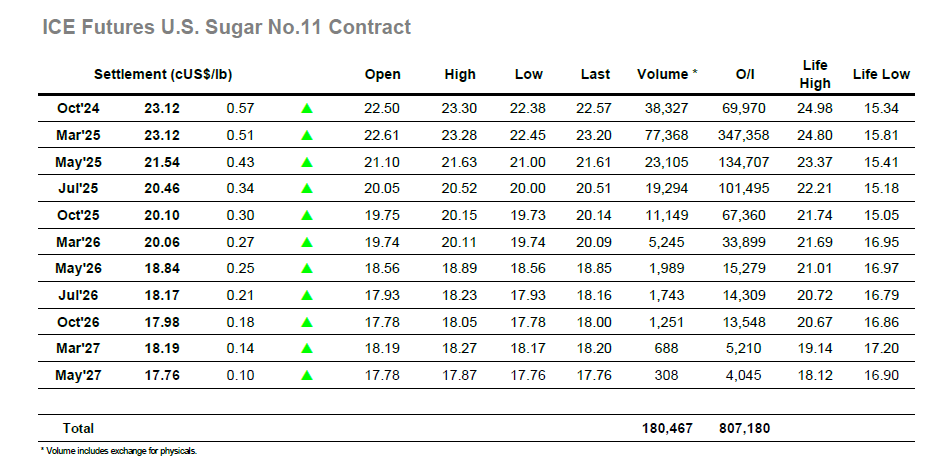

The usual choppy trading on the opening saw March’25 trading either side of unchanged, but when things calmed it was with a stable bias as the price worked along in the vicinity of 22.70. As with yesterday the morning saw a continuation of the consolidation pattern and it was apparent that any movement would be dependant upon the intent of the US specs once they joined proceedings. As anticipated the afternoon did bring new movement and it was the 23c area which provided the attraction for longs with another push to add yet more technical strength, gathering pace as the market broke through 23.12 and extending the current move up to 23.28. Volume was notably lower than last week with the specs not willing to accumulate in the same quantities as previously, while overhead the 2025 positions continue to attract a smorgasbord of producer pricing orders. Oct’24 remains actively traded ahead of expiry with the Ocr’24/March’25 spread having levelled out near to parity, though with open interest standing at 69.970 lots 5 trading days before the tender the market has potential to become quite thin by the end of the week. The final few hours saw quieter trading as prices levelled out above 23.00, with longs seemingly happy to maintain gains and post another solid chart day. They accomplished this easily as a quiet close led March’25 to settle at 23.12, maintaining the strength for another day.

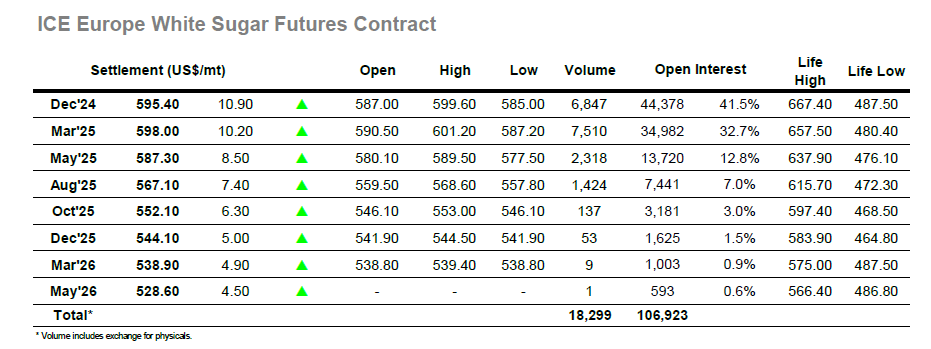

It was another positive start for Dec’24 as values jumped higher, and though there was a retreat to $585.00 which erased much of the gain by the middle of the morning the mood was positive, and prices soon started to look higher again. Another small dip around noon made little impact upon the trend and as we moved through into the afternoon there was a gradual push up into the lower $590’s. With the speculative sector determined to build upon the astonishing progress made across the past week we soon saw Dec’24 nudging towards $600 to try and test the high made yesterday, but despite a persistent effort through the afternoon this level remained just out of reach and a high was recorded at $599.60. The positive showing was helping the nearby premium values to nudge back up with March/March’25 moving into the low $90’s during the afternoon, though towards the end of the session the price fell back slightly and closed at $88.30. The flat price meanwhile held firm, and despite seeing the usual end of day closeouts worked its way to the highest settlement value of the move at $595.40. Overall, it was a more subdued session than recent efforts, though the progress made will be viewed positively by longs who have as yet not exhausted their efforts /capacity to continue higher.