Opinion Focus

We expect Mexico’s crop to recover. Mexican Latin American sugar imports should decrease. Mexican exports to the US could increase.

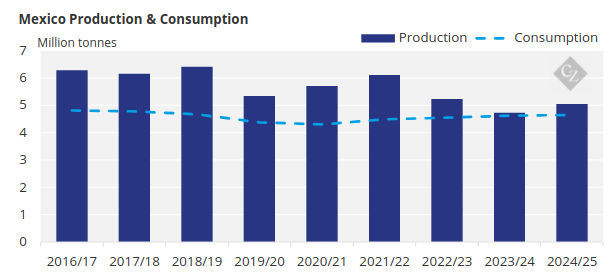

Will Mexico’s Crop Recover?

After two years of drought, we think Mexico’s cane crop should recover due to favourable weather. We forecast Mexico will produce 5m tonnes of sugar in 2024/25. This is more conservative than some forecasts we’ve seen, but we remain concerned by lingering effects of the drought of the past few years.

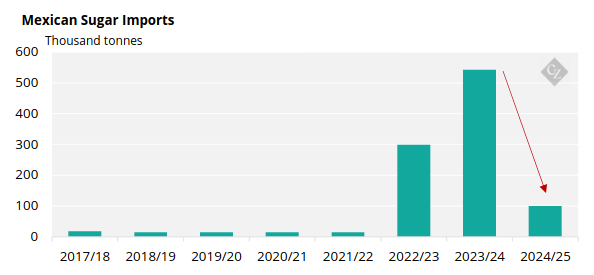

After two years of record sugar imports into Mexico, we expect these to decrease to 100,000 tonnes, down from almost 550,000 tonnes last year. Most imports into Mexico came from Brazil and countries in Central America.

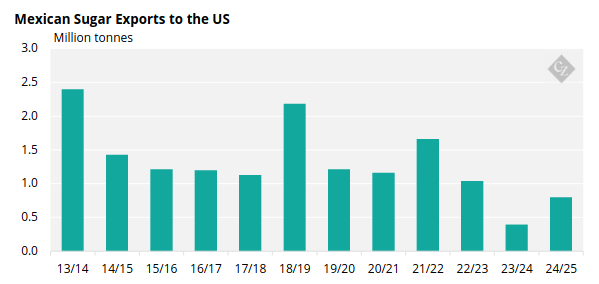

With a recovery of the crop and decrease in total imports, we are expecting Mexican exports to the US to increase to 800,000 tonnes, up 400,000 tonnes compared to last year.

With higher availability from Mexico to the US, we also expect paid duty imports into the US to return to normal levels of 273,000 tonnes.

Most US duty-paid sugar imports come from Latin America. With the volume decreasing by over 600,000 tonnes compared to last year, there will be higher availability from countries in Latin America for the world market.

What Does This Mean for Central America?

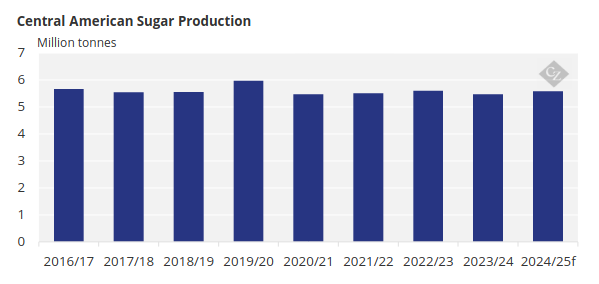

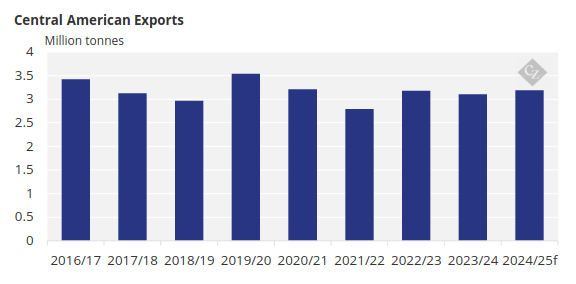

We expect Central American sugar production to increase by 100,000 tonnes this upcoming season as Guatemala’s sugar production recovers.

With higher sugar production, exports should increase by 82,000 tonnes. Last year, most Central American exports went to Mexico and the US. With a decrease in duty-paid Mexican and US imports, there will be more availability from Central America for the world market. We expect to see around 300,000 tonnes become available to the world market compared to last season.

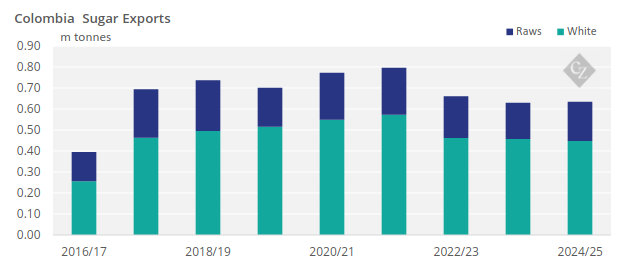

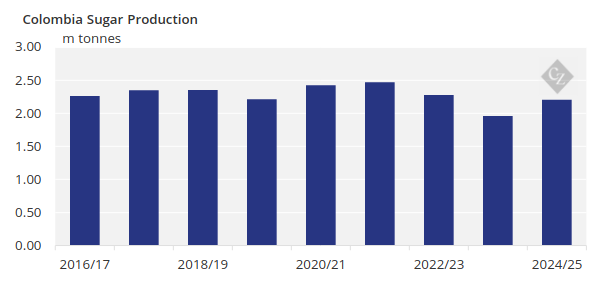

In addition to higher availability from Central America to the world market, Colombia’s crop is expected to recover, which would also lead to higher availability to the world market.

Colombia’s Sugar Production

We expect Colombian sugar production to recover to 2.2 million tonnes this upcoming season. So far, we have seen better weather that will allow yields to recover after two consecutive years of la Niña.

This will allow for an export increase of 30,000 tonnes compared to last season. Around half of Colombia’s exports go to the world market and the rest are quotas. If this weather continues, we could see even more sugar from Colombia enter the world market.