Insight Focus

Europe’s top container ports remain dominant in 2024. However, shifts are emerging as Valencia comes close to overtaking Piraeus. Ports like Sines and Barcelona are posting strong growth, while the Red Sea crisis causes disruptions. Global shipping challenges and potential strikes in the US add uncertainty to future forecasts.

European ports serve as major hubs for global trade, hosting some of the world’s most critical and busiest container terminals. A significant portion of global cargo flows through Europe’s shipping corridors and terminals, making their performance vital to international commerce.

Piraeus Port’s Position at Risk

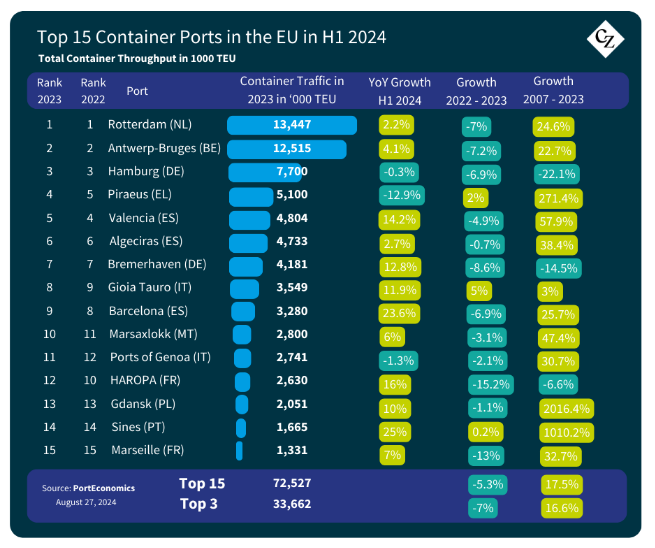

According to PortEconomics, while the top three ports for container traffic remain unchanged, the first half of the year saw notable shifts in the mid and lower sections of the rankings. Spain’s Port of Valencia is on track to surpass the COSCO-owned Port of Piraeus by year-end, having reduced the gap to fewer than 300,000 TEUs. The Port of Piraeus has experienced the sharpest decline among the top 15 EU container ports, with a 12.9% drop, largely attributed to the ongoing Red Sea crisis.

“The Greek Port of Piraeus incurred hefty traffic losses as the East Med became a maritime ‘cul-de-sac’ due to the dramatic drop in Suez Canal transits,” highlighted Theo Notteboom, a PortEconomics member who compiled the following EU port rankings table.

Notteboom warned of a potential further decline in Piraeus’ position if current trends persist. “Valencia is expected to overtake Piraeus as the fourth largest EU port by the end of 2024, with Algeciras and Bremerhaven also poised to overtake Piraeus, potentially pushing it to seventh place,” he noted.

The effects of the Red Sea crisis and associated shipping network changes are evident in the West Med and Atlantic coast. Ports like Sines, Barcelona, and Valencia all reported robust growth. Gioia Tauro’s growth accelerated in the first half of 2024, while the Spanish transshipment hub, Algeciras, didn’t fully benefit from favourable market conditions.

Additionally, the French port complex of Le Havre, Rouen, and Paris (HAROPA) is projected to climb two positions to secure the tenth spot, pushing Malta’s Marsaxlokk port out of the top 10.

European Port Giant Trio Stays on Top

The ports of Rotterdam, Antwerp-Bruges, and Hamburg continue to dominate the European container port rankings. Both Rotterdam and Antwerp-Bruges recorded slight volume increases in the first half of the year, with Rotterdam growing by 2.2% and Antwerp-Bruges by 4.1%. Meanwhile, Hamburg maintained relatively steady volumes, showing a minor decline of 0.3%.

Specifically, in the first six months of 2024, Rotterdam moved 13.5 million TEUs, Antwerp-Bruges handled 12.5 million TEUs and Hamburg processed 7.7 million TEUs.

Among the ports that recorded impressive double-digit growth, Portugal’s Port of Sines led the way with a remarkable 25% increase in container volumes. Spain’s Port of Barcelona followed closely with a 23.6% rise, while the French HAROPA complex posted a solid 16% growth. Spain’s Port of Valencia showed a 14.2% increase, Bremerhaven reported 12.8% growth, Gioia Tauro saw an 11.9% rise, and Poland’s Port of Gdansk boosted its container throughput by 10%.

On the other hand, EU ports that recorded declines include Piraeus with the largest drop of 12.9%, followed by Genoa with a 1.3% decrease, and Hamburg with a slight reduction of 0.3%.

Uncertainty Looms Amid Ongoing Challenges

With the shipping industry facing continuous challenges, reliable forecasts remain elusive. For instance, the Red Sea crisis drastically reshaped the global transportation landscape in unforeseen ways.

Looking ahead, a potential strike at US East Coast and Gulf ports could further destabilise global shipping. If the International Longshoreman Association (ILA) and the United States Maritime Alliance (USMX) fail to reach an agreement before October 1, a strike could have a global ripple effect, impacting even European ports.

Despite geographical distance, the interconnected nature of global shipping means that disruptions in one region can quickly cascade across the globe.