Insight Focus

Urea prices rise steadily, supported by India tender and Brazil. Processed phosphate prices climb with strong DAP demand in India. Potash markets remain quiet but should pick up in October, while the ammonia market awaits price guidance from the Yara Mosaic contract.

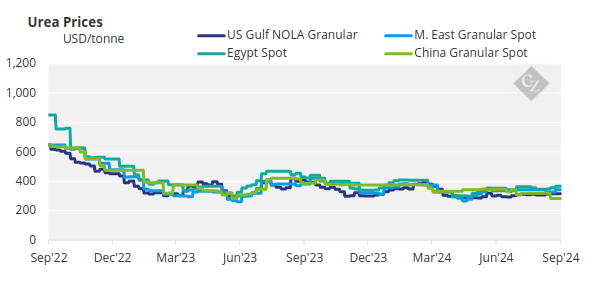

Urea Prices Rise Ahead of India Tender

The India tender, closing on October 3, is looming large over trading activity, with producers holding back unless price offers are too high to refuse. Although activity has been muted since the announcement of the India tender, prices are edging up. On average, Middle East FOB prices have risen by around USD 25/tonne since the beginning of the month, while Southeast Asia FOB levels have increased by about USD 30/tonne over the same period.

A 30,000-tonne Middle East second-half October cargo appears to have changed hands at USD 356/tonne FOB, destined for Australia. This price is up from the previously assessed range of USD 335-340/tonne FOB. The increase followed Pupuk Indonesia’s granular urea tender, which resulted in an award at USD 358.35/tonne FOB, with the destination still unknown. Further supporting higher prices is yet another production issue at Petronas’s Sipitang facility.

Traders and producers are speculating about a possible India CFR price, with some expecting an L1 sub-USD 360/tonne CFR and others predicting closer to USD 370/tonne CFR. One reason for the lower figure is that Iranian cargoes are expected to participate, as they did in the previous tender, where at least two Iranian shipments were included. Iranian FOB prices are now below USD 300/tonne, with the highest price reportedly at USD 295/tonne for granular urea and USD 313/tonne for prilled urea.

Brazil is another destination for Iranian urea, with prices soon expected to reach USD 370/tonne for non-sanctioned products. Normally, Iranian prices are USD 10-20/tonne lower.

Egyptian granular urea was sold in small parcels to Europe this week, with the latest price reported at USD 370/tonne FOB. Egyptian producers benefit from duty-free shipments to Europe.

Brunei Fertilizer Industries (BFI) conducted a sales tender on Thursday, September 26. While no official outcome has been disclosed, speculation suggests prices above USD 360/tonne FOB, marking a significant increase from the low-to-mid USD 330s/tonne FOB achieved in previous sales.

Chinese urea exports remain minimal, with little or no significant shipments. From January to August, exports totalled just 245,000 tonnes, compared to 1.6 million tonnes for the same period last year. Export restrictions, enforced in October 2021 and reinforced in September 2023, have severely limited Chinese urea exports, with no signs of significant change in the fourth quarter.

The largest importer of Chinese urea was South Korea, receiving nearly 90,000 tonnes, followed by Japan with approximately 30,000 tonnes and Australia at just over 10,000 tonnes. China’s urea production capacity is expected to grow by 4 million tonnes, reaching nearly 80 million tonnes by 2025, while domestic demand is projected to increase by 5 million tonnes, bringing total consumption to 60 million tonnes. This raises the question of what will happen with the surplus of 20 million tonnes if exports remain restricted.

The outlook for urea prices is stable to bullish, but the market’s direction will become clearer after India’s price discovery on October 3.

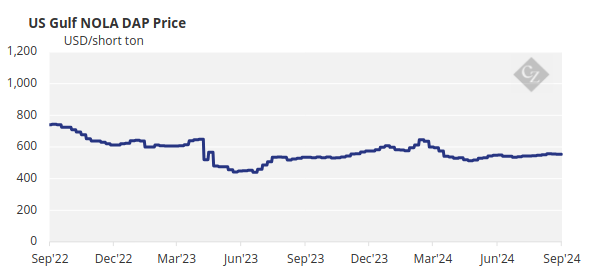

Indian Demand Boosts Phosphate Prices

The processed phosphate market remains focused on India and its demand for diammonium phosphate (DAP) imports. After weeks of stability at USD 625/tonne CFR, Indian buyers have had to pay more, with several deals concluded in the USD 640s/tonne CFR region. The sources include Morocco, Saudi Arabia, Jordan, and Russia.

In Pakistan, CFR prices are slightly higher than in India, with some offers reaching USD 665/tonne CFR and others in the low USD 640s/tonne CFR. However, neither price level is likely to gain traction due to high inventories in Pakistan. In China, FOB levels are around USD 615-620/tonne, with no reported business.

Monoammonium phosphate (MAP) prices in Brazil remain fixed at USD 635/tonne CFR, with no new business reported.

In OCP of Morocco’s first half earnings statement, it reported that sales of processed phosphates reached 5.6 million tonnes, up 30% year on year, with exports of DAP/MAP increasing to 3.2 million tonnes from 2.7 million tonnes year on year. NPS/TSP exports rose to 1.9 million tonnes from 1.2 million tonnes year on year.

Based on estimates, OCP’s January-August 2024 exports reached 8 million tonnes, up from 6.9 million tonnes year on year. Together with Ma’aden of Saudi Arabia, OCP is expected to dominate the processed phosphate markets, with future capacities expected to reach 15 million tonnes in Morocco and 10 million tonnes in Saudi Arabia.

China’s DAP/MAP exports fell by 13% year on year in January-August to 4.09 million tonnes. DAP exports dropped 19% year on year to 2.63 million tonnes, with India receiving 549,853 tonnes, a 73% decrease year on year. Vietnam and Thailand saw increases of 136% and 100%, respectively, receiving 408,455 tonnes and 390,487 tonnes. MAP exports remained stable year on year at 1.45 million tonnes, with volumes to Brazil up 9% to 627,615 tonnes, while exports to Australia dropped 21% to 112,059 tonnes.

The outlook for the processed phosphate market is stable to firm, although some price erosion could occur due to lower DAP imports in India. However, the commencement of Australian MAP imports in the latter part of Q4 could add excitement.

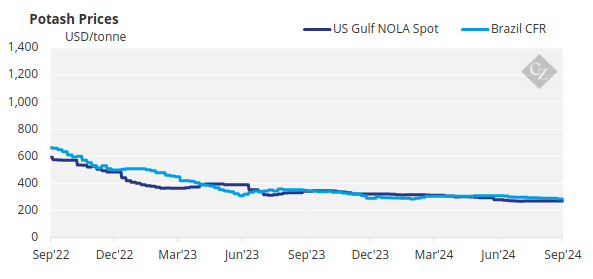

Potash Market Awaits October Surge

Potash price benchmarks were largely unchanged this week, with demand and spot market activity remaining dormant. Demand is expected to return to key global markets in October.

Brazil’s potash import price remained at its lowest level since February, after dropping USD 5/tonne last week. Bids are still at USD 280/tonne CFR, with the majority of sales at the lower end of this week’s range of USD 285-295/tonne CFR. Prices are approaching their floor and are expected to rebound once demand for the second corn crop returns.

The Southeast Asian market also remained stagnant, awaiting clarity from recent tenders in Indonesia.

China imported 934,148 tonnes of muriate of potash (MOP) in August, an 11% increase year on year, bringing total imports for the first eight months to 8.2 million tonnes, up 16% year on year. Russia exported 2.75 million tonnes of MOP to China from January to August, up 105% compared to last year, while Belarus supplied 1.9 million tonnes, down 25% year on year. Canadian MOP exports to China increased by 69% year to 1.6 million tonnes.

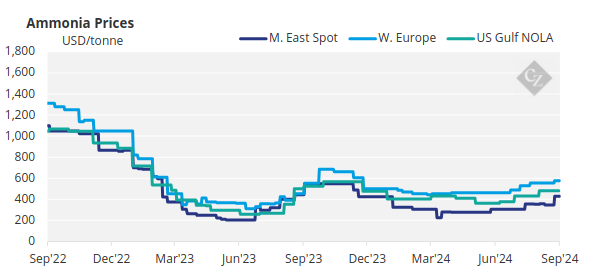

Ammonia Prices Await Guidance

Global ammonia benchmarks remained steady-to-firm this week, with increases seen in the west. All eyes are on October settlement news from Tampa, where prices are expected to rise from the current USD 530/tonne CFR. Outside of this, the market has been quiet, with participants awaiting price guidance from the Yara Mosaic October contract price.