plant due to maintenance. Iran’s MIS apparently sold 30,000 tonnes at USD 288/tonne FOB. Some attribute this to lower USD values against most currencies, following the 50-basis point interest rate reduction a few days ago.

There is very little traction in Brazil, with offers at around USD 360/tonne CFR subsequently slipping to as low as USD 350/tonne CFR.

Conspiracy theories are now circulating that China could enter the Indian tender, with daily production reported at 197,000 tonnes, the highest in a very long time. It is reported that accumulated inventories at factory sites are around 850,000 tonnes, but insiders say this is not an issue.

The problem arises when urea inventories start to accumulate at the distribution level and major export ports. There is no evidence that this is happening now, although in China, things can change quickly. The bottom line is that if China does participate in the Indian tender, the entire outlook of the urea industry would change dramatically. If it continues to abstain from exporting, it will be interesting to see how much product will be available from traditional suppliers in the Middle East and the Baltics.

Producers in Southeast Asia are reportedly sold out well into October, with current sales levels ranging from the high USD 320s to USD 335/tonne FOB. Malaysia’s urea exports for January-July increased 4% year on year to 1.17 million tonnes, with firm deliveries to Australia and Thailand, while shipments to the Philippines tapered off by 44%, citing high inventories and drought. Exports to Myanmar slipped 53%, with buyers opting for alternative sourcing at better CFR prices.

The outlook for the urea market is bullish, with prices expected to increase across the board.

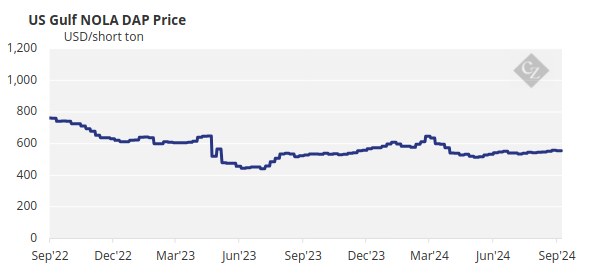

Phosphate Market Challenges

On the phosphate side, India’s expected final P/K subsidy rates leave DAP imports at a USD 100/tonne loss for the importer. Some claim that this is why India is coming out with another urea tender overlapping the previous one.

The latest reported transaction on DAP in India is for a USD 637/tonne CFR Russia-origin sale concluded this week. India has been trying to temper subsidy payments since spending over USD 30 billion in the 2022/2023 fertilizer year to keep prices affordable for farmers.

In the 10 fertilizer years between 2010/2011 and 2019/2021, India’s fertilizer subsidy bill never exceeded USD 10 billion per year. India’s total imports in the calendar year 2024 are forecasted at 4.2 million tonnes to 4.3 million tonnes, down more than 2 million tonnes from 6.3 million tonnes in 2023.

China DAP prices are slightly higher this week, pegged at USD 615-620/tonne FOB versus USD 610-620/tonne last week. China’s fourth quarter export quota is a major talking point, with the market expecting it will be less than last year’s 1.9 million tonnes.

In Brazil, MAP is holding at USD 635/tonne, but seasonality and low demand are expected to put pressure on prices in the near future. Brazil imported around 8.4 million tonnes of DAP/MAP/NP/NPK/TSP/SSP in January-August, a 3% increase year on year.

The outlook for DAP prices could rise in India, where demand remains strong. Other markets remain muted.

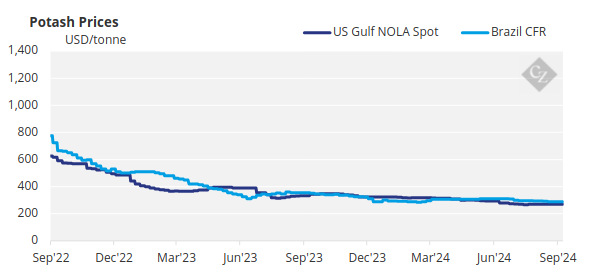

Potash Prices Decline

The international potash market seems detached from developments in the nitrogen and processed phosphates sectors. Brazil granular potash prices declined by an average of USD 10/tonne this week to a range between USD 285-295/tonne CFR. Bids are coming in at around USD 280/tonne CFR, and the market now accepts that the floor has been reached.

Pupuk Indonesia scrapped its 125,000-tonne standard potash tender, opting for optional tonnage at USD 299/tonne CFR, matching the previous tender price.

The outlook for potash prices is stagnant but soft.

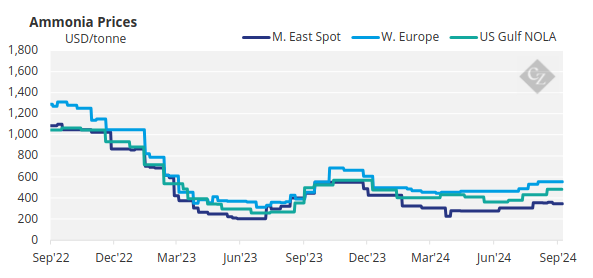

Ammonia Supply Tightens

The ammonia market is now supply-driven, with the first of two maintenance periods at Ma’aden in Saudi Arabia set to be extended further into September. As a result, sentiment is bullish on both sides of the Suez heading into the fourth quarter, with the Tampa October ammonia contract price imminent. Most market players expect an increase on the current USD 530/tonne CFR price.

In general, the assessment of prices is stable to firm across all regions.