Insight Focus

India’s urea tender faces price increases from supply uncertainties. The processed phosphate market remains stable, with India as the sole buyer. Potash prices show mixed trends, and ammonia contract prices are rising.

Urea Supply Challenges Ahead

India’s government agency RCF closed a tender for urea on October 3, attracting offers from 21 companies totalling over 2.5 million tonnes. Of this volume, 1.373 million tonnes are allocated for the east coast, while 1.196 million tonnes are designated for the west coast.

As is common in Indian tenders, some tonnage is “double counting,” and certain offers may exceed the lowest L1 price. The critical questions now are the net volume available for consideration and how much India will ultimately purchase. Speculation suggests that purchases may fall well below 1 million tonnes, with price discovery expected later to determine the final volume secured during this tender.

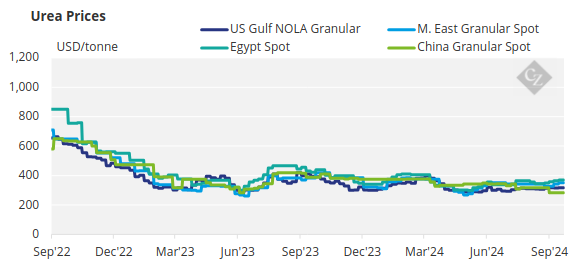

Further complicating the situation are escalating conflicts in the Middle East, which have led suppliers to raise or withdraw offers across various markets. On October 2, the November Arab Gulf futures contract traded at USD 367/tonne FOB, up USD 12/tonne from October 1 levels. The Middle East typically ships around 20 million tonnes of urea, and any supply disruptions could significantly impact both availability and prices.

In Brazil, offers have been withdrawn as suppliers are unwilling to quote at the last done price of USD 360/tonne CFR, with indications of USD 370/tonne CFR no longer available, and prices cited around USD 10/tonne higher. The last recorded price in Egypt was USD 387/tonne FOB for full November loading, with expectations for higher prices now.

The intensifying conflict between Iran and Israel increases the risk of disrupting Iranian and other Middle Eastern urea exports, prompting traders to pay higher prices for Nola urea. Of the 5.4 million tonnes of US urea imports during the 2023-2024 fiscal year (July-June), 37% (or 2 million tonnes) passed through the Strait of Hormuz from exporting countries, including Qatar, Saudi Arabia and the UAE, according to US Census Bureau data.

Iran’s role in the global urea trade has grown significantly, with exports increasing from 3 million tonnes in 2012 to approximately 5 million tonnes in 2023, and further expansion is expected with new export capacity coming online in 2025. Iran now represents nearly 10% of global urea exports, which are estimated at about 55 million tonnes.

Despite long-standing sanctions, major urea off-takers include Brazil and Turkey, with Iranian shipments to Brazil exceeding 1 million tonnes annually, while Turkey received close to 2.3 million tonnes in 2023.

South Africa has also been a significant recipient, importing 446,000 tonnes in 2023. Additionally, Iranian urea has been misreported in Southeast Asian markets, often assigned to other origins in customs data.

Phosphate Market Remains Resilient

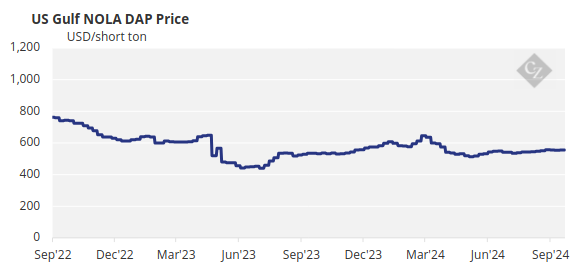

In contrast to the urea market, increased tensions in the Middle East have not yet affected phosphate prices from the region. Prices in China are currently pegged between USD 615-620/tonne FOB, although the market remains inactive due to the Golden Week celebrations from October 1-7.

Export quotas for Q4 are anticipated to be between 1.5 million tonnes and 1.8 million tonnes of DAP/MAP combined, compared to 1.8 million tonnes year over year. Suppliers can apply for Q4 exports starting October 1, with inspection times expected to range from 14 to 28 days.

Indian importer IPL has confirmed the purchase of 60,000 tonnes of DAP at USD 644/tonne CFR from Saudi Arabia. In Brazil, MAP prices are holding at USD 635/tonne CFR due to limited supplies, affordability issues and farmers shifting to SSP/TSP.

Pakistan has been inactive in imports for the past two months, with slow demand and higher inventory entering the Rabi season. A key concern is that DAP offers reflect significant losses in inland transport and sales. Private importers face potential losses of around USD 60/tonne on imported DAP products due to prevailing domestic prices.

OCP of Morocco is thriving, with January to August exports up by 1.3 million tonnes, including 1.2 million tonnes in August alone, bringing the total for the period to 8.1 million tonnes, an 18% increase year over year. The company is projected to produce 12.6 million tonnes, with exports estimated at 12.1 million tonnes, supported by increased production.

Additionally, ammonia and sulphur imports surged between January and August, with imports of ammonia up 28% year over year to 1.2 million tonnes and sulphur up 35% to 5.6 million tonnes. Together with Ma’aden of Saudi Arabia, the two phosphate producers are expected to dominate global trade, posing significant challenges for other exporters, especially those in China, who are grappling with stringent export policies.

Potash Prices Show Mixed Signals

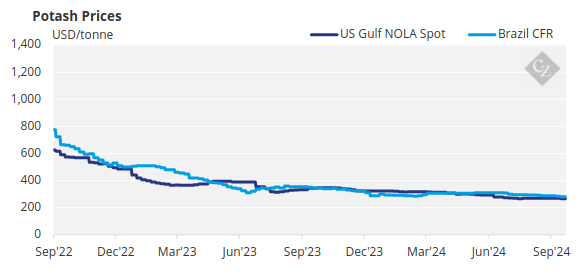

Potash prices diverged this week, with standard MOP prices in Southeast Asia and India advancing, while granular MOP prices fell in Brazil and Southeast Asia amid limited spot market activity. Brazil’s potash price has declined to an average of USD 285/tonne CFR, its lowest level since late February 2024. Bids have slumped to USD 270/tonne CFR, although most market players believe prices are nearing the floor. Granular prices have dropped by 9% since the downward trend began in May.

The Southeast Asian MOP market saw mixed price movements this week, with sMOP prices rising by USD 10/tonne at the high end, while gMOP prices decreased by USD 5/tonne. Diverging price views between buyers and sellers persisted as the region lacked fresh price input, and dry weather in palm oil regions continues to keep buyers out of the market. An ample supply combined with minimal spot activity is likely to keep potash prices flat to soft in the coming weeks.

Ammonia Prices Steady

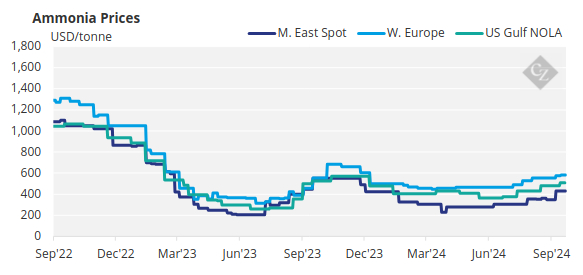

Ammonia benchmarks on both sides of the Suez remained mostly steady this week, with the latest increase in Tampa for October expected given recent availability constraints west of Suez.

The USD 30/tonne hike agreed upon between Yara and Mosaic brought the October Tampa index to USD 560/tonne CFR, reflecting a similar upward adjustment in FOB spot values in both the US Gulf and Trinidad. Exports from both locations were largely hampered in September, although there is hope for healthier export activity in October, despite domestic demand potentially capping shipments from the former.

Prices are expected to remain steady to firm through October, though a lack of demand may limit any significant price increases.